U.S. Welding Consumables Market Research Scope And Data Sources 2028

U.S. Welding Consumables Industry Overview

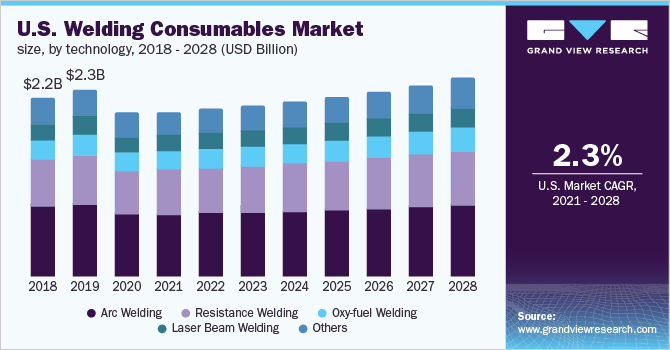

The U.S. welding consumables market size was valued at USD 2.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 2.3% from 2021 to 2028.

The demand for welding consumables in the U.S. is expected to be driven by automation in the automotive sector, coupled with the extensive manufacturing abilities of the industrial sector in the economy. The market for U.S. welding consumables witnessed a notable decline on account of the lockdown imposed to curb the spread of COVID 19. The market also exhibited a decline due to the stoppage of industrial manufacturing on account of the lockdown imposed in the country. The demand for welding consumables for services involving essential MRO, coupled with the resumption of the manufacturing sector in the latter half of 2020, drove the demand for welding consumables.

Gather more insights about the market drivers, restrains and growth of the U.S. Welding Consumables Market

The industry in the country was impacted due to the fluctuations in the prices of the raw materials used for the production of welding consumables. In addition, suspension in cargo transportation in the initial part of the lockdown in early-2020 resulted in a limited supply of the product across the country, which led to a reduction in the industry growth.

Welding consumables in the U.S. are supplied through wholesalers, retailers, direct agreements between manufacturers and distributors, and third-party supply agreements. Several manufacturers are adopting forward integration, which enables them to sell their products directly. For instance, The Lincoln Electric Company and Illinois Tool Works, Inc. are among the major manufacturers and suppliers in the market whose operations are forward integrated.

The industry has witnessed a trend towards the adoption of low-heat input welding techniques, such as single arc, and better-performing consumables, which has increased the automation levels for OEMs in the automotive industry. The presence of a notable automotive manufacturing base in the country is also expected to benefit the industry growth over the forecast period.

The U.S. emerged as one of the pioneers in innovation related to the advanced manufacturing technologies for several manufacturing industries such as the internet of things (IoT) and smart factories leading to smart products and advanced materials, which are likely to emerge as the key instruments of growth. The growing innovation in the country is expected to promote industrial manufacturing, which, in turn, is expected to fuel growth.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

- Injection Molding Market: The global injection molding market size was estimated at USD 261.8 billion in 2021 and is anticipated to expand at a compounded annual growth rate (CAGR) of 4.8% from 2022 to 2030.

- Blow Molding Tools Market: The global blow molding tools market size was valued at USD 12.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2022 to 2030.

Key Companies profiled:

Some of the prominent players in the U.S. welding consumables market include:

- Voestalpine

- The Lincoln Electric Company

- Obara Corporation

- Kiswel, Inc.

- Colfax Corporation

- Air Liquide Welding, Ltd.

Order a free sample PDF of the U.S. Welding Consumables Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment