Europe Squalene Market Production and Revenue Analysis Report 2028

Europe Squalene Industry Overview

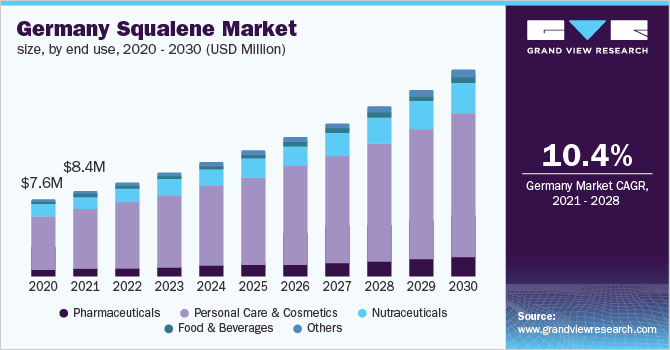

The Europe squalene market size was valued at USD 36.22 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 10.6% from 2021 to 2030.

Increasing demand for squalene in the pharmaceutical applications as an adjuvant for immune enhancement is one of the major factors driving the consumption. Furthermore, increasing applications of squalene in nutraceuticals and food supplements owing to its ability to serve as an anti-cancer and antioxidant agent are projected to propel the demand for the product.

Gather more insights about the market drivers, restrains and growth of the Europe Squalene Market

Squalene, being a naturally occurring compound, is derived from animal and plant oils and shark livers. Shark livers traditionally have been the predominant source globally. However, there have been growing concerns regarding the conservation of shark species, due to which Europe is banning the usage of shark-derived squalene in cosmetic formulations. The chemical can be produced from both natural and chemical sources, such as animal oils, plant oils, and synthesized chemical feedstock. Synthetic squalene is produced from genetically engineered yeast cells. However, squalene obtained from the liver of deep-sea sharks is considered to produce the highest yields of good-quality squalene.

The demand for squalene in the pharmaceutical industry went up during the lockdown owing to its usage in the COVID-19 vaccines. There are only a handful of companies that are manufacturing vaccines derived from squalene and most of them have collaborated with GlaxoSmithKline to do so.

However, at the beginning of the pandemic, from March 2020 to July 2020, due to the shortage of supplies and disruptions in the supply chain, the market registered a decline in growth. With an increase in the research & development activities related to the development of covid-19 vaccines, the demand for the product has replenished.

The European Union has banned the use of shark oil-based squalene in the cosmetics industry, which has forced manufacturers to focus on finding suitable alternatives for the product. Increasing concerns regarding the extinction of sharks have prompted the use of plant-based and synthetically derived squalene. The industry pivoted towards its extraction through plant oils that include amaranth, olive, rice bran, and others. The European Union is the leading producer, consumer, and exporter of olive oil, accounting for approximately 65% of the world’s export.

The main destinations of the European Union’s olive oil are Brazil, the U.S., and Japan. Spain is the world’s largest producer of olive oil contributing to more than 40% of the world’s olive oil production, especially from Andalusia. Other 20% is produced in Italy, followed by 18% from Tunisia and 12% from Greece. The European oil market is anticipated to witness considerable growth over the projected period being the largest producer of olive oil in the world.

Browse through Grand View Research's Food Additives & Nutricosmetics Industry Research Reports.

- Squalene Market - The global squalene market size was valued at USD 111.9 million in 2015 and is expected to witness steady growth owing to rising awareness regarding its health benefits. This has resulted in its increasing usage in pharmaceuticals, food supplements, and cosmetics.

- Nutraceuticals Market - The global nutraceuticals market size was valued at USD 454.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.0% from 2021 to 2030.

Key Companies profiled:

Some prominent players in the Europe squalene market include

- efpbiotek

- Gracefruit Limited

- VESTAN

- Henry Lamotte Oils GmbH

- Sophim

- Kuraray Europe GmbH

- Maruha Nichiro Corporation

- Wilshire Technologies Inc.

Order a free sample PDF of the Europe Squalene Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment