India Electric Vehicle Market Competitive Landscape Report to 2028

India Electric Vehicle Industry Overview

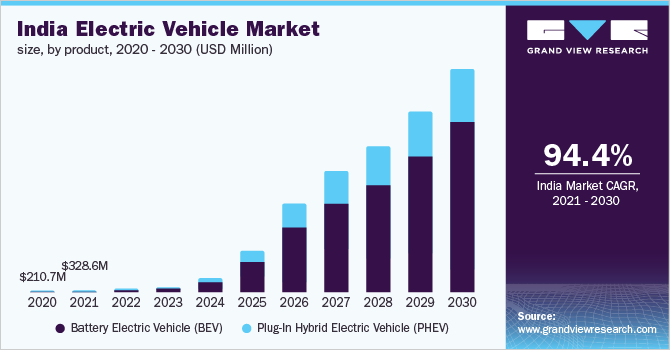

The India electric vehicle market size was valued at USD 220.1 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 94.4% from 2021 to 2030.

The attractive incentives being offered by the Indian government on the production and purchase of electric vehicles to encourage the adoption of electric vehicles are anticipated to drive the growth of the market over the forecast period. The outbreak of the COVID-19 pandemic triggered a significant decline in the overall sales of passenger and commercial vehicles in 2020. However, the sales of electric vehicles in India remained unaffected. The post-lockdown sale of pure and hybrid electric vehicles is a prominent driving factor for the electric vehicle market in India. The stringent GreenHouse gas (GHG) emission norms drafted by the government, such as the Bharat Stage (BS) VI emission standards introduced by India’s Ministry of Road Transport and Highways (MoRTH), are also expected to play a decisive role in driving the growth of the market.

Gather more insights about the market drivers, restrains and growth of the India Electric Vehicle Market

The increasing prices of conventional fuel are expected to accentuate the development of vehicle electrification. The stringent emission norms being drafted by the government and the growing environmental awareness among Indian consumers are also expected to fuel the demand for electric vehicles. Furthermore, Indian automakers, such as Tata Motors, and Mahindra and Mahindra Ltd., have embarked upon aggressive efforts to add electrified vehicles to their product portfolio, which is expected to encourage Indian consumers to opt for electric vehicles. All these factors bode well for the growth of the electric vehicle market in India over the forecast period.

The EV market in India comprised only two electric vehicle models in 2019. As a result, only 0.15% of the new passenger cars registered between April 2019 and March 2020 were BEVs. However, at the beginning of 2021, the India electric vehicle (EV) market consisted of around eight electric vehicle models, thereby offering more options for Indian consumers looking forward to buying electric vehicles. Moreover, the prices of electric vehicles are also expected to decline over the forecast period, thereby allowing EVs to provide a lower Total Cost of Ownership (TCO) as compared to conventional vehicles. This is expected to pave the way for the mass-market penetration of electric vehicles.

India has been recognized as one of the prominent regions in the automotive industry globally. Several companies are aggressively establishing manufacturing facilities in India. The new 4,600 square-meter facility would produce Dana TM4 low- to high-voltage inverters, electric motors, and vehicle control units. Meanwhile, the Phase-II of the Indian government’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme envisages further enhancing the adoption of electric mobility and the development of its manufacturing eco-system. Phase-II of the FAME scheme would be implemented through the following verticals, namely incentivizing the demand for EVs; running awareness campaigns, including publicity, and information, education & communication (IEC) activities; and establishing a charging station network.

The outbreak of the COVID-19 pandemic changed the overall business dynamics in 2020 and is anticipated to affect the overall business scenario over the next few years. Lockdowns imposed in different parts of the world as part of the efforts to arrest the spread of coronavirus resulted in supply chains disruptions. Production was also suspended at numerous production facilities as part of the lockdowns. As a result, shipments were delayed and production volumes plummeted, thereby severely affecting automotive production. Manufacturers of electric vehicles continued to confront issues with supplies of raw materials owing to the looming delays in international shipments and hence, reported production delays. Nevertheless, although the pandemic triggered a significant decline in the overall sales of passenger and commercial vehicles, the sales of electric cars in India remained unaffected. According to the Society of Manufacturers of Electric Vehicles (SMEV), the sales of electric cars in India increased over the year by 109% from 2,814 units in 2019 to 5,905 units in 2020. The majority of over 64% of the sales came from the Tata Nexon EV, with a total of 3,805 units sold in 2020.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

- Commercial Vehicles Market - The global commercial vehicles market size was estimated at USD 1,274.50 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 4.0% from 2022 to 2030.

- Electric Vehicle Market - The global electric vehicle market demand was estimated at 2,373.5 thousand units in 2019 and is expected to witness a CAGR of 41.5% 2020 to 2027.

Market Share Insights

- October 2020: Uber, a ride-hailing company, announced a partnership with Lithium Urban Technologies, an electric vehicle fleet operator in India.

- September 2020: Dana TM4 Inc. announced plans to establish a manufacturing facility in Pune, India.

Key Companies profiled:

Some prominent players in the India electric vehicle market include

- Audi AG

- BMW AG

- Hyundai Motor India

- Jaguar Land Rover Limited

- Mahindra & Mahindra Ltd

- Mercedes-Benz AG

- MG Motor India Pvt. Ltd.

- Olectra Greentech Limited

- Tata Motors

- Toyota Motor Corporation

Order a free sample PDF of the India Electric Vehicle Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment