South Africa Veterinary Medicine Market Size, Share, Revenue Analysis By 2028

South Africa Veterinary Medicine Industry Overview

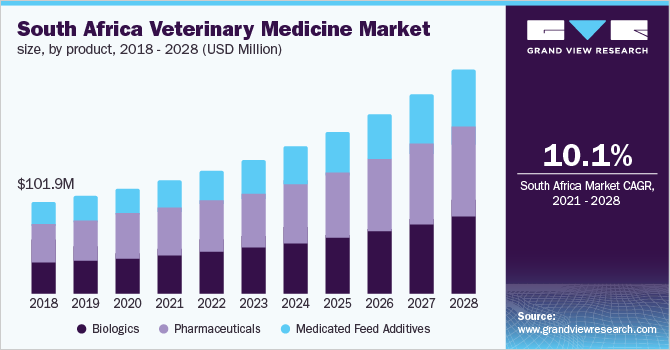

The South Africa veterinary medicine market size is expected to reach USD 248.2 million by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 10.1% from 2021 to 2028. The market holds many opportunities to grow during the forecast period owing to the growing livestock and pet population, increasing consumption of meat, rising incidence of diseases in animals, and the presence of key global companies. According to a report published by the African Union/Interafrican Bureau for Animal Resources (AU/IBAR), MSD Animal Health leads the South African market for veterinary medicines, followed by other key companies.

South Africa Veterinary Medicine Market Segmentation

Grand View Research has segmented the South Africa veterinary medicine market on the basis of animal type, product, mode of delivery, and end-use:

Based on the Animal Type Insights, the market is segmented into Production Animal and Companion Animal.

- In 2020, the production animal segment captured the largest revenue share. The companion animal segment is estimated to exhibit the highest CAGR over the forecast period. The growing prevalence of diseases in animals, the need to secure food sources, and increasing pet health concerns are estimated to fuel the market growth over the forecast period.

- As per the OIE, there were about 56 new disease outbreaks during 2020, with over 3,000 cases of animals being infected and over 1,000 dead in South Africa across animal types. Companies such as Boehringer Ingelheim, MSD, Ceva, and Virbac offer a wide portfolio of products that help prevent and treat various diseases in production and companion animals. MSD, for example, is a market leader that sells its products through direct sales and an intricate network of distributors spread across the country.

Based on the Product Insights, the market is segmented into Biologics, Pharmaceuticals, Medicated Feed Additives and others.

- The pharmaceuticals accounted for the largest revenue share in 2020 owing to the availability of a large number of products in this category and the rapid adoption of pharmaceuticals such as parasiticides and anti-infectives for animals. Rabies, for instance, is a viral infection of the nervous system with the most cases of rabies detected in domestic dogs in South Africa, according to the National Institute for Communicable Diseases. Human rabies cases, although rare, continue to be confirmed annually with the most cases associated with domestic dog exposures. This is expected to increase the demand for antivirals targeting rabies.

- The biologics segment is anticipated to expand at the fastest CAGR over the forecast period due to an increase in R&D efforts by key companies and partnerships with animal welfare organizations and other global bodies to reduce the spread of infectious diseases, such as African swine fever and rabies. Onderstepoort Biological Products, for instance, is a South African company offering an extensive lineup of vaccines for various animal types, such as cattle, sheep, goats, horses, and poultry.

Based on the Mode of Delivery Insights, the market is segmented into Oral, Parenteral, Others.

- Parenteral mode of delivery held the largest revenue share in 2020. Veterinary medicines given parenterally through injections do not go through the gastrointestinal system and may be formulated in different ways, including solutions, suspensions, and emulsions. They may also be formulated as dry powders mixed with liquids prior to injection to become a solution or a suspension, making them a preferred dosage form for drugs that are otherwise unstable in liquid form.

- The oral segment is projected to exhibit the fastest CAGR over the forecast period as it is a popular dosage form for the treatment of companion and livestock animals due to its ease of administration. In May 2021, Elanco, for example, launched the first-of-its-kind oral flea and tick chewable product for Cats-Credelio. Rising expenditure on animal health and the availability of different dosage forms and delivery systems are anticipated to drive the market. MSD Animal Health, for instance, offers a wide range of oral, parenteral, and topical formulations for treating various disease conditions, such as internal and external parasites, wounds and abscesses, infectious diseases, and dermatological conditions.

Based on the End-use Insights, the market is segmented into Reference Laboratories, Veterinary Hospitals & Clinics, Point-of-Care/In-house Testing, Others.

- The veterinary hospitals and clinics segment dominated the market in 2020 owing to the large volume of patients treated at these facilities and the availability of trained veterinary personnel. The Penzance Veterinary Clinic, for example, offers a range of services, including general consultations, surgical services, radiology and ultrasound, and microchipping, to pet parents. In addition, the clinic has a retail outlet that supplies pet food, prescription-based diet foods, parasiticides, and other products.

- The reference laboratories segment is anticipated to witness the fastest growth over the forecast period. This can be attributed to the presence of a significant number of veterinary reference laboratories. Onderstepoort Veterinary Research, for instance, is a veterinary reference lab that partners with OIE for African Horse Sickness, Bluetongue, foot and mouth disease, African swine fever, and other key diseases ailing the animal population in the country.

Key Companies Profile & Market Share Insights

The South African market for veterinary medicine is competitive. Market players deploy various strategic initiatives, including the expansion of distribution networks, sales and marketing initiatives, partnerships, and product development.

Some of the prominent players operating in the South Africa veterinary medicine market include,

- MSD

- Ceva

- Zoetis

- BoehringerIngelheim International GmbH

- Virbac

- Wildlife Pharmaceuticals (Pty) Ltd.

- Nutreco N.V.

- Design Biologix

- Deltamune

- Bupo Animal Health (Pty) Ltd.

Order a free sample PDF of the South Africa Veterinary Medicine Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment