Real-time PCR, Digital PCR, And End-point PCR Market Company Revenue Shares And Analysis Report 2030

Real-time PCR, Digital PCR, And End-point PCR Industry Overview

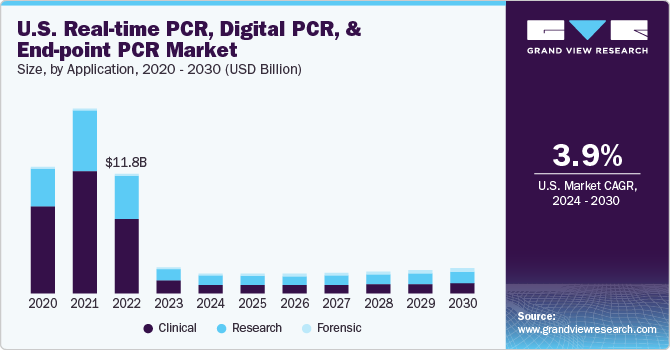

The global real-time PCR, digital PCR, and end-point PCR market size was valued at USD 31.64 billion in 2021 and is expected to decline at a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030.

The decrease in the demand for PCR testing for COVID-19 testing is expected to decline the market growth. However, the global real-time PCR(qPCR), digital PCR(dPCR), and end-point PCR market without the impact of the COVID-19 pandemic is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2022 to 2030. Polymerase chain reaction (PCR) uses polymerase enzyme, primers, and repeated thermal cycles to make limitless DNA copies from a single strand. Because these tests are performed in automated thermal cyclers, they are less sensitive to cross-contamination. Technological advancement is increasing the demand for molecular testing. dPCR and qPCR are commonly used diagnostic procedures used in research, pharmaceutical, and biotech organizations, and have a wide range of applications.

Gather more insights about the market drivers, restrains and growth of the Global Real-time PCR, Digital PCR, And End-point PCR Market

The COVID-19 pandemic has had a significant impact on the healthcare industry. The diagnostic industry was the hardest hit, with exponential growth in the market. As they are used for diagnostic and drug development, digital PCR and real-time PCR have seen a lot of interest. Therefore, the industry vendors are increasingly focusing on building droplet digital PCR kits to detect COVID-19. Moreover, many market players have introduced innovative instruments and novel tests for COVID-19 testing. For instance, in September 2020, the U.S. FDA approved Emergency Use Authorization (EUA) for Bio-Rad’s SARS-CoV-2 ddPCR Kit for the detection of SARS-CoV-2 infection. In addition, regulatory agencies have expressed strong support for approving these tests to mitigate the impact of the COVID-19 outbreak. Thus, it will boost market growth.

Several companies' marketing strategies have been altered to cope with the pandemic and increase revenue. In addition, major market players are concentrating on new technologies to expand the industry. For instance, to address the COVID-19 outbreak, in March 2020, Thermo Fisher developed several PCR kits and assays for diagnostic and research purposes. SARS-CoV-2 multiplex real-time PCR test gained emergency use authorization (EUA) from the US FDA, and AcroMetrix Coronavirus 2019 (COVID-19) RNA Control was introduced in 2020. Such market players’ initiatives are expected to open new opportunities in the market.

The increasing incidence of genetic disorders and major infectious diseases, growing utilization of biomarker profiling for disease diagnostics, and the successful execution of the Human Genome Project are the primary factors increasing the demand for technologically advanced PCR tests over the forecast period. In the coming years, significant technological breakthroughs in technologies, increasing investments, funding, and grants are likely to increase the demand for digital PCR in different applications.

Consumer preferences for early disease detection and treatment have accelerated research and development into novel genetic techniques and product creation. Furthermore, increased investment and the accessibility of cash and grants are supporting this surge in R&D activity. Moreover, governments and federal organizations all over the world are increasingly emphasizing the importance of qPCR and dPCR technologies in genomics research. In addition, several financing efforts by government and corporate organizations to assist genomic research have been seen in the qPCR and dPCR industries during the last decade.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- Polymerase Chain Reaction Market - The global polymerase chain reaction market size was valued at USD 36.84 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of -9.30% from 2023 to 2030.

- Monkeypox Testing Market - The global monkeypox testing market size was estimated at USD 1.79 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.35% from 2022 to 2030.

Market Share Insights

- February 2022: Hoffmann-La Roche Ltd expanded the COVID-19 PCR tests in countries accepting the CE market. Company expansion is anticipated to increase its share in the market.

Key Companies profiled:

Some prominent players in the global real-time pcr, digital pcr, and end-point pcr market include

- Abbott

- Qiagen

- Bio-Rad Laboratories Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- GE Healthcare

- BIOMÉRIEUX

- Hoffmann-La Roche Ltd.

- Fluidigm Corporation

Order a free sample PDF of the Real-time PCR, Digital PCR, And End-point PCR Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment