Fixed Voice Market Striking Opportunities, And Forecasts To 2028

Fixed Voice Industry Overview

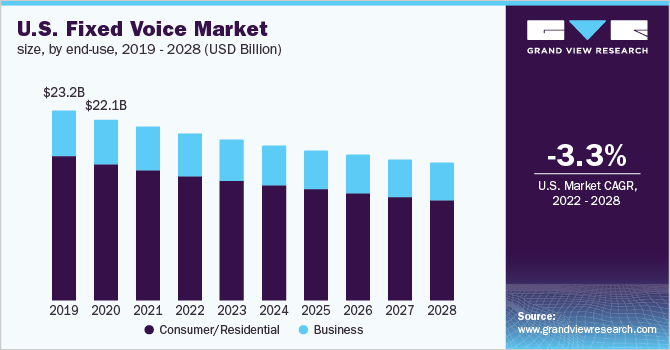

The global fixed voice market size was valued at USD 142.2 billion in 2021 and is expected to decline at a compound annual growth (CAGR) of -2.3% from 2022 to 2028.

Due to decreased circuit-switched subscriptions among businesses and consumers and a drop in average revenue per user (ARPU), fixed voice service revenue is expected to shrink in the coming years. Fixed voice revenues will be dragged down in the next few years due to a high preference for mobile and OTT-based communication services. Over the recent years, consumers and businesses have made a strong shift toward the mobile voice and online voice communication channels. This has further declined the overall revenue streams for the global fixed voice services market.

Gather more insights about the market drivers, restrains and growth of the Global Fixed Voice Market

The rising deployment of 5G technology, an increasing number of mobile smartphones, and consumer inclination towards next-generation technologies have made a strong consumer shift towards VoIP and mobile voice communication platforms. This has hampered market growth in recent years. Additionally, governments across the globe are taking major initiatives to boost the adoption of mobile voice technologies. For instance; the Thailand government is working on the development of a fiber optic core network covering 80,000 kilometers across the country as part of the 'Thailand's Village Broadband Internet Project (Net Pracharat)'. The continuous fall in fixed voice service revenue is failing to balance the steady rise in fixed broadband service revenue, resulting in a decline in fixed communications services revenue.

Globally consumers are likely to abandon their fixed-line communication services and shift to mobile technology. Through 2024, revenue growth in the fixed broadband segment will be supported by a recovery in ARPU levels, as well as an increase in fiber-to-the-home/business (FTTH/B) subscribers as a result of the national broadband network (NBN) project. Fixed voice revenues will be dragged down in the coming years due to a high preference for mobile and OTT-based communication services.

During the COVID-19 crisis, the telecom services business has been one of the most robust sectors of the global economy. Many governments' anti-pandemic policies, which have forced people to stay at home and minimize face-to-face encounters, have boosted the use of telecom services. However, the market will be harmed by the economic impact of firm closures, rising unemployment, halted tourist activities, and lower consumer spending on non-essential goods and services.

Owing to decreased revenues from roaming costs, work-from-home scenarios, and slower net additions in the consumer sector, the mobile segment will see a minor dip in 2020. Fixed voice service spending will continue to fall and will take a further dip as a result of the pandemic, as consumers are likely to cancel fixed call services to save costs.

Browse through Grand View Research's Communication Services Industry Research Reports.

- Video As A Service Market - The global video as a service market size was valued at USD 2.13 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 39.7% from 2021 to 2028.

- Network Traffic Analysis Market - The global network traffic analysis market size was valued at USD 2.49 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2021 to 2028.

Key Companies profiled:

Some prominent players in the global fixed voice market include

- AT&T Inc.

- Verizon Communications Inc.

- Nippon Telegraph and Telephone Corporation (NTT)

- China Mobile Ltd.

- Deutsche Telekom AG

- KT Corporation

- Telefonica SA

- KDDI Corporation

- Orange SA

- Reliance Jio Infocomm Limited.

Order a free sample PDF of the Fixed Voice Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment