Southeast Asia Pipes Market Growth Impact and Demand by Regions till 2028

Southeast Asia Pipes Industry Overview

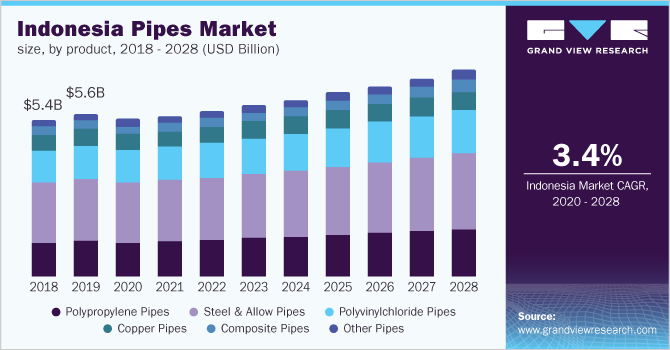

The Southeast Asia pipes market size was estimated at USD 19.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.3 % from 2020 to 2028.

Growth in the infrastructure development in the region spurred by FDI inflow due to the “China plus one” policy adopted by major downstream companies is expected to drive the demand for pipes in the region, which is further expected to drive market growth.

Stringent covid restrictions imposed in key economies such as Indonesia, Malaysia, the Philippines, and Thailand resulted in the temporary closure of many non-essential industries and construction sites. In addition, the construction sector witnessed a downfall in several countries, leading to a decline in demand for pipes in key construction applications, thereby limiting the industry growth.

Gather more insights about the market drivers, restrains and growth of the Southeast Asia Pipes Market

The rise in awareness of sanitization, demand for pure drinking water, and rise in investments in hospital buildings post the COVID-19 pandemic are factors likely to improve the macroeconomic indices of the Southeast Asian countries in the coming years. In addition, the market is also expected to witness a revival on account of the restart of the construction activities in 2021, in the region.

The construction and industrial sector are the major application areas propelling the demand for pipes in the market. Factors such as stable exchange rates, rapid industrialization, fast-paced infrastructural developments, subdued oil prices, and a moderate inflation rate drive the overall economic growth in emerging economies in the region, consequently driving the demand for pipes in residential and commercial spaces.

Plastics have progressively displaced multiple materials, especially in the piping or tubing industry. Rising construction activities on account of increasing population, industrialization, and urbanization across the region are expected to result in the growth of the market over the forecast period.

Pipe manufacturers tend to opt for recyclable raw materials to curb pollution and reduce their recycling burden. For instance, Wavin, a prominent market player, offers pipes produced from 50% recyclable raw materials using its Recycore technology. A majority of the manufacturers of plastic and plastic pipes exhibit similar trends in investment, acquisition, expansion, product launches, and geographic expansions.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

- Geomembrane Market: The global geomembrane market size was estimated at USD 1,986.6 million in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 5.2% from 2022 to 2030

- Automotive Adhesive Tapes Market: The global automotive adhesive tapes market size was estimated at USD 3.1 billion in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 6.5% from 2022 to 2030.

Market Share Insights:

- April 2021: The Thailand government announced the construction of 100,000 homes under the National Housing Authority’s house-rental project for the low-income sector.

- March 2021: Wavin has launched its advanced low-noise pipe system, Wavin AS+ in Indonesia, which is currently witnessing significant urbanization and infrastructure development

- February 2020: JICA signed a grant agreement with the government of Vietnam to provide an aid of about USD 17.4 billion for the Trenchless Sewerage Pipe Rehabilitation project in Ho Chi Minh City.

Key Companies profiled:

Some of the prominent players in the Southeast Asia pipes market include:

- Kobelco

- Thai Premium Pipe Co., Ltd.

- George Fischer Pte., Ltd.

- Binh Minh Plastics

- Vesbo Asia Pte., Ltd.

- Bina Plastic Industries Sdn. Bhd.

- Wavin Asia Pacific

Order a free sample PDF of the Southeast Asia Pipes Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment