Pharmaceutical Stability & Storage Services Market Comparison by end-user To 2030

Pharmaceutical Stability & Storage Services Market Growth & Trends

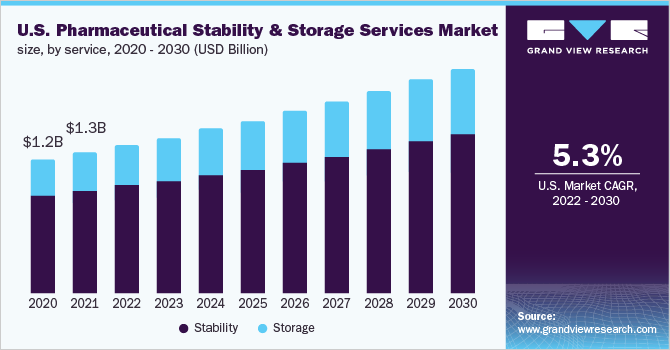

The global pharmaceutical stability & storage services market size is expected to reach USD 4.4 billion by 2030, registering a CAGR of 5.6% from 2022 to 2030, according to a new report by Grand View Research, Inc. Stability and storage is a mandatory regulation in various regions. For instance, different regulatory authorities have different data requirements and testing rules for testing stability. Even though FDA and EMA follow the ICH guidelines for stability testing, they still have different microbiological limits for stability tests. This has improved the demand for stability testing outsourcing services and is likely to have a positive impact on the market.

Pharmaceutical Stability & Storage Services Market Segmentation

Grand View Research has segmented the global pharmaceutical stability & storage services market based on services, molecule, mode and region:

Based on the Services Insights, the market is segmented into Stability and Storage.

- The stability segment dominated the market and accounted for the largest revenue share of 72.8% in 2021. Stability testing is an important parameter that must be analyzed and reported by pharmaceutical companies aiming to gain marketing approvals from the regulatory authorities. The mandatory requirement for stability testing in each phase of the clinical studies is further improving its demand in the market.

- The storage segment is expected to register the fastest CAGR of 6.3% during the forecast period. Pharmaceutical drugs are stored in cold and non-cold conditions under environmentally controlled chambers to check whether the quality of the drug changes with time under the environmental conditions of humidity, temperature, and light. The majority of small molecule drugs are required to be stored in non-cold conditions and the high existence of commercially available small molecules is driving the demand for non-cold storage in the market.

Based on the Molecule Insights, the market is segmented into Small Molecule and Large Molecule.

- The small molecule segment accounted for the maximum revenue share of 63.6% in 2021. Over the last three decades, small molecule drug development has advanced dramatically. Small molecules consist of approximately 90% of the total pharmaceutical drugs. It is used in the treatment of fever, migraine, cancer, diabetes, and other common diseases. The use of small-molecule drugs in the treatment of common diseases and disorders is contributing to its demand for stable testing and storage.

- The large molecule segment is expected to rise with the fastest CAGR of 6.6% over the forecast period. Large molecules are widely used in the treatment of cancer, infectious diseases, and autoimmune diseases among others. The high burden of these diseases is expected to improve the demand for large molecules and thus is likely to promote the demand for stability and storage of large molecules.

Based on the Mode Insights, the market is segmented into In-house and Outsourcing.

- The in-house segment accounted for the maximum revenue share of 60.2% in the global market in 2021. The majority of pharmaceutical manufacturers choose in-house stability testing, as these tests are required to be performed for all drugs and in all phases of clinical studies. Owning a stability chamber for performing stability studies is considered cheaper in the long run, which is one of the reasons that pharmaceutical companies consider in-house services for stability testing. An in-house team performing stability testing will be more convenient for those pharmaceutical companies that can afford the initial setup cost; these factors are driving the demand for in-house services in the market.

- The outsourcing segment is expected to rise with the fastest CAGR of 6.2% during the forecast period. Complications associated with stability testing are driving the demand for outsourcing in the market. Different regulatory authorities have different data requirements and testing rules, which makes it difficult to market products, especially in different markets.

Pharmaceutical Stability & Storage Services Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

- February 2022: Charles River Laboratories International, Inc. announced the expansion of its manufacturing capacity in Bruntwood SciTech’s Alderley Park.

- September 2021: BioLife Solutions announced the acquisition of Sexton Biotechnologies. This acquisition will help in strengthening cell and gene therapy and broader biopharmaceutical.

Key Companies Profile & Market Share Insights

Companies are undergoing expansions, acquisitions, and partnerships among others in the market to stay competitive.

Some of the prominent players operating in the global pharmaceutical stability & storage services market include,

- Catalent Inc.

- Almac Group

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Intertek Group plc

- Lucideon Limited

- Alcami Corporation

- Element Materials Technology

- BioLife Solutions

- Q1 Scientific

- Masy BioServices

- Reading Scientific Services Ltd.

- Roylance Stability Storage Limited

- ALS Ltd.'s

- Q Laboratories

- Auriga Research Private Limited

- PD Partners

- Precision Stability Storage

Order a free sample PDF of the Pharmaceutical Stability & Storage Services Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment