Viral Vectors And Plasmid DNA Manufacturing Market Key Players and Growth Information Analysis Report 2030

Viral Vectors And Plasmid DNA Manufacturing Industry Overview

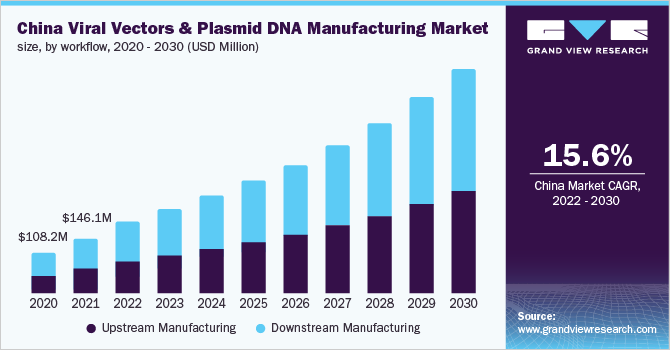

The global viral vectors and plasmid DNA manufacturing market size was valued at USD 2.87 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.71% from 2022 to 2030.

Viral vectors are tools for delivering genetic material into cells. Viruses have developed specific systems for transporting their DNA inside the cells they infect. Furthermore, retrovirus, adenovirus, lentivirus, herpes simplex virus, and others are among the viral vectors which can be employed to transfer genetic material into the genetic composition of cells.

Gather more insights about the market drivers, restrains and growth of the Global Viral Vectors And Plasmid DNA Manufacturing Market

The viral vectors and plasmid DNA manufacturing market saw a lucrative opportunity due to the COVID-19 pandemic. Furthermore, the market players are shifting their business focus toward the development of viral vectors for the SARS-CoV-2 vaccine. Viral vectors are commonly employed tools used in the discovery and development of vaccines against SARS-CoV-2. The ongoing COVID-19 pandemic has encouraged investment in this space in search of a vaccine as viral vector-based vaccines can be manufactured and designed relatively quickly with the use of the same building blocks. For instance, Companies such as Johnson and Johnson/Janssen (J&J); AstraZeneca/University of Oxford; Gamaleya Research Institute; and CanSino Biologics have developed viral vector-based vaccines.

The market for viral vectors and plasmid DNA manufacturing is growing due to the increasing prevalence of target ailments and diseases and the efficacy of viral vectors in gene therapy delivery. This increase is aided by continued research into viral vector-based cell and gene therapies, as well as financing for gene therapy advancement. In addition, an increase in the number of gene therapy-based discovery programs initiated by biotechnology and pharmaceutical companies is expected to drive the demand for scalable production of gene therapy vectors.

A rising number of patients opting for gene therapy is driving the global market. Due to a surge in gene therapy development, demand for plasmid DNA is skyrocketing. Thus, Adeno-associated virus (AAV), lentivirus, and other viral vector systems require pDNA (Plasmid DNA) to be manufactured. In addition, several genetic illnesses and infectious diseases are on the rise in different areas of the globe. For instance, as per UNAIDS data, 38.0 million people across the globe were living with HIV in 2019, and 1.7 million people were newly infected with the virus.

Additionally, rising demand for synthetic genes and untapped expanding market potential are projected to open up new chances for market players in the future. However, the risk of insertional mutagenesis and the high cost of gene treatments stymie market expansion. Furthermore, technical innovations that address the constraints posed by traditional vector production processes create an attractive potential for industry manufacturers.

Browse through Grand View Research's Biotechnology Industry Research Reports.

- Microplate Reader Market - The global microplate reader market size was valued at USD 452.6 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.59% from 2023 to 2030.

- HLA Typing Market - The global HLA typing market size was valued at USD 1,032.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030.

Market Share Insights

- January 2021: Cobra Biologics expanded its manufacturing facilities in Europe and the U.S. It includes the expansion of the HQ DNA manufacturing facility by four times and new facilities in Europe.

- January 2021: Johnson & Johnson revealed positive efficacy and safety results for COVID-19 from its Phase 3 ENSEMBLE clinical study, which used its AdVac vaccination platform.

- April 2018: GE Healthcare Life Sciences announced the introduction of KUBio BSL 2, a prefabricated, modular bioprocessing facility for the manufacturing of viral vector-based vaccinations, oncolytic virus, and cell and gene therapies.

Key Companies profiled:

Some prominent players in the global viral vectors and plasmid DNA manufacturing market include

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies

- Thermo Fisher Scientific

- Cobra Biologics

- Catalent Inc.

- Wuxi Biologics

- Takara Bio Inc.

- Waisman Biomanufacturing

- Genezen laboratories

- Batavia Biosciences

- Miltenyi Biotec GmbH

- SIRION Biotech GmbH

- Virovek Incorporation

- BioNTech IMFS GmbH

- Audentes Therapeutics

- BioMarin Pharmaceutical

- RegenxBio, Inc.

Order a free sample PDF of the Viral Vectors And Plasmid DNA Manufacturing Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment