Stoma Care Market Leading Players Updates and Industry Analysis Report till 2028

Stoma Care Industry Overview

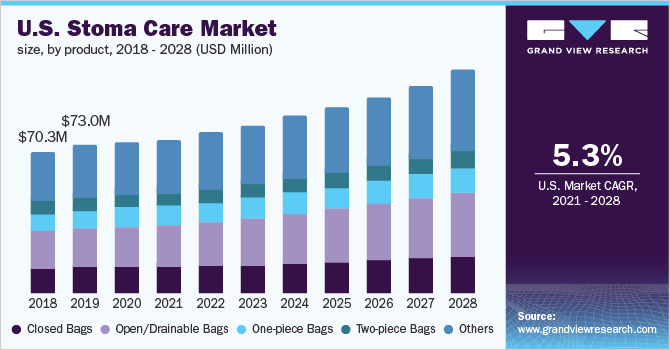

The global stoma care market size was valued at USD 487.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028.

Increasing cases of colorectal cancer and bladder cancer, Inflammatory Bowel Disease (IBD), adoption of advanced technologies and rising awareness regarding stoma care products are the key driving factors for the market. In addition, the increasing prevalence in the young population is expected to upsurge the demand for stoma care and accessories during the forecast period. The COVID-19 pandemic had a detrimental effect on the market.

The sudden outbreak of COVID-19 has postponed many ostomy procedures owing to which the demand for stoma care products has slightly decreased. In addition, the hospitals faced a surge of patients which overburdened emergency rooms (EDs), intermediate care units (ICUs), and intensive care units (ICUs) due to the COVID-19 pandemic. As a result, several ostomy surgeries were delayed which negatively impacted the market care to some extent. This impact has been the highest in the European region, especially in the U.K. and Italy. However, the stoma care products required for homecare have considerably increased due to COVID-19 as most of the patients opted for home treatments. Therefore, this factor is expected to maintain the steady growth of the market.

Gather more insights about the market drivers, restrains and growth of the Global Stoma Care Market

Several initiatives are being undertaken by various nonprofit organizations and private players to raise awareness regarding stoma care, globally. For instance, European Ostomy Association organizes World Ostomy Day (WOD) each year. It aims at improving the rehabilitation of ostomates worldwide by bringing them together. Many associations organize activities to raise awareness, such as educational programs, support meetings, and electronic information networks.

Coloplast is a leading market player that has undertaken several projects globally for creating awareness about ostomy and developing and promoting ostomy care guidelines. The company has recently published Ostomy Life Study Review to raise awareness and improve the standard of ostomy care. The review presents some of the guidelines that help in efficient patient care, such as minimizing the risk of leakage. Coloplast also supports WOD by awarding the members of the International Ostomy Association (IOA) that share their experience stories regarding stoma patients, which inspires them to live a quality life. These initiatives are expected to streamline the management of ostomy care. An increase in awareness, development of suitable reimbursement policies, and favorable policy frameworks are expected to boost investments in R&D to manufacture technologically advanced stoma care products. This in turn is expected to drive the market.

Furthermore, one of the major reasons likely to boost the market for stoma care products throughout the forecast period is the growing geriatric population. According to the World Health Organization in 2019, the global population aged 65 and up is predicted to grow from 7.00% in 2000 to 16.00% in 2050. The majority of people who have an ostomy are over the age of 50. According to the National Centre for Biotechnology Information, patients aged 70 and above have more permanent ostomy procedures than younger people, with longer hospital stays and a higher mortality rate, which is expected to raise the sale of the products.

The prevalence of colorectal cancer in North America is the highest. The increasing risk of colorectal and urinary bladder cancer has increased the demand for ostomy care products. In addition, the American Cancer Society (ACS) reported that in 2019, the number of colorectal cases in the U.S. has increased to 101,420. Thus, the growing geriatric population and increasing prevalence of colorectal cancer are expected to drive the demand for stoma care products.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Biopharmaceutical Third-party Logistics Market: The global biopharmaceutical third-party logistics market size was estimated at USD 119.8 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 5.9% over the forecast period.

- India Home Healthcare Market: The India home healthcare market size was valued at USD 7.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.27% from 2022 to 2030.

Market Share Insights

- April 2018: Coloplast Corp. announced the addition of SenSura Mio Concave to its SenSura Mio product category. This has helped the company expand its customer base.

- April 2016: Hollister Incorporated received Novation's NOVAKIDSTM Novation's Pediatric Supply Chain Program‘s Signature Supplier contract to provide hospitalized pediatric patients in the U.S. with ostomy products, support services, and educational materials.

Key Companies profiled:

Some of the prominent players in the global stoma care market include:

- Coloplast

- Braun Melsungen AG

- Hollister Incorporated

- ConvaTec Inc.

- Salts Healthcare

- Welland Medical Limited

Order a free sample PDF of the Stoma Care Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment