U.S. Liquid Waste Management Market Emerging Trends, Opportunities and Forecast To 2027

U.S. Liquid Waste Management Industry Overview

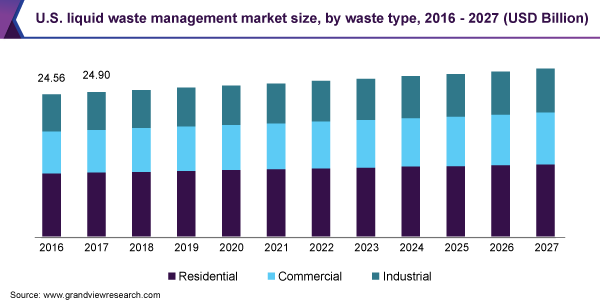

The U.S. liquid waste management market size was valued at USD 25.62 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 1.5% from 2020 to 2027.

Rising concerns regarding the improper disposal of liquid waste causing pollution, environmental toxicity & degradation, and soil contamination are expected to drive the market growth. An approximate estimate of global wastewater production is about 1,500 km3 per day, and over 2 million tons of waste is discharged to receiving water per day, with the U.S. accounting for a large share. A majority of this arises from industrial manufacturing operations and often contains chemical compounds or other toxic materials unsuitable for the environment or human and animal health.

Industrial chemical waste poses serious threats, such as potential radiation risks or potential biological organisms, which are likely to result in epidemic breakouts in the U.S. Liquid waste treatment aims to render these effluents safe for disposal in the environment. Thus, these effluents are thoroughly processed and inspected to identify their compatibility with standard seawater or other ecosystems. The rapid spread of the COVID-19 pandemic has resulted in augmenting the demand for disposal, decontamination, and disinfection services in the U.S. In response to the outbreak, various agencies such as the Texas Commission on Environmental Quality have formulated measures for proper collected, transportation, treatment, and disposal of waste related to COVID-19 from the healthcare facilities.

Gather more insights about the market drivers, restrains and growth of the U.S. Liquid Waste Management Market

Although no evidence is found regarding the transmission of COVID-19 through sewerage systems, traces of the virus were detected in human excreta. This has resulted in increasing wastewater treatment services in the country. Similarly, the management of toxic and hazardous waste in the healthcare facilities witnessed significant growth in the past few months.

The presence of toxic or hazardous materials and chemicals, or even metals, is anticipated to augment the cost of segregation, processing, and treatment as these require careful handling and disposal or recycling. Aging infrastructure remains another critical area of concern as the existing liquid waste management systems in place are currently quite old, averaging about 15 to 20 years.

Browse through Grand View Research's Water & Sludge Treatment Industry Research Reports.

- Waste Management Market - The global waste management market size was valued at USD 989.20 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030.

- Liquid Waste Management Market - The global liquid waste management market size was valued at USD 90.3 billion in 2018 and is expected to register a CAGR of 3.8% over the forecast period.

U.S. Liquid Waste Management Market Segmentation

Grand View Research has segmented the U.S. liquid waste management market on the basis of waste type, source, service, and states:

- S. Liquid Waste Management Waste Type Outlook (Revenue, USD Billion, 2016 - 2027)

- Residential

- Commercial

- Toxic & Hazardous Waste

- Organic & Non-Hazardous Waste

- Industrial

- Toxic & Hazardous Waste

- Organic & Non-hazardous Waste

- Chemical Waste

- S. Liquid Waste Management Source Outlook (Revenue, USD Billion, 2016 - 2027)

- Municipal

- Textile

- Paper

- Iron & Steel

- Automotive

- Pharmaceutical

- Oil & Gas

- Others

- S. Liquid Waste Management Service Outlook (Revenue, USD Billion, 2016 - 2027)

- Collection

- Transportation/Hauling

- Disposal/Recycling

Key Companies profiled:

Some prominent players in u. s. liquid waste management market include,

- Veolia

- Clean Harbors, Inc.

- Covanta Holding Corporation

- Stericycle, Inc.

- Waste Management, Inc.

- US Ecology, Inc.

- Republic Services, Inc.

- Heritage-Crystal Clean, LLC

- Heritage

- APS Environmental

- Hazardous Waste Experts

- Liquid Environmental Solutions

Order a free sample PDF of the U.S. Liquid Waste Management Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment