Gas Turbine Services Market Growth, Latest Trends & Dynamics By 2027

Gas Turbine Services Industry Overview

The global gas turbine services market size was valued at USD 26.0 billion in 2019 and is projected to register a CAGR of 9.8% over the forecast period.

The rise in environmental concerns owing to the high amount of carbon emissions from coal-based power generation has resulted in the adoption of low carbon emission power generation technologies such as natural gas-powered turbines. This eventually results in the rise in demand for services of these gas turbines globally.

Although natural gas-powered turbines are expected to gain popularity globally, particularly in the North American and European regions, emerging economies in the Asia Pacific such as India and China still rely on coal-based power generation owing to its lower costs. This factor is expected to hinder new gas turbine sales and maintenance contracts in the region in the future. Moreover, limited natural gas reserves are expected to restrict the growth of the market in the coming years.

Gather more insights about the market drivers, restrains and growth of the Global Gas Turbine Services Market

The U.S. has a well-developed natural gas infrastructure and the presence of established key end-use industries, which are the major demand drivers for gas turbine services in the country. According to the Energy Information Administration, natural gas surpassed coal as the most common source for electricity generation in the U.S. in 2016. This has resulted in the rise in demand for maintenance services of gas turbines in the country.

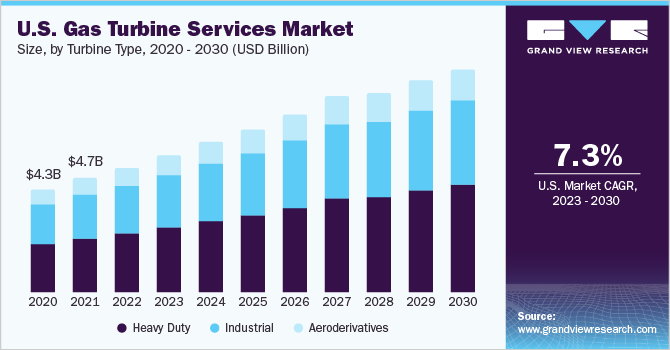

Heavy-duty gas turbines accounted for the largest market share in 2019 followed by industrial and aero-derivative turbines. Although aero-derivative turbines account for a relatively lesser share as compared to other variants in the U.S market, the future of small aero-derivative power generation looks promising owing to the development of the aerospace and defense sector in the country, where these turbines are used on a large scale. This would subsequently drive the demand for maintenance services for aero-derivative gas turbines in the U.S. in the coming years.

The rise in multiyear service contracts is one of the major factors driving the turbine service market globally. Plant operators find multiyear agreements to be an economical solution in the long term. These agreements can be signed for a range of services such as basic maintenance or overall maintenance. Basic maintenance includes preventive maintenance to full-service maintenance whereas overall maintenance comprises repair for concerned equipment.

Browse through Grand View Research's Conventional Energy Industry Research Reports.

- Lithium-ion Battery Market: The global lithium-ion battery market size was valued at USD 41.97 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.1% from 2022 to 2030.

- Coal Power Generation Market: The global coal power generation market demand was valued at 1,961.56 GW in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 1.6% from 2020 to 2028.

Gas Turbine Service Market Segmentation

Grand View Research has segmented the global gas turbine services market report based on turbine type, turbine capacity, service type, service provider, end-use, and region:

- Gas Turbine Services Turbine Type Outlook (Revenue, USD Million, 2016 - 2027)

- Heavy Duty

- Industrial

- Aeroderivative

- Gas Turbine Services Turbine Capacity Outlook (Revenue, USD Million, 2016 - 2027)

- <100 MW

- 100 to 200 MW

- >200 MW

- Gas Turbine Service Type Outlook (Revenue, USD Million, 2016 - 2027)

- Maintenance & Repair

- Overhaul

- Spare Parts Supply

- Gas Turbine Service Provider Outlook (Revenue, USD Million, 2016 - 2027)

- OEM

- Non-OEM

- Gas Turbine Services End-use Outlook (Revenue, USD Million, 2016 - 2027)

- Power Generation

- Oil & Gas

- Other Industrial

- Gas Turbine Services Regional Outlook (Revenue, USD Million, 2016 - 2027)

- North America

- Europe

- Asia Pacific

- Commonwealth of Independent States

- Central & South America

- Middle East & Africa (MEA)

Market Share Insights

- September 2018: General Electric launched a new 6B Repowering upgrade for turbines which can advance performance in both, gas turbines and combined-cycle operation.

Key Companies profiled

Some prominent players in the global gas turbine services market

- Siemens AG

- General Electric

- Mitsubishi Hitachi Power Systems, Ltd.

- Kawasaki Heavy Industries, Ltd

- MAN Energy Solutions

- Ansaldo Energia S.p.A.

Order a free sample PDF of the Gas Turbine Services Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment