COVID-19 Diagnostics Market Opportunities, And Forecasts To 2030

COVID-19 Diagnostics Market Growth & Trends

The global COVID-19 diagnostics market size is expected to reach USD 50.1 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to decline at a CAGR of (7.7%) from 2022 to 2030. Since testing is pivotal for effective management of the rising burden of coronavirus cases, the rate at which testing is performed has witnessed a steep increase. More than 150 million tests have been performed in the U.S. as of November 2020, followed by more than 100 million tests conducted in India, and around 20 million tests performed in Brazil.

COVID-19 Diagnostics Market Segmentation

Grand View Research has segmented the global COVID-19 diagnostics market on the basis of product and service, sample type, test type, mode, end-use, and region:

Based on the Product & Service Insights, the market is segmented into Instruments, Reagents & Kits and Services.

- The services segment is estimated to dominate the market for Covid-19 diagnostics and accounted for revenue share of 47.8% in 2021. Service providers are boosting their testing capabilities by expanding technological footprints in existing labs and diagnostic centers as well as by launching new, high-capacity laboratories, which has contributed to the segment growth.

- The reagents and kits segment is expected to register a CAGR of (7.2%) from 2020 to 2030. The reduction in the number of active COVID-19 cases is responsible for the declining market growth of this segment. In response to the pandemic, companies are implementing various strategic initiatives, such as new product development and collaborations.

Based on the Sample Type Insights, the market is segmented into Nasopharyngeal (NP) swabs, Oropharyngeal (OP) swabs, Nasal Swabs, Blood, Others.

- The nasopharyngeal swabs segment accounted for the largest revenue share of 43.9% in 2021. Nasopharyngeal swabs have been observed to exhibit a significantly higher SARS-CoV-2 sensitivity, detection rate, and viral load than other swab types. Thus, this swab type is primarily recommended when testing for COVID-19 and assessing SARS-CoV-2 load, resulting in the largest revenue share of this segment.

- The blood sample type segment is estimated to register a growth rate of (7.3%) from 2020 to 2030. This is attributed to the significant decrease in the COVID-19 incidence rate. The demand for blood-based serology tests/antibody detection tests for the detection of SARS-CoV-2 infection is likely to drop further during the forecast period.

- Oropharyngeal swab samples are observed to be less sensitive than nasopharyngeal samples; however, using multiple types of samples help attain maximum sensitivity during infection screening. This has accelerated the use of OP swabs for COVID-19 diagnosis. The use of an OP swab sample alongside a nasopharyngeal swab increases the detection of viral illnesses in clinical settings or enables a thorough study of the etiology of lower respiratory tract infection.

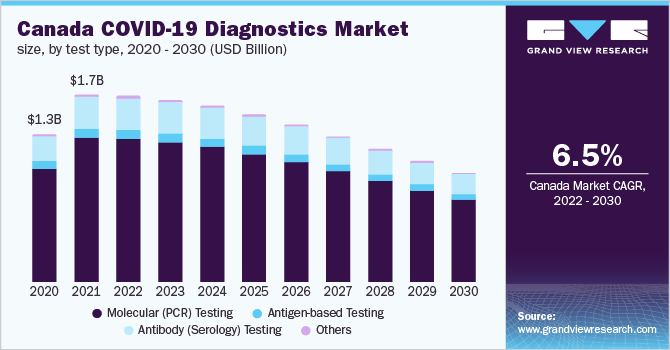

Based on the Test Type Insights, the market is segmented into Molecular (PCR) Testing, Antigen-based Testing, Antibody (Serology) Testing, Others.

- The Molecular (PCR) testing dominated the market and accounted for a revenue share of 67.1% in 2021. Currently, the PCR technique is considered to be the most accurate for the detection of COVID-19, thereby leading to a tremendous increase in the adoption of PCR testing kits.

- The antigen-based testing is expected to witness a CAGR of (6.1%) from 2020 to 2030. Antigen- and antibody-based tests are observed to be considerably more stable than RNA samples, which makes them less hazard-vulnerable during storage and transportation, thus minimizing the chances of false-negative results.

Based on the Mode Insights, the market is segmented into Point-of-Care (PoC) and Non Point-of-Care (Non-PoC).

- The non-POC (centralized) testing segment dominated the market and accounted for revenue share of 64.5% in 2021. Currently, most of the COVID-19 tests are carried out in the laboratory environment, thus centralized or laboratory testing is currently the key testing mode in the market.

- The development of point-of-care technology for the detection of COVID-19 infection is aimed at reducing the assay duration and scaling up the testing capacity to prevent further transmission of the disease.

Based on the End-Use Insights, the market is segmented into Laboratories, Hospitals, Diagnostic Centers and Clinics, Others.

- The laboratories segment dominated the market and accounted for the largest revenue share of 39.6% in 2021. An increasing number of laboratories are leveraging high-throughput technologies to process COVID-19 tests rapidly and effectively on a large scale. This is driven by the effective implementation of favorable reimbursement policies in developed economies.

- The diagnostic centers and clinics segment is expected to register a growth rate of 6.9% from 2022 to 2030. According to NHS England, up to 20% of patients have hospital-acquired COVID-19 infection. This is encouraging many individuals to opt for diagnostics centers over hospitals for COVID-19 testing, which is a major factor contributing to revenue generation for this segment.

COVID-19 Diagnostics Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- COVID-19 Diagnostics Market - The global COVID-19 diagnostics market size was valued at USD 97.4 billion in 2021 and is expected to decline at a compound annual growth rate (CAGR) of 7.7% from 2022 to 2030.

- COVID-19 Sample Collection Kits Market - The global COVID-19 sample collection kits market size was valued at USD 6.48 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030.

Market Share Insights

- October 2020: Quest Diagnostics announced a pilot program for drone delivery of COVID-19 at-home self-collection kits to single-family homes in the Cheektowaga area.

- September 2020: LabCorp launched a combined test for RSV, flu, and COVID-19. The company has applied for U.S. FDA approval to use this test with its Pixel by LabCorp at-home test collection kit.

Key Companies Profile & Market Share Insights

Key industry participants constantly accelerated the supply and production of diagnostic tests to address the rising need for the effective containment of the COVID-19 pandemic.

Some of the prominent players operating in the global COVID-19 diagnostics market include,

- Hoffman-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Perkin Elmer, Inc.

- Neuberg Diagnostics

- 1drop Inc.

- Veredus Laboratories

- ADT Biotech Sdn Bhd

- altona Diagnostics GmbH

- bioMérieux SA

- Danaher

- Mylab Discovery Solutions Pvt. Ltd.

- ALDATU BIOSCIENCES

- Quidel Corporation

- Quest Diagnostics

- Hologic Inc.

- Laboratory Corporation of America Holdings

- Luminex Corporation

- Abbott

Order a free sample PDF of the COVID-19 Diagnostics Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment