U.S. Burn Care Centers Market Share, Regional Outlook, Survey Report 2030

U.S. Burn Care Centers Industry Overview

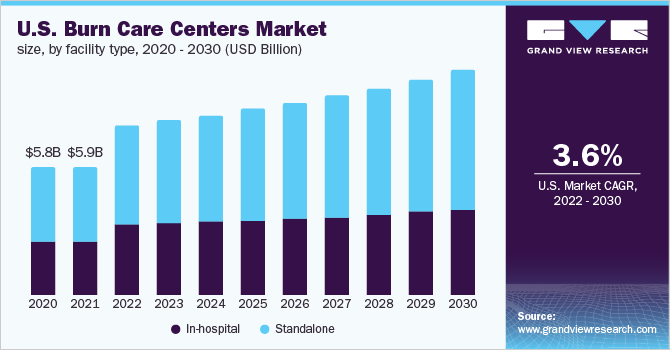

The U.S. burn care centers market size was valued at USD 5.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.6% from 2022 to 2030.

The growing cases of burn-related emergency department (ED) visits and increasing admissions of patients in hospitals mainly due to partial-thickness or second degree are some of the significant factors propelling the market growth. As per the report of the University of Wisconsin Hospital Burn Center, between July 1, 2018, to June 30, 2019, 402 patients were admitted to treatment units out of which, 36 burns were due to hot fluid, 25 burns due to hot food, 24 from hot drinks, 22 from other hot and heat substances, 20 burns from fat and cooking oil, and others. Favorable reimbursement policies for burn treatment procedures, a rise in the number of government initiatives for providing medical emergency assistance, and a limit on the number of preventable deaths for victims are expected to boost the demand for treatment and care services, thereby positively impacting the market growth.

Gather more insights about the market drivers, restrains and growth of the U.S. Burn Care Centers Market

According to the Children’s Safety Network article on Fire and Burn Prevention 2021, fire is the fifth leading cause of injury-related mortalities amongst children. In the U.S., over 100,000 children in the age group of 1 to 19 years old are admitted to healthcare facilities and approximately 300 children succumb to injuries annually. The most common burns recorded in children are burns from hot objects or flames and thermal burns. As per American Burn Association, burn injuries in the U.S. have continued to be one of the leading causes of injuries and accidental deaths with the majority of the injuries occurring in the home. Approximately one-third of all the burn injuries are registered in children below age 15, and nearly 400,000 individuals in the U.S. are receiving burn care annually.

Among all burn cases, second-degree or partial thickness has been reported to be the most frequent burn severity for both related ED visits accounting for approximately 56.4% and inpatient stays accounting for 51.9% of overall burn cases in the U.S. In addition, the majority of burn-related ED visits and inpatient stays were reported to be accidents caused by steam and hot liquids. According to the article published by American Family Physician in April 2020, around 500,000 patients receive medical care for burns every year in the U.S., and around 92% are treated as outpatients.

The growing number of hospitals in the U.S. are increasing the set-up of new burn care units within these facilities, which is expected to drive the market. With the increase in the number of hospital facilities, the number of burn procedures such as wound debridement, skin grafting, and respiratory intubation and ventilation being performed in the in-house treatment facilities is also growing. The number of in-hospital burn centers in the country was reported to grow from 121 in 2017 to approximately 128 in 2018. However, in-hospital burn treatment centers in the U.S. were estimated to be around 4,500 by the end of 2018. As per the report of the American Hospital Association, in 2020, there were 1,280 burn care bed admissions recorded in community hospitals.

Furthermore, an increase in investments for the up-gradation of hospitals, the development of new treatment units, and an increase in the number of new standalone burn care centers in the country are expected to drive the market. For instance, in August 2020, San Antonio Health (Methodist Healthcare) opened a new burn and reconstructive center to increase access to care for children and adults.

Growing initiatives undertaken by government organizations such as the WHO and nonprofit organizations including the American Burn Association (ABA) have contributed majorly to spreading awareness regarding prevention and cure guidelines and have positively impacted market growth. The American Burn Association sponsored an initiative called National Burn Awareness Week 2020, under which they brought together the firefighting department and personnel, patient life, and safety educators to spread awareness among the public regarding the frequency, devastation, and most frequent causes of burn injuries. The initiative is focused on helping the general population by providing them education to prevent the occurrence of burns and how to take the best care in case of severe injuries.

The majority of burn-related treatments are high-cost procedures and are selectively performed in high-end treatment facilities. As treatment facilities are capable of maintaining a high level of disinfection in their treatment units, their demand is higher as compared to their alternatives, including in-hospital treatment centers. The costs associated with burn-related injuries are significantly higher than many well-known health-related disorders. This may hamper the market growth in the forecast period.

The total burn care center's capacity has witnessed a significant decline by one-third of the original capacity during the pandemic, especially during the lockdown. The psychological impact of the COVID-19 pandemic is undoubtedly expected to have a long-lasting effect on the U.S. market, wherein telehealth services including tele-visits and video visits will continue to witness growth. Moreover, the majority of the treatment facilities have adopted the new normal and have upgraded their facilities with disinfection and protective supplies in their departments and wards to carry out emergency procedures.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Outpatient Rehabilitation Centers Market - The global outpatient rehabilitation centers market size was valued at USD 79.8 billion in 2021 and is projected to witness a compound annual growth rate (CAGR) of 7.09% from 2022 to 2030.

- Trauma Care Centers Market - The global trauma care centers market size was valued at USD 15.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.53% from 2023 to 2030.

Key Companies profiled:

Some prominent players in the U.S. burn care centers market include

- Saint Francis Memorial Hospital Bothin Burn Center

- LAC+USC Medical Burn Center

- Weill Cornell Medicine William Randolph Hearst Burn Center

- Temple University Hospital Adult Burn Center

- Parkland Memorial Hospital Regional Burn Center

- MedStar Washington Hospital Center

- Barnabas Burn Center

- UMC Lions Burn Center

- University of Chicago Burn Center

- Ohio State University Hospital Adult Burn Center

- University of Miami Jackson Memorial Hospital Burn Center

- Brigham and Women's Hospital Burn Center Adult Burn Center

Order a free sample PDF of the U.S. Burn Care Centers Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment