Surgical Clips Market Emerging Trends, Analysis and Forecasts 2028

Surgical Clips Industry Overview

The global surgical clips market size is expected to reach USD 2.3 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 26.7% from 2021 to 2028. An increasing number of surgical procedures, the growing geriatric population, ease of operations, cost efficiency, and rising adoption of minimally invasive surgeries are the factors expected to contribute to the market growth. The presence of a large number of players at the global and local levels and their growth strategies to enhance product portfolios are likely to boost the market growth.

Surgical Clips Market Segmentation

Grand View Research has segmented the global surgical clips market on the basis of type, material, surgery type, end user, and region:

Based on the Type Insights, the market is segmented into Ligating and Aneurysm.

- The ligating clips segment accounted for the largest revenue share of 78.2% in 2020. Ligating clips have numerous benefits like structural and dimensional stability, compatibility with open and endoscopic clip appliers, tactile feedback to allow surgeons to ensure accurate locking, high biocompatibility, and they effectively prevent biofluid leakage (such as bile and blood) post-surgical applications.

- Aneurysm clips are expected to witness lucrative growth during the forecast period. Decreased post-operative brain contusions, prolonged efficacy of aneurysm clipping, and reduced serious complications led to the increased adoption of the aneurysm clipping technique, which positively impacted the market growth.

Based on the Material Insights, the market is segmented into Titanium, Polymer and Others.

- Titanium surgical clips held the largest revenue share of 82.6% in 2020. The advantages of titanium include durability, inertness, non-reactivity, high tensile strength, and lightness. Its exceptional compatibility with imaging modalities like CT, X-rays, and MRI and the ability to effectively secure the closure of even the most delicate vessels during surgeries make it a preferred choice for surgical equipment, thereby leading to the segment growth.

- Resistance to axial pull, inertness, and radiolucency are the key advantages of a polymer as a material for surgical clips. Its non-conductive property resists thermal spread preventing tissue necrosis, thus saving organs adjacent to the surgical clip. Hem-o-lok is a commonly used non-absorbable polymer clip that has better tissue holding power and improved resistance to arterial pressure (up to 800 mmHg) than titanium clips.

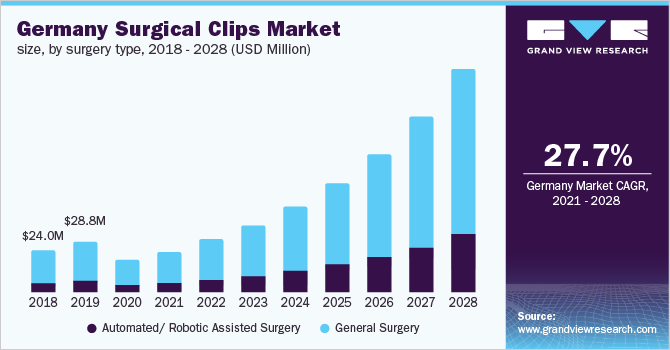

Based on the Surgery Type Insights, the market is segmented into Automated/ Robotic Assisted Surgery and General Surgery.

- General surgery held the largest share of 87.5% in 2020. Thoracic, vascular, urologic, gynecological, bariatric, and other general surgeries have a constant need for surgical clips. Reduced infection rate, faster healing time, minimized scar visibility, and increased patient satisfaction are the prominent advantages of surgical clips over sutures.

- The automated/robotic-assisted surgery segment is still in the initial growth phase. The lack of financial aid, infrastructure, and skilled personnel and insufficient clinical evidence related to automated surgery are the major reasons behind its smaller market share. However, reduction in human errors and improved efficiency have led to the improved adoption of this surgery in economically developed countries.

Based on the End-user Insights, the market is segmented into Ambulatory Surgical Centers and Clinics.

- The hospitals segment captured the largest share of 78.8% in 2020 owing to the large procedural volume and preventive surgeries. With an increase in the number of surgical procedures, such as neurosurgery and abdominal laparoscopy, and the growing incidence of trauma, the demand for surgical clips has significantly increased in hospitals.

- Ambulatory Surgical Centers(ASCs) are anticipated to register the highest growth rate of 28.6% during the forecast period. This can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs. Most Asian and Middle Eastern countries lack the economy and infrastructure for establishing ambulatory centers, but they are soon to develop the same to minimize the surgical burden on hospitals.

Surgical Clips Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Companies Profile & Market Share Insights

The market is highly fragmented due to the presence of local manufacturers and sellers in most regions of the globe. Major players offer these clips in different sizes and styles and market them exclusively for specific applications. Strong marketing and affordable pricing play an important role in the competition and are considered to be the major deciding factors for the customers.

Some of the prominent players operating in the global surgical clips market include,

- Ackermann Medical GmbH & Co.

- Braun Melsungen AG

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Grena Ltd.

- Johnson & Johnson (Ethicon)

- Scanlan International, Inc.

- Teleflex Incorporated

- MERIL LIFESCIENCES Pvt. Ltd.

- Anrei and Sinolinks

Order a free sample PDF of the Surgical Clips Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment