U.S. Pet Wearable Market Sustainable Growth Opportunities and Forecasts 2030

U.S. Pet Wearable Industry Overview

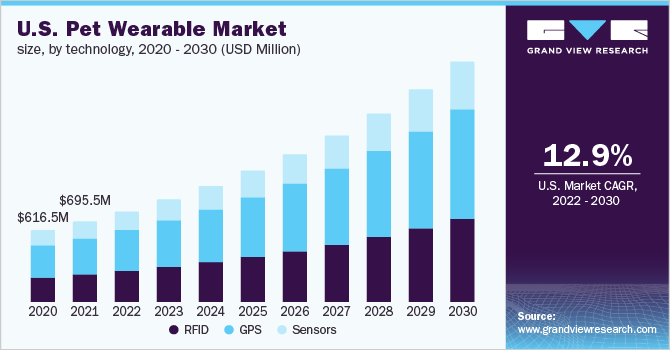

The U.S. pet wearable market size was valued at USD 695.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2022 to 2030.

The rising concern regarding pet safety and well-being is one of the prime factors contributing to market growth. Further, rising disposable income and increasing demand for advanced features in pet wearables for monitoring pets’ health are expected to drive the adoption of pet wearables in the U.S. Additionally, the U.S. has witnessed a growing trend in pet adoption in the past few years, which is expected to continue, which bodes well for market growth.

Pet wearables offer advanced features such as controlling, tracking, monitoring, treatment, medical diagnosis, security, and safety; facilitating the well-being of pets. Several veterinary professionals in the U.S. rely on technologies such as telehealth. This helps them remotely observe their patient’s health while also gaining health-related data stored in wearables, which can be used for medical diagnosis. The ability of pet wearables to monitor and record various animal behavior such as vital signs, sleep patterns, licking, resting, scratching, and more is expected to increase the adoption of these devices among pet owners.

Gather more insights about the market drivers, restrains and growth of the U.S. Pet Wearable Market

The market experienced a minor setback during the COVID-19 pandemic due to the shortage in supply of semiconductor chips caused by the suspension of manufacturing and logistic activities. According to data published by the American Veterinary Medical Association, pet adoption from shelters in the U.S. fell by 15% in 2020 compared to 2019. Although the market experienced a decline in pet adoption, the veterinary practices saw an uptick in consultations from several new and existing pet owners. These consultations were virtual and highly relied on technology such as pet wearables for gaining animal behavioral insights. As such, several pet owners opted for pet wearable devices, which kept the market stagnant during the pandemic.

The increase in spending on pet products is expected to drive market growth. According to data published by the American Pets Products Association (APPA), spending on pet products amounted to USD 123.6 billion in 2021, an increase of 19.3% over 2020. Pet owners are expected to invest in smart technologies such as wearables to secure their pets’ health. As such, companies are investing heavily in introducing feature-loaded products offering multiple functionalities such as voice commands, vibration, sound alerts, and gentle electric shocks, which help keep the pets within a specified zone. Such technological advancements are anticipated to appeal to pet owners and drive them to purchase pet wearables, thereby contributing to market growth.

The high cost and power consumption of pet wearables are expected to pose a challenge to the market growth. These devices usually fall in the range of USD 90 to 150, with an additional subscription charge levied by the company between USD 5 to 10, which is an expensive affair for an average consumer. Additionally, the advanced features in these devices draw a lot of power, leading to high frequency in charging cycles. However, with the increasing demand, several new players are expected to enter the market with newer and cheaper products and technologies, which is anticipated to upkeep the demand for these products.

Browse through Grand View Research's Sensors & Controls Industry Research Reports.

- Oxygen Flow Meters Market - The global oxygen flow meters market size was valued at USD 1.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2021 to 2028.

- Pet Wearable Market - The global pet wearable market size was valued at USD 2,365.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 14.3% from 2023 to 2030.

Market Share Insights

- February 2022: Garmin Ltd. introduced two new dog tracking devices, TT 15 X and T5X. These devices have a long battery life of up to 80 hours and improved tracking functions, which enable pet owners to track dogs from a distance of nine miles.

Key Companies profiled:

Some prominent players in the global U.S. pet wearable market include

- Konectera Inc.

- Datamars

- Allflex USA Inc.

- Avid Identification Systems, Inc.

- Garmin Ltd.

- Link AKC

- Invisible Fence

Order a free sample PDF of the U.S. Pet Wearable Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment