U.S. Construction And Design Software Market 2030: Innovations Driving the Future

U.S. Construction And Design Software Market Growth & Trends

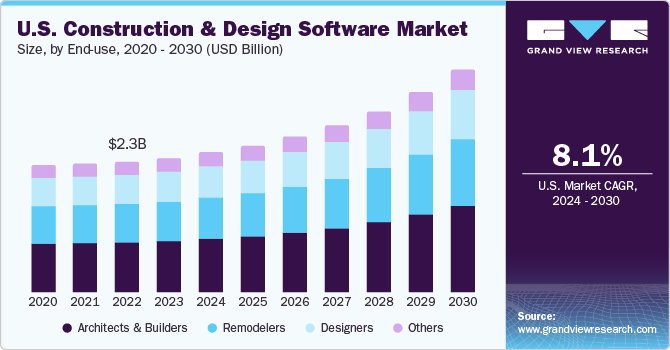

The U.S. construction and design software market size was valued at USD 2,388.1 million in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. The U.S. accounted for 22.9% of the global construction and design software market. AI, cloud computing, and IoT, among other digital technologies, have contributed to the market's growth. The U.S. market players are aggressively introducing innovative software tools that help end-users reduce time, minimize errors, and limit resources. This technological advancement is expected to play a crucial role in driving the growth of the market.

The U.S. market is witnessing a constant technological transformation in the construction industry and civil engineering, including architectural verticals. The software assists designers in designing complex layouts, assessing the potential risks, and planning & conceptualizing designs. In addition, the growing adoption of these latest software tools is helping organizations enhance practical visualization, and make complex designs with practical approaches, and execute construction & design plans more efficiently. The extensive use of construction software solutions based on data analytics, AI, and ML also plays a decisive role in addressing, predicting, classifying, and solving complex mathematical problems associated with complex construction projects.

Gather more insights about the market drivers, restrains and growth of the U.S. Construction And Design Software Market

U.S. based architects and builders recognize the potential of construction and design software in reducing their reliance on paperwork, documentation, and manual designing. Using integrated tools, such as construction estimating, project management, safety, and reporting, allows construction companies to ensure well-organized work sites, well-developed designs, and overall safety and success of their construction projects. Construction and design software enables architects and builders to ensure the success of their construction projects. As a result, software advancements and innovations are expected to drive its demand among architects and builders.

Furthermore, the rising number of construction projects undertaken in the U.S. is becoming challenging due to these projects becoming increasingly complex, and safety and regulatory concerns are also growing. Therefore, construction companies in the U.S. are deploying construction and design software solutions to track various project processes, deadlines, and compliance status in real-time. These software solutions give construction companies deeper insights into future spending, helping create purchase and exchange orders, estimate project costs, and ensure effective team communication, enhancing efficiency and scaling the business in the long-term.

However, the increased adoption of the software in the U.S. is witnessing high initial costs of the software, and evolving digital threats such as phishing, Distributed Denial of Service (DDoS), ransomware, and viruses are the two key factors expected to hamper the growth of the market over the forecast period. In addition, the construction and design software development process is costly as the provider needs to hire expert software engineers and implement advanced software testing and assessment tools. Furthermore, if any company develops an innovative feature and integrates it into the software, it increases the project's overall costs.

U.S. Construction And Design Software Market Report Highlights

- Project management & scheduling segment dominated the market and accounted for the highest revenue share of 18.4% in 2023.

- On-cross bid management segment is anticipated to witness a significant CAGR of 9.6% from 2024 to 2030 in the U.S. construction and design software market.

- Cloud segment led the market and accounted highest revenue share of 54.0% in 2023. Cloud deployment ensures cost-efficiency while increasing productivity by allowing the use of data to streamline processes.

- Architects & builders segment accounted for the largest market revenue share of 38.6% in 2023.

- Autodesk Inc. is an application software company offering software and services for the 3D design, engineering, and entertainment industries.

U.S. Construction And Design Software Market Segmentation

Grand View Research has segmented the U.S. construction and design software market report based on function, deployment, and end-use.

Function Outlook (Revenue, USD Million, 2018 - 2030)

- Safety & Reporting

- Project Management & Scheduling

- Project Design

- Field Service Management

- Cost Accounting

- Construction Estimation

- On-cross Bid Management

- Others

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

- Cloud

- On-premise

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Architects & Builders

- Remodelers

- Designers

- Others

Order a free sample PDF of the U.S. Construction And Design Software Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment