Oral Solid Dosage Contract Manufacturing Market Share, Regional Outlook, Survey Report 2030

Oral Solid Dosage Contract Manufacturing Industry Overview

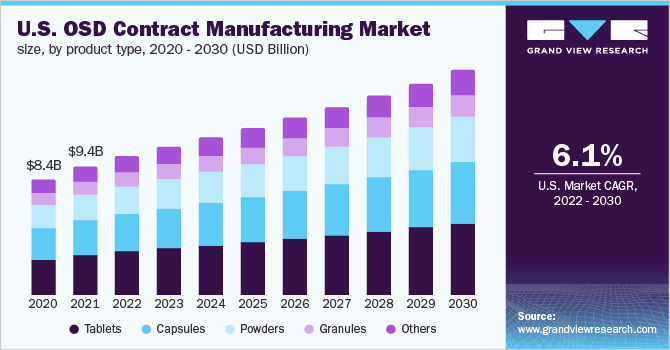

The global oral solid dosage contract manufacturing market size was valued at USD 31.9 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 6.0% over the forecast period.

An increase in the advancement of drug delivery technology, such as targeted drug delivery and sustained release dosage forms, rising investments by CDMOs to expand the oral solid dosage (OSD) development and increasing demand for novel therapies drive the market growth. Oral dose pharmaceutical products are highly improbable to be replaced with new technologies anytime in the near future. The expansion of solid dose pharmaceutical manufacturing is driven by new solid dose formats and increased efficiency.

Gather more insights about the market drivers, restrains and growth of the Global Oral Solid Dosage Contract Manufacturing Market

According to an article published in Pharma Manufacturing, tablets would be the preferred solid dosage form, with estimated sales of more than USD 500,000 by the end of 2027. There were 24 solid dose tablets and 7 capsule solid dose forms among the 59 new molecular entities approved in 2018. Catalent recently completed a USD 1.2 billion regenerative medicine partnership with Paragon Bioservices, and the company is already investing USD 40 million to increase tablet and capsule controlled-release capacity. Metrics Contract Services invested USD 80 million in a new OSD pharmaceutical manufacturing facility in North Carolina in 2018. However, the pandemic had a positive impact on the market.

In 2021, small molecules accounted for 72% of newly approved drugs, and nearly 50% of new drugs approved were OSD. As the world engrossed itself in the possibility of vaccine therapy in 2021, another treatment of OSD small molecule products, such as azithromycin and hydroxychloroquine, demonstrated promising results. These OSD products, designed to treat fewer common diseases, such as malaria, also find themselves in the spotlight as their efficacy against COVID-19 symptoms becomes known. Small molecules, capsules, tablets, gummies, effervescence, soft gels, and pills are all OSD forms, which refer to a final drug product therapy that is consumed through the mouth, dissolved in the digestive system, and delivered to the body via absorption into the bloodstream.

There are three major reasons for the dominance of OSD. It is relatively simple to administer, it is simple to differentiate one OSD product from another, and OSD manufacturing approaches are well developed.The overarching objective of OSD processing, regardless of product type, is to establish a formulation that helps ensure that each dose is consistent. Each has a repeatable distribution of ingredients, as well as uniformity in dissolution and bioavailability, to verify that the drug product is safe and effective.

Tier 1 players such as AbbVie Contract Manufacturing, Patheon (Thermo Fisher Scientific), Piramal Enterprises, Capsugel (Lonza), Catalent Inc., Siegfried AG, NextPharma, Recipharma AB, Piramal Pharma Solutions, Aurobindo Pharma Ltd., and CordenPharma, account for nearly 63% of the global market, while tier 2 and 3 represent approximately 12% & 25% of the total market share. Furthermore, contract manufacturing is the primary business of approximately 64% of OSD contract manufacturing firms. According to the Patheon director, oral delivery of new drug candidates, solid dose manufacturing, a new formulation of existing molecules, controlled release dosage forms, fixed-dose combinations, and other life cycle management strategies would then maintain their importance and market share.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Antibody Drug Conjugates Contract Manufacturing Market - The global antibody drug conjugates contract manufacturing market size was valued at USD 9.75 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.9% from 2023 to 2030.

- Biosimilar Contract Manufacturing Market - The global biosimilar contract manufacturing market size was valued at USD 5.3 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 18.5% over the forecast period.

Market Share Insights

- February 2022: Corden Pharma announced the acquisition of three manufacturing facilities of Vifor Pharma. This acquisition would then broaden Corden Pharma’s capacities and capabilities in the production of Oral Solid Dosage (OSD) forms, such as capsules and tablets & non-sterile drug product dosage forms.

- June 2020: Piramal Enterprises Ltd. acquired G&W Laboratories Inc.’s oral solid dosage drug product manufacturing facility in Sellersville, Pennsylvania.

Key Companies profiled:

Some prominent players in the global oral solid dosage contract manufacturing market include

- Catalent, Inc.

- Lonza Group

- Piramal Pharma Solutions

- Aenova

- Jubilant

- Boehringer Ingelheim

- AbbVie Contract Manufacturing

- Patheon

- Recipharm

- Next Pharma AB

- Siegfried AG

- Corden Pharma

Order a free sample PDF of the Oral Solid Dosage Contract Manufacturing Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment