Clinical Trials Matching Software Market Development Trends of Analysis Report By 2030

Clinical Trials Matching Software Market Growth & Trends

The global clinical trials matching software market size is expected to reach USD 396.1 million by 2030, based on a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 13.8% from 2022 to 2030. The significant increase in the number of ongoing clinical trials is likely to drive the market. In addition, the growing adoption of the clinical trial matching software catering to the clinical trials, along with the increased demand for virtual trials and automation in the healthcare sector are some of the key factors contributing to the market growth. The matching software help in effective and fast patient matching with patient-centric approaches.

Clinical Trials Matching Software Market Segmentation

Grand View Research has segmented the global clinical trials matching software market based on deployment mode, end use, and region:

Based on the Deployment Mode Insights, the market is segmented into Web & Cloud Based and On-premise.

- In 2021, the web and cloud-based segment dominated the market with a revenue share of over 90.0% owing to the cloud computing model, which is easier to maintain with no upkeep charges. As in-house server infrastructure is not required, development costs are reduced. The integration time is significantly reduced and it may be accessed from any location. Data sharing is convenient and allows collaboration on different projects.

- The on-premise model requires in-house infrastructure, software licensing, IT support, and lengthier integration times. Therefore, this model is costlier and less preferred. On the other hand, organizations with highly confidential data, including government and financial institutions, require an on-premises environment's security and privacy. Based on the deployment model, the market for clinical trials matching software is segmented into web and cloud-based, and on-premise.

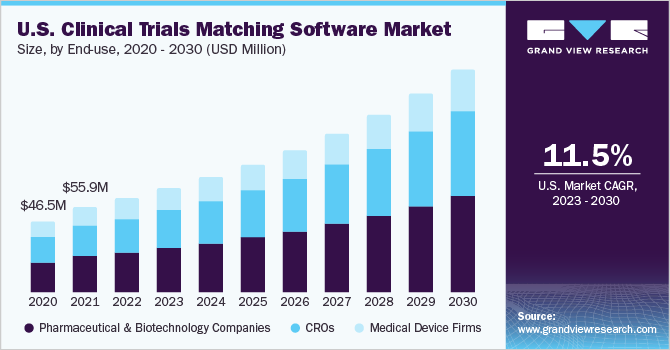

Based on the End-use Insights, the market is segmented into Pharmaceutical & Biotechnology Companies, CROs and Medical Device Firms.

- In 2021, the pharmaceutical and biotechnology companies segment dominated the market with a revenue share of over 40.0% due to the large number of clinical trials required for product launches. Based on end-use, the market is segmented into pharmaceutical and biotechnology companies, CROs, and medical device firms.

- The CROs segment is anticipated to expand at the fastest CAGR of 13.7% over the forecast period. CROs offer drug development through commercialization, pharmacovigilance, and post-approval services to manufacturing organizations with low R&D budgets. A sponsor (the entity wishing to research the safety and efficacy of the products) contracts a CRO, a project-by-project basis for clinical trials. The organizations that are unable to afford to conduct extensive clinical trials prefer to outsource these services. Hence, the demand for CROs is growing rapidly.

Clinical Trials Matching Software Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

- December 2021: Optimapharm, a leading European clinical research organization, acquired SSS International. This acquisition helped the company is widening its portfolio of clinical research studies.

Key Companies Profile & Market Share Insights

The supportive government initiatives and rapidly evolving technology are further encouraging the market players to focus significantly on the new features and develop innovative products. In addition, rapid growth in the number of companies offering updated features, which can be customized, is contributing to the growth of the market in healthcare.

Some of the prominent players operating in the global clinical trials matching software market include,

- IBM Clinical development

- Antidote Technologies, Inc.

- Clinical Trials Mobile Application

- SSS International Clinical Research

- Advarra

- Aris Global

Order a free sample PDF of the Clinical Trials Matching Software Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment