U.S. Medical Billing Outsourcing Market Research by Key Types and Major Application 2030

U.S. Medical Billing Outsourcing Industry Overview

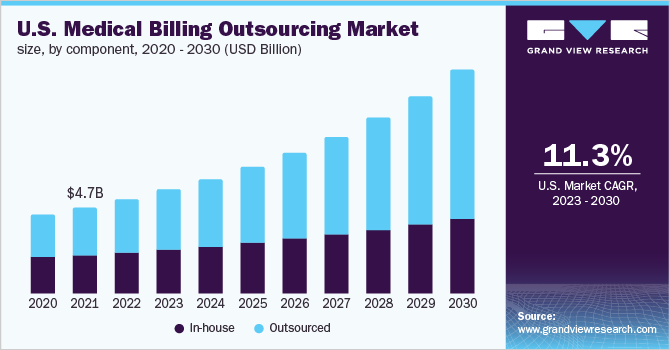

The U.S. medical billing outsourcing market size was valued at USD 5.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.56% from 2023 to 2030.

Medical billing involves revenue cycle management (RCM), which comprises the most complex and crucial components of the healthcare IT business. Healthcare service providers are facing challenges in managing a large volume of claims and reimbursements, resulting in huge revenue losses. Owing to this, the demand for medical billing outsourcing services is increasing in the U.S.

Gather more insights about the market drivers, restrains and growth of the U.S. Medical Billing Outsourcing Market

The rising patient load and the need to address the ever-growing record and bills are creating a burden on medical practitioners. To counter such a situation, hospitals are outsourcing the medical billing process, which is expected to drive the market. For instance, in October 2021, American Physician Partners (APP), a major company in emergency and intensive care management services, announced to extend its contract with R1 RCM Inc. till 2031. The partnership was first established in 2019 and is extended in the view of streamlining operations and scaling up performance.

The rules and regulations for health insurance in the U.S. are constantly changing and hospitals are struggling to keep up with the rapidly changing reimbursement environment. The current systems in practice for managing revenue are gradually becoming obsolete due to the lack of expertise in tackling new payment models and revenue management tools. Keeping pace with such rapid changes in the industry and being well updated with expanding knowledge base are time-consuming and tedious processes for businesses.

Hence, outsourced RCM services are the best option for hospitals and other medical institutions. U.S. hospitals partner with outsourcing companies who pose end-to-end knowledge of the Affordable Medical Care Act, Medicaid, and other health care and insurance programs. RCM practices involve high technological sophistication, coupled with trained expertise. The increasing implementation of several healthcare IT platforms has been positively influencing the growth of the market.

Hassle-free process of settling claims with features such as accounts receivable management and claims management and the availability of professional coders acquainted with the latest medical codes are the primary driving forces behind practices opting to outsource their billing services. However, the high threats of data breaches associated with medical billing in the U.S. are expected to hinder the growth of the market during the forecast period. For instance, according to Becker’s Healthcare data, in 2021, approximately 50 million of the American population’s health data was breached, which is around 3 times greater than in the past three years.

The pandemic has had some positive as well as negative effects on the market. The introduction of new ICD codes, Current Procedural Terminology (CPT) codes, and diagnosis codes for the COVID-19 billing and the telehealth billing has posed a greater challenge for the medical billing service providers. On the other hand, the adoption of RCM increased in the U.S. For instance, as per a survey conducted by AKASA, nearly 75% of the health systems in the U.S. has deployed RCM solutions during the pandemic.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Revenue Cycle Management Market - The global revenue cycle management market size was valued at USD 243.1 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 11.6% from 2022 to 2030.

- Medical Kiosk Market - The global medical kiosk market size was valued at USD 1.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.8% from 2022 to 2030.

Market Share Insights

- January 2022: R1RCM Inc. entered into a definitive agreement for the acquisition of Cloudmed. The deal was worth USD 4.1 billion and is expected to enter into an 18-month lock-up agreement.

- September 2021: GeBBS Healthcare Solutions, a major RCM provider for a healthcare firm in the U.S., received recognition by Modern Healthcare in its top 10 list of RCM companies.

Key Companies profiled:

Some prominent players in the U.S. medical billing outsourcing market include

- R1RCM Inc.

- Allscripts Healthcare, LLC

- Cerner Corporation

- eClinicalWorks

- Kareo, Inc.

- McKesson Corporation

- Quest Diagnostics Incorporated

- Promantra Inc.

- AdvancedMD, Inc.

Order a free sample PDF of the U.S. Medical Billing Outsourcing Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment