U.S. Charging As A Service Market 2030: Revolutionizing EV Infrastructure

U.S. Charging As A Service Market Trends

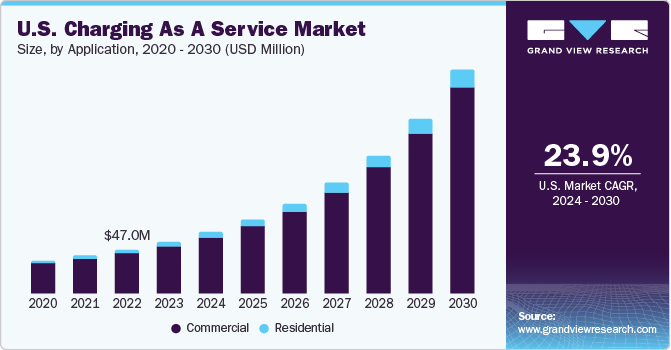

The U.S. charging as a service market size was valued at USD 55.2 million in 2023 and is anticipated to grow at a CAGR of 23.9% from 2024 to 2030. The rapidly growing adoption of electric vehicles in the United States has created significant need for efficient and intelligent charging solutions. However, there has been a simultaneously rising demand for making EV charging accessible and reliable for vehicle owners, which has led to the expansion of the charging-as-a-service (CaaS) segment. CaaS addresses the challenges involved in the setup and maintenance of EV charging infrastructure by providing EV drivers and charging station owners with subscription-based programs. With the U.S. government encouraging citizens to shift toward electric mobility, advancements in the charging-as-a-service model are expected to accelerate this push and help create a more sustainable transportation system.

The U.S. accounted for a revenue share of 19.38% in the global charging as a service market in 2023. According to estimates from Kelly Blue Book, a Cox Automotive company, 1.2 million new EVs were sold in the country in 2023, with the share of these vehicles climbing to 7.6%, growing from a 5.9% share in 2022. Another study from Wards Intelligence, published by the U.S. Energy Information Administration, stated that the total sales from battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid vehicles accounted for 16.3% of the overall sales of new light-duty vehicles. These numbers highlight a healthy demand for EVs from consumers, consequently driving the need for supportive charging infrastructure and services. As consumers increasingly embrace EVs, convenient and accessible charging solutions become paramount, thereby leading to the emergence of innovative charging-as-a-service models, whereby service providers offer charging solutions to address evolving needs of EV owners.

Get a preview of the latest developments in the U.S. Charging As A Service Market; Download your FREE sample PDF copy today and explore key data and trends

Well-developed charging networks help address range anxiety, which is a primary concern of prospective EV buyers in the country. As such, the rollout of convenient and easily accessible charging options across urban centers and highways becomes vital to encourage EV adoption. Stakeholders in the EV ecosystem have realized that the current disparity in charging station availability is contributing to longer wait times at charging stations, causing inconveniences to EV users. As per the Department of Energy’s Alternative Fuels Data Center, while California has the highest number of public charging stations (>40,000), states such as Alaska and Wyoming have fewer than 100 stations. Thus, the absence of a standardized charging infrastructure can potentially restrain the adoption of EVs. Charging-as-a-service can play a prominent role in this regard by bridging the gap between the growing number of EVs and relatively slower rollout of charging points.

Notable advances in EV charging management software platforms are opening up significant growth opportunities for the charging-as-a-service market in the country. These developments are particularly allowing market players to introduce innovative service models, optimize charging station operations, offer real-time monitoring, facilitate predictive maintenance and seamless billing, and subsequently enhance efficiency and user experience. Smart algorithms facilitate load balancing, ensuring optimal energy distribution and reducing grid strain. Similarly, user-friendly interfaces and remote accessibility can simplify customer interactions and foster widespread adoption. Companies such as EV Connect and Eaton have introduced advanced offerings that aim to mitigate issues concerning operational control, accessibility, and monetization in charging operations, creating strong growth potential for the market.

U.S. Charging As A Service Market Report Highlights

- The AC charging segment accounted for a larger revenue share of 53.62% in the U.S. charging as a service market in 2023.

- Based on application, the commercial segment dominated the U.S. market for charging as a service in 2023. This can be attributed to the increasing corporate adoption of sustainable practices and the expanding fleet of electric vehicles.

- The residential segment is poised to witness a substantial growth rate during the forecast period.

- In terms of service, the hosted segment held the largest revenue share in the market in 2023. The hosted business model involves third-party providers that install and operate EV charging stations at locations owned by other entities.

- The U.S. market for charging as a service has witnessed a strong growth in recent years, with several companies establishing their dominance through the integration of advanced charging technologies.

U.S. Charging As A Service Market Segmentation

Grand View Research has segmented the U.S. charging as a service market report based on service, charging station, and application:

Service Outlook (Revenue, USD Million, 2017 - 2030)

- Subscription

- Hosted

- Financed

Charging Station Outlook (Revenue, USD Million, 2017 - 2030)

- AC Charging

- DC Charging

Application Outlook (Revenue, USD Million, 2017 - 2030)

- Commercial

Curious about the U.S. Charging As A Service Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Comments

Post a Comment