Smart Lighting Market Analysis and Product segments By 2028

Smart Lighting Industry Overview

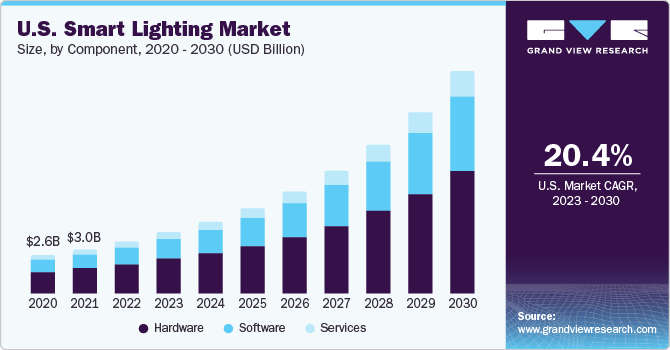

The global smart lighting market size was valued at USD 10.85 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2021 to 2028.

The ability of lights to connect with IoT devices and create a variety of ambient lighting using just smartphones or tablets has increased its popularity and demand across commercial and residential spaces. Smart lights are dimmable with various color tones as per requirement, can be scheduled to turn on/off, monitor lighting’s energy usage, and be connected via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee. Additionally, smart lights can be voice-controlled by integration with the platform, such as Google Assistant, Amazon’s Alexa, Apple’s Siri, or Microsoft’s Cortana. These wide ranges of features apart from illumination coupled with growing adoption for IoT devices and smart assistant platforms have created market growth avenues for smart lightings.

Gather more insights about the market drivers, restrains and growth of the Global Smart Lighting Market

Smart lightings are also termed connected lighting as it can be seamlessly integrated into the IT network in a building or city infrastructure to share information regarding the status of the operation. For instance, smart street lights in city parking or roads ensure safety by offering wide coverage, environmental monitoring, parking and traffic management information, and city surveillance by connecting with IoT devices. Smart lights are often integrated with sensors, which turn them into a point of intelligence device to gather information on activity patterns, daylight levels, occupancy, change in temperature, or humidity. This information proves to be vital for government departments to take appropriate actions and monitor the city for unwarranted activity.

Government policies encouraging energy conservation and environment protection coupled with stringent regulations discourage the usage of incandescent lamps, which is anticipated to bolster the demand for LED smart lighting. The global lighting industry consumes approximately 19% of the total electricity and is responsible for around 6% of the total greenhouse gas emissions. On the contrary, LED smart lights are highly efficient. They consume almost 70% lesser energy and connect devices to collect information for future processes. They have significantly longer life spans and are free from any mercury content. Similarly, there are no harmful greenhouse gas emissions associated with LED lights. Thus, the LED technology has potentially revolutionized the entire lighting industry and infiltrated the smart lighting segment wherein LED is a preferable choice among vendors and consumers.

The penetration of smart lights is expected to increase owing to benefits such as controlled power usage, longer life, multiple light setting in a single lamp/luminaire, and availability of a wide range of modern decorative lighting products. The adoption of smart lighting in the residential, commercial, and industrial sectors is yet to reach its full potential. Hence, various government initiatives to promote the use of LED-based smart lights are expected to boost their demand over the forecast period. Moreover, countries such as China, Brazil, Colombia, Mexico, France, Spain, and Germany have imposed a complete ban on the sale of incandescent lamps to encourage the adoption of LED lights; wherein high-income groups are leaning towards LED-based smart lights. Furthermore, many smart lighting companies have reported a negative impact of the COVID-19 pandemic due to lockdown, disrupting construction activity, and raw material supply. The decline in consumer purchasing capacity, and delay in completing construction projects due to the COVID-19 pandemic pushed the smart lights purchase order quantity, timeline, and payment.

Browse through Grand View Research's Semiconductors Industry Research Reports.

- Smartphone Market - The global smartphone market is expected to gain significant demand owing to the growing demand for mobile internet services and applications along with real-time need for information exchange. Constant technological advancements for enhanced experiences are expected to provide positive avenues to market growth over the next seven years.

- Artificial Intelligence Market - The global artificial intelligence market size was valued at USD 93.5 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

Market Share Insights

- November 2019: The California Energy Commission voted to ban the sales of inefficient lighting bulbs with effect from 01 January 2020. China has also banned the production of incandescent lights for domestic use to encourage the replacement of traditional lighting with LED lights.

- January 2019: N.Y. Power Authority allocated a fund of USD 7.5 million to municipalities across the state for installing new smart LED street lights.

Key Companies profiled:

Some prominent players in the global smart lighting market include

- Acuity Brands

- Signify Holding

- Honeywell International Inc.

- Itron Inc (Streetlight Vision)

- Ideal Industries, Inc.

- Häfele GmbH & Co KG

- Wipro Consumer Lighting

- YEELIGHT

- Sengled Optoelectronics Co., Ltd.

- Verizon

- Schneider Electric SA

Order a free sample PDF of the Smart Lighting Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment