Vendor Risk Management Market 2030: Innovations Driving Enhanced Security

Vendor Risk Management Market Growth & Trends

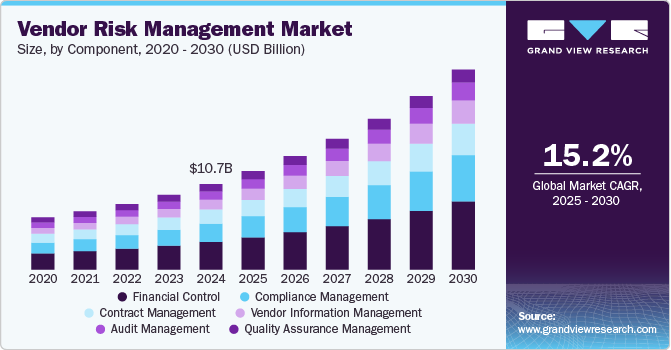

The global vendor risk management market size is expected to reach USD 24.95 billion by 2030, according to a new study conducted by Grand View Research, Inc. It is expected to expand at a CAGR of 15.2% from 2025 to 2030. Enterprises have been outsourcing critical tasks to their vendors, which considerably brings benefits and risks. Many events such as the COVID-19 pandemic, the Colonial Pipeline attack, SolarWinds cyber-attack, and other ransomware breaches have further increased the scope of risks associated with vendors. Thus, enterprises are exceedingly opting for advanced vendor risk management solutions to identify, understand, mitigate, and reduce the impact of hazards. As a result, the global market is anticipated to progress significantly through the forecast period.

Gather more insights about the market drivers, restrains and growth of the Vendor Risk Management Market

The outbreak of the COVID-19 pandemic is likely to impact businesses drastically, stifling innovation, suppressing profitability, and drying up cash flow and financial reserves. The IT and software development industries have also faced challenges due to this unforeseen outbreak. A significant portion of global supply chains was disturbed due to the outburst of the pandemic, which also affected the market. Organizations from highly impacted industries such as manufacturing, BFSI, retail, and government showed less adoption of the solutions due to financial losses, interrupted business operations, and lack of visibility. However, healthcare, IT and telecom, and energy and utility industries, which presented some business opportunities amidst the pandemic, showed slight growth in vendor risk management solutions adoption. Thus, the global market is estimated to be moderately impacted by the COVID-19 crisis.

According to statistics, nearly two-thirds of the security breaches originate from vendors and third-party suppliers. Breaches like cyber security threats, intrusion of ransomware, growing disinformation campaigns, and other data privacy concerns are engaging companies to opt for risk mitigation solutions, including vendor risk management, which drives the market. Moreover, managing multiple vendors' activities seems like a tedious job for several organizations across the world. As a result, the implementation of vendor risk management solutions allows them to evaluate risks associated with vendors, identify critical issues, and enhance production rate significantly.

The key vendors in the global VRM market are focusing on introducing new solutions and services while upgrading their existing product portfolio to strengthen their foothold. For instance, in November 2017, LockPath, one of the solution providers, introduced its Keylight Platform with Security Scorecard's security rating platform. This product was aimed to support enterprises with practical vendor assessment and management while strengthening security programs. Thus, numerous developments in terms of new product launches, mergers & acquisitions, and partnerships are observed in this market, contributing to the market growth.

Vendor Risk Management Market Report Highlights

- The financial control segment dominated the market and accounted for the revenue share of over 32.0% in 2024

- The on-premises segment accounted for a largest revenue share of over 66.0% in 2024. Despite the rise of cloud computing, many businesses still maintain on-premises environments due to specific regulatory, security, or operational requirements

- The small & medium enterprises segment accounted for a largest revenue share of over 68.0% in 2024

- The vendor risk management market in North America held a largest share of nearly 59.0% in 2024. The digital transformation and adoption of cloud technologies are also fueling VRM market growth in North America

Vendor Risk Management Market Segmentation

Grand View Research has segmented the global vendor risk management market based on solution, deployment, enterprise size, end-use, and region:

Vendor Risk Management Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Vendor Information Management

- Contract Management

- Financial Control

- Compliance Management

- Audit Management

- Quality Assurance Management

Vendor Risk Management Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

Vendor Risk Management Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

Vendor Risk Management End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Government

- Others

Vendor Risk Management Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the Vendor Risk Management Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment