U.S. Behavioral Health Care Software And Services Market Business Outlook 2030

U.S. Behavioral Health Care Software And Services Industry Overview

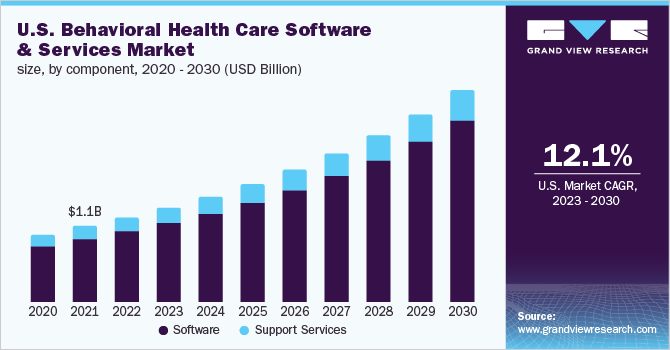

The U.S. behavioral health care software and services market size was valued at USD 1.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.20% from 2023 to 2030.

The emerging technologies for behavioral health management, rising awareness regarding substance abuse, and expanding reimbursement coverage are contributing to market growth. The adoption of behavioral health care software by care providers is likely to improve the management of mental health issues and treatment prospects. The providers of behavioral health can adopt integrated EHRs for effective practice management and cost savings.

Gather more insights about the market drivers, restrains and growth of the U.S. Behavioral Health Care Software And Services Market

For instance, in May 2022, Osmind, a San Francisco-based firm, raised USD 940 million in Series B financing to expand its technology. The company is dedicated to developing e-health record software for the psychiatrist and its EHR technology is aimed at novel therapies such as psychedelic drugs and neuromodulation treatments including transcranial magnetic stimulation (TMS). The communication between the care providers and patients is simplified by the real-time monitoring system. Integration of new technologies with other treatment approaches assists to improve the effectiveness and productivity of care. Video conferencing is provided by telepsychiatry or Tele-mental health, which helps care providers coordinate with the patients from a distant location.

The U.S. government is particularly concerned about high healthcare expenditures associated with the treatment of behavioral health-related disorders. For instance, the overall impact of substance abuse including treatment is approximately USD 600 billion annually in the U.S., according to the Substance Abuse and Mental Health Services Administration (SAMHSA). The administration stated that substance abuse leads to loss of productivity and increases the burden on public healthcare.

Value-based medicine programs by behavioral health care providers help in reducing the costs related to substance abuse. For instance, in May 2022, the Department of Health and Human Services announced a nearly USD 15 million budgetary opportunity for a 3-year federal grant to create a Substance Abuse and Mental Health Services Administration program. This will improve behavioral health care delivery to citizens of nursing homes and other long-term care facilities. This initiative will construct a Center of Excellence for Capacity Building in Nursing Centers to Serve Patients with Behavioral Health Conditions, which will be funded by the Centers for Medicare & Medicaid Services.

The COVID-19 pandemic opened new opportunities for mental wellness apps. There is a shift to virtual care for patients seeking psychiatric treatment. Software providers are undertaking initiatives to help tackle the health crisis. Cerner Corporation provided its associates with online fitness and wellbeing tools and activities for encouraging mental and physical health. Moreover, it worked in association with public authorities, such as CDC, to accelerate data sharing and reduce the overall burden on healthcare facilities. Furthermore, the download and use of mental wellbeing apps such as Calm, Headspace, Reflectly, and Meditopia increased to multiple folds during the pandemic.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Surgical Planning Software Market - The global surgical planning software market was valued at USD 102.1 million in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030.

- Medical Terminology Software Market - The global medical terminology software market size was valued at USD 991.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030.

Market Share Insights

- February 2022: Noble, a new startup for mental wellness, launched an app to provide automated between-session assistance and therapist-formed content, which is backed by research for clients.

Key Companies profiled:

Some prominent players in the U.S. behavioral health care software and services market include

- Cerner Corporation

- Core Solutions, Inc.

- Epic

- Meditab

- Holmusk

- Netsmart Technologies

- Qualifacts Systems, Inc.

- Welligent, Inc.

- Simple Practice, LLC

- Therapy Notes, LLC

- Thera Nest

Order a free sample PDF of the U.S. Behavioral Health Care Software And Services Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment