Turboexpander Market Trends, Drivers And Restraints By 2030

Turboexpander Market Growth & Trends

The global turboexpander market size is projected to reach USD 1,404.1 million by 2030, growing at a CAGR of 4.8%, according to a new report by Grand View Research, Inc. The market growth can be attributed to the increasing demand for energy-efficient turboexpanders for geothermal, waste to recovery, natural gas production, and other gas processing applications. Favorable government initiatives to curb the Green House Gases (GHG) emissions have encouraged the economies worldwide to consume natural gas by-products such as Liquefied Natural Gas (LNG) and Compressed Natural Gas (CNG). This would eventually increase the demand for the turboexpanders in the oil & gas sector over the forecast period.

Turboexpander Market Segmentation

Grand View Research has segmented the global turboexpander market based on product type, loading device, power capacity, application, end use, and region:

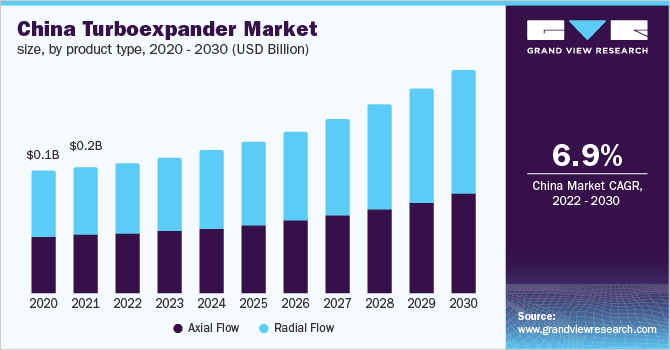

Based on the Product Type Insights, the market is segmented into Axial Flow and Radial Flow.

- The axial flow segment is projected to reach USD 623.1 million by 2030. The growth of the segment can be attributed to the increase in demand for high power applications such as geothermal and heat recovery applications. Moreover, the axial flow turboexpanders are dominated and extensively used for large gas turbine Major power plants install axial gas turboexpanders to provide heat and power for the district heating process, facilities and electricity to the grid.

- The radial flow segment accounted for more than 50% of the overall market in 2021. The large-scale adoption of radial expanders for low output power applications such as hot gas expanders used in refineries, binary cycle geothermal plants, and other low power cryogenic plants contributed to the high share of the segment. The demand for radial flow turboexpanders in binary cycle geothermal plants is intended to produce carbon dioxide-free electricity. It is expected to favor market growth.

Based on the Loading Device Insights, the market is segmented into Compressor, Generator and Hydraulic/Oil-brake.

- The compressor segment accounted for more than 40% of the global market share in 2021, growing at a CAGR of 4.7% from 2022 to 2030. Compressor-loaded turboexpander is the most common arrangement in industries and is extensively used in LNG feed-gas treatment (onshore and floating), high-demanding cryogenic, and energy recovery applications.

- The generator segment is expected to register the highest CAGR over the forecast period. The market growth can be ascribed to a surge in demand for hydrogen turboexpanders used during the hydrogen liquefaction process. Furthermore, an increase in demand for blue and green hydrogen in aerospace and automotive is further expected to drive market growth over the forecast period. Owing to the surge in demand for hydrogen generations, OEMs in this space are focused on offering customized turboexpanders to their customers.

Based on the Power Capacity Insights, the market is segmented into Less than 1 MW, 1MW - 4 MW, 5MW - 9MW, 10MW - 19MW, 20MW - 24 MW, 25 MW - 40 MW, Above 40 MW.

- Combined, the less than 1 MW, 1 MW-4 MW, and 5MW -9 MW power capacities accounted for 70% of the overall market in 2021. These segments are expected to grow at a CAGR exceeding 4-5% over the forecast period. Based on power capacity, the market has been segmented into less than 1MW, 1 MW-4 MW, 5 MW-9 MW, 10 MW-19 MW, 20 MW-24 MW, 25 MW-40 MW, and above 40 MW.

- End users primarily focus on low power capacity turboexpanders, preferably less than 10 MW, across the economies. Due to a low product development cycle and low costs, less time is taken for installation, commission, and maintenance during downtime. The low power capacity is extensively used in oil & gas processing, air separation plants, refining, dew point control, Natural Gas Liquids (NGL) recovery, and Nitrogen Rejection Units (NRU).

Based on the Application Insights, the market is segmented into Air Separation, Oil & Gas Processing, Cryogenic Application, Others.

- The cryogenic applications are expected to dominate the market over the forecast period. The market for cryogenic applications recorded growth in late 2020 and H1/2021 due to the pent-up demand and backlog orders resulting from the pandemic. However, in H2 2021, owing to supply chain disruptions still posed a threat due to low inventory levels at an OEM level for the short term.

- The oil & gas processing segment is expected to witness a moderate 4.9% CAGR over the forecast period. Delay in new construction for LNG projects is expected to be one of the bottlenecks for the OEMs over the short term. Furthermore, the ongoing Russia- Ukraine conflict is likely to create a shortage of cryogen liquids, notably Helium and other LNG by-products, hike in the raw materials prices and logistics costs which may hamper the market profitability of the OEMs over the next few years.

Based on the End-use Insights, the market is segmented into Oil & Gas, Energy & Power, Chemical & Petrochemicals, Others.

- The oil & gas segment accounted for the largest market share with more than 30% in 2021 and is expected to maintain its dominance over the next eight years. The oil & gas segment includes on-shore and offshore LNG applications. The surge in demand for LNG for industrial, commercial, and residential sectors is one of the primary factors for the market growth. Favorable government initiatives to promote clean energy and net zero emissions by 2050 are anticipated to surge the demand for LNG gas, expected to drive market growth over the forecast period.

- The energy & power segment is expected to register a CAGR of 4.9% during the forecast period. Due to soaring carbon prices, utility companies in Europe are transiting to cleaner-burning gas. The rising popularity of Cryogenic Energy Storage (CES) and, in particular, energy storage with liquid air is also anticipated to drive the market growth over the forecast period.

Turboexpanders Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Companies Profile & Market Share Insights

The market is a moderately consolidated market characterized by globally recognized and well-established players.

Some of the prominent players operating in the global turboexpanders market include,

- Atlas Copco AB

- Air Products Inc. (ROTOFLOW)

- Air Liquide (formerly Nikkiso Cryogenic Industries)

- Baker Hughes Company

- Chart Industries (L.A. Turbine)

- Linde Plc (Cryostar)

- R&D Dynamics Corporation

- Elliott Group (EBARA Corporation)

- Siemens Energy (Siemens AG)

- Man Energy

- PBS Group, a. s.

- Turbogaz

- Others (Honeywell International Inc.; Blair Engineering; Tibo; Sichuan Air Separation Plant Group; and Suzhou XIDA Cryogenic Equipment Co., Ltd)

Order a free sample PDF of the Turboexpanders Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment