North America And Europe Medical Technology Market Revenue, Share and Growth Rate to 2028

North America And Europe Medical Technology Industry Overview

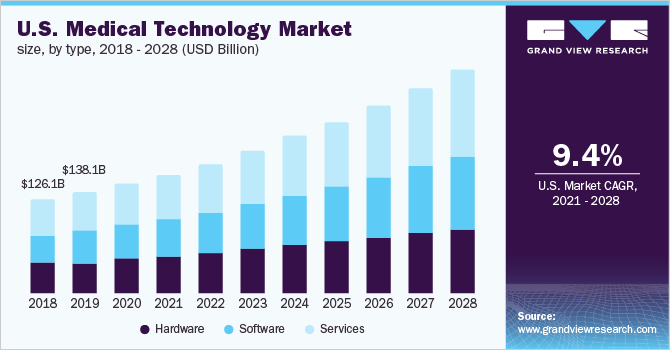

North America and Europe medical technology market size was valued at USD 270.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.5% from 2021 to 2028.

Rising healthcare expenditure, ineffective hospital service management, growing influx of patient population at various healthcare facilities, increasing healthcare personnel shortage, is boosting public and private organizations to discover and develop innovative models of healthcare delivery. Healthcare professionals are constantly demanding for advanced technological solutions to improve the quality of patient care, eliminate growing data siloes, reduce operational costs. The increasing adoption of digital health technologies is anticipated to drive market growth over the forecast period.

The rapidly growing geriatric population in North America and Europe coupled with the rising prevalence of diseases, increasing healthcare costs, and lack of healthcare infrastructure in developing regions are driving the demand for medical technological solutions. The increasing penetration of smartphones and advancements in internet connectivity is supporting and boosting the adoption of mHealth technologies by healthcare providers and patients. As per The Mobile Economy 2018 estimates, the smartphone penetration is expected to reach 77% by 2025 from 57% in 2017. The increasing adoption of smartphones by the consumer is paving a path for the adoption of telehealth, patient monitoring, mHealth apps, and other digital health technologies.

Gather more insights about the market drivers, restrains and growth of the North America And Europe Medical Technology Market

Technological advancements in smartphone technology for improving disease diagnostics are anticipated to drive market growth. For instance, as per data published in 2017, researchers at the University of Illinois have developed a camera to improve the diagnostic features of smartphones. Furthermore, continuous improvement in network infrastructure and growing network coverage are boosting the demand for digital health services. Mobile network operators view digital health as an opportunity for investment owing to growing user adoption of smartphones and rising awareness about fitness.

Easy availability of technologically advanced devices and growing penetration of smartphones and enhanced internet connectivity, public and private investors have begun investing in the potential of the industry to deliver innovative healthcare solutions and enhance patient care through various digital platforms. Through these digital solutions, patients can easily track their fitness regimes and well-being, obtain answers to medical inquiries. For instance, several apps have been launched over the last decade to help the patient population book appointments, track their consultations and medical prescriptions, and store their healthcare information throughout the treatment.

Telehealth solutions are being widely adopted by the healthcare fraternity and thereby, improving patient-provider engagement and enabling delivery of care to patients in remote locations. Telemedicine has been legalized and is regulated in many countries such as the U.S., Canada, Germany, Russia, and many other European countries. Technology companies such as Apple, Google, and IBM are focusing on improving mobile health experience by providing numerous options through different subscription plans and are emphasizing data security. Thus, these factors are expected to drive the market over the forecast period. The ongoing Covid-19 pandemic exposed the shortcoming of the existing healthcare systems and drove the need to rapidly adopt digitalization and automation.

Medical technological solutions have enabled healthcare facilities to streamline their workflows and automate manual tasks, thereby reducing the burden on the workforce. Government authorities in North America and Europe laid down restrictions and imposed lockdowns to curb the transmission of infection. These preventive measures led to a significant surge in the number of visitors and active members utilizing digital health solutions such as telehealth and teleconsultation to avoid hospital visits. The Covid-19 pandemic had a positive impact in unearthing the potential of digital health technologies. Healthcare fraternities grew aware of the potential of outpatient hospital care and primary care which can be delivered virtually and digitally, thereby boosting the adoption of medical technology solutions.

The emergence and integration of the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML) algorithms into digital healthcare platforms are revolutionizing the healthcare industry. Through the support of integrated analytics, advanced wearables, and strong connectivity, IoT has evolved and transformed the healthcare sector by facilitating various activities such as optimization of prescriptions, tracking of healthcare staff and patients, and chronic disease management. AI/ML algorithms can enhance the personalization of healthcare services. For example, a doctor can accurately diagnose patients by availing the patient’s ancestry and DNA information from an AI-based healthcare information system and provide the best course of treatment.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Smart Card In Healthcare Market: The global smart card in healthcare market size was valued at USD 1.01 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2021 to 2028.

- Biohacking Market: The global biohacking market size was valued at USD 15.42 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 19.4% from 2021 to 2028.

Market Share Insights

- March 2021: Greenway Health launched its latest revenue cycle management solution, Greenway Revenue Services (GRS) Select. This customizable revenue cycle management solution meets the growing needs of ambulatory care practices.

- January 2021: Athenahealth, Inc. collaborated with Humana, Inc. to deliver value-added insights using athenahealth’s athenaClinicals and Humana’s intelligence to empower EHR workflows.

Key Companies profiled:

Some of the prominent players in the North America and Europe medical technology market include:

- Allscripts Healthcare Solutions

- eClinical Works

- Athenahealth, Inc.

- Carestream Health

- e-MDS Incorporation

- American Well

- Teladoc Health

- MDLive Inc.

- AdvancedMD Inc.

- Qualcomm Technologies Inc.

- Greenway Health LLC

- CureMD Healthcare

- DXC Technology Company

- HealthTap Inc

- Doctor On Demand, Inc.

Order a free sample PDF of the North America And Europe Medical Technology Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment