U.S. Ambulatory Surgery Centers Market Trends and Future Prospects Details 2030

U.S. Ambulatory Surgery Center Market Growth & Trends

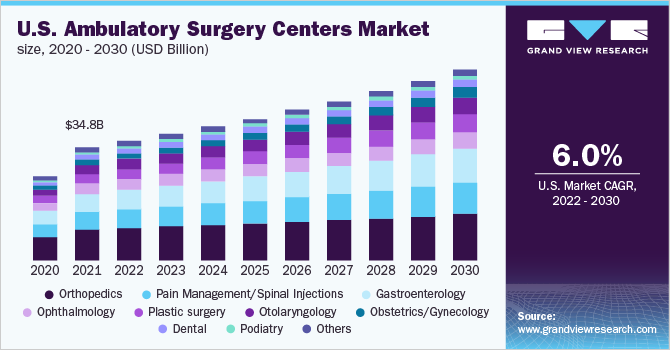

The U.S. ambulatory surgery centers market size is expected to reach USD 58.6 billion by 2030, expanding at a CAGR of 5.9%, according to a new report by Grand View Research, Inc. The cost-effectiveness of procedures performed at ASCs along with the rising geriatric population, in turn contributing to demand for surgeries, is expected to fuel the market over the next few years. As per a report by the Ambulatory Surgery Center Association, healthcare costs in the U.S. have been reduced by USD 38 billion due to the availability & use of ambulatory surgery centers. Healthcare expenditure in ambulatory surgery centers is quite lower compared to hospitals. A report by OR manager based on CMS statistics revealed that 57 million surgical procedures were performed in the U.S. in 2020, wherein less than 20% of the procedures were performed in outpatient hospital facilities indicating a shift in demand from hospitals to ambulatory surgery centers.

U.S. Ambulatory Surgery Center Market Segmentation

Grand View Research has segmented the U.S. ambulatory surgery center market on the basis of application, ownership, center type and region:

Based on the Application Insights, the market is segmented into Orthopedics, Pain management/spinal injections, Gastroenterology, Ophthalmology, Plastic surgery, Otolaryngology, Obstetrics/gynecology, Dental, Podiatry, Others.

- The orthopedics segment held the market share in 2021 attributed to the addition of new procedures under ASC coverage. In addition, improving diagnostic methods & imaging technologies in orthopedic surgeries, the introduction of new products, a rise in the number of acquisitions, and favorable reimbursement scenarios are likely to boost the market. However, the otolaryngology segment is expected to register the fastest growth over the forecast period.

- Orthopedic surgery is the most performed procedure in multispecialty ASCs. Around 68% of the total orthopedic procedures are performed in multispecialty ASCs. According to the Becker ASC Review, ASCs account for about 68% of the orthopedic surgeries conducted in the U.S. With the addition of more complex procedures like total hip replacement under ASC coverage by CMS, the demand for orthopedic surgery in the ASC setting is expected to increase.

U.S. Ambulatory Surgery Centers Regional Outlook

- Northeast

- Southeast

- Southwest

- Midwest

- West

Key Companies Profile & Market Share Insights

The market is fragmented, with the presence of several large and small players. UnitedHealth Group, Tenet Healthcare Corporation, Community Health Systems, Inc., and Surgery Partners are leading players in the market in terms of overall revenue. The leading position of these companies can be attributed to the presence of a skilled workforce, a high number of facilities across the U.S., and a strong service portfolio.

Some of the prominent players operating in the U.S. ambulatory surgery centers market include,

- Envision Healthcare Corporation

- Tenet Healthcare Corporation

- Mednax Services, Inc.

- TeamHealth

- UnitedHealth Group

- Quorum Health

- Surgery Partners

- Community Health Systems, Inc.

- SurgCenter

- Prospect Medical Systems

- Edward-Elmhurst Health

Order a free sample PDF of the U.S. Ambulatory Surgery Centers Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment