North America Legal Cannabis Market Competition by Manufacturers 2030

North America Legal Cannabis Industry Overview

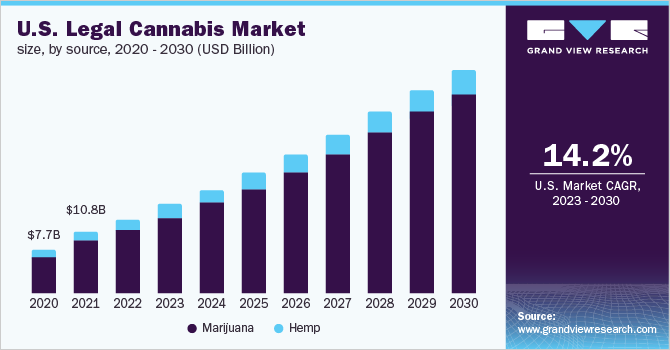

The North America legal cannabis market size was valued at USD 15.2 billion in 2022 and is expected to rise steadily with a compound annual growth rate (CAGR) of 14.6% from 2023 to 2030.

Cannabis was made illegal by the tax act passed in 1937, California was the first state to make cannabis legal for use in medical applications, in 1996. North America has played a major role in shaping the legal cannabis industry. Maximum states across the U.S. and Canada have legitimized the use of cannabis for medical as well as recreational purposes. The drug has been studied for its effectiveness in managing chronic conditions in a much more efficient manner as compared to a contemporary line of treatment and thus has gained a lot of traction in recent years, propelling the growth of the regional market.

Gather more insights about the market drivers, restrains and growth of the North America Legal Cannabis Market

Cannabis is used in the form of oils and tinctures, or as dried flowers or buds. In epileptic seizures, it is frequently used to stop or reduce episodes of seizures. The active compounds CBD and THC in cannabis both bind to pain receptors and reduce the signals being transferred, due to these effects it is frequently being prescribed for chronic pain in conditions like multiple sclerosis, HIV/AIDS, etc.; there are only limited studies on effects and working of cannabidiols or active compounds in cannabis, despite which it is gaining a lot of popularity as an alternate treatment in the medical sector.

Governor Phil Murphy signed three laws in February 2021 to legalize recreational usage of cannabis for individuals aged 21 years and older in New Jersey, the United States. Laws regarding legalization differ greatly between Canada and the U.S.; in Canada, provinces have control over how cannabis and its products are sold in that region, and government-operated stores are more common than privately owned stores, like in Quebec. Whereas, in the U.S., most of the stores are privately owned and have little to no government control. Further legalization and use of cannabis-based products are expected to be aided by increasing government measures aimed at reducing the region’s illegal drug market.

The MORE (Marijuana Opportunity, Reinvestment, and Expungement) Act, for example, was reintroduced in the United States House of Representatives in May 2021. If passed, the bill would put an end to the federal government’s prohibition on cannabis and would help decriminalize the drug. On the economic front, adult-use legalization will help create new job possibilities and add billions to the economy. Tourism, real estate, finance, food, and transportation are just a few of the industries that will benefit from legalization. Many banks, for example, have begun to accept loans for marijuana businesses, which will gain traction following the legalization of marijuana for adult use.

As a result, the upcoming adult-use legalization is likely to increase the consumption of legal cannabis and shrink the criminal market, thus supporting the growth of the legal market in North America. The presence of strict laws, on the other hand, makes it more difficult for manufacturers to establish a workable and legal route for the production and distribution of cannabis-derived goods like cannabidiol. Because different governments allow different activities in terms of hemp processing, extraction, and cultivation, several firms are obliged to operate in different countries.

This makes it challenging in determining the source of the cannabidiol product and who is accountable for the end product’s quality. As a result, the legal cannabis market is expected to be hampered by the varying restrictions for these goods in the region. The COVID-19 outbreak has significantly hampered the cannabis supply chain. As a result of the global ban, the supply of cannabis in dispensaries has plummeted. The supply chain has been disrupted as a result of lockdowns in major countries, affecting both import and export businesses.

The number of patients using cannabis as a medication, on the other hand, is certain to rise as the number of medical diseases that require marijuana treatment rises. Moreover, as per the poll, roughly 22% of respondents said they used more cannabis during the COVID-19 pandemic than they did before the outbreak. Furthermore, roughly 56% of respondents said they used the same quantity of cannabis before and throughout the pandemic. Such studies and cases show that cannabis products and derivatives are becoming more widely used in the region. BofA Securities also reported an increase in cannabis sales by 41% in 2021, in the USA.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

- Cannabidiol Market - The global cannabidiol market size was valued at USD 5.18 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030.

- Medical Marijuana Market - The global medical marijuana market size was valued at USD 13.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 21.80% from 2023 to 2030.

Key Companies profiled:

Some prominent players in the North America legal cannabis market include

- Insys Therapeutics, Inc.

- SUNDIAL

- Cara Therapeutics

- Tilray

- Aurora Cannabis

- The Cronos Group

- Jazz Pharmaceuticals, Inc.

Order a free sample PDF of the North America Legal Cannabis Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment