Smart Finance Hardware Market Company Revenue Shares And Analysis Report 2028

Smart Finance Hardware Industry Overview

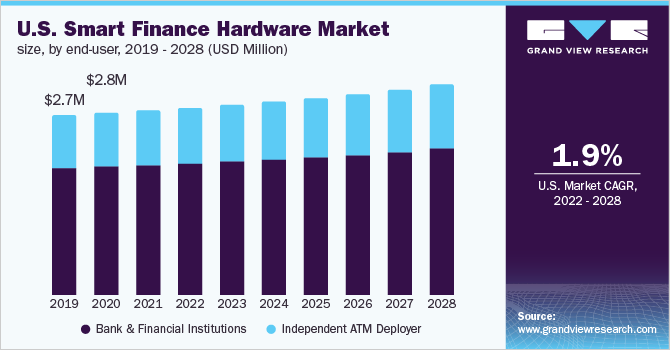

The global smart finance hardware market size was valued at USD 14.07 million in 2021 and is anticipated to register a compound annual growth rate (CAGR) of 2.4% from 2022 to 2028.

Smart finance hardware includes IoT components such as a communication module, a processing module, data acquisition, and sensors for ATMs. The rising adoption of smart ATMs across smart cities is one of the major factors propelling the market growth during the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Smart Finance Hardware Market

Smart ATMs are increasingly being deployed in bank locations for providing customers the ease of cash withdrawals, deposits, and transfers. Moreover, the rising technical development in IoT technologies, such as the integration of data analysis tools, is further projected to contribute to the growth of the market during the forecast period. However, the growing data breaches and rising concerns related to data security are anticipated to hinder the market growth.

The growing integration of next-generation smart ATMs that can be remotely maintained further encourages the demand for smart devices among end-users, which is projected to contribute to the growth of the smart finance hardware industry. For instance, a bank in Russia is using facial recognition through Intel RealSense camera technology to avoid fraud in ATMs.

Moreover, the growing number of ATMs is further projected to provide ample opportunity to the market for growth. As per World Bank data, in 2019, there were 42.6 ATMs per 100,000 people across the globe, which further increased to 51.6 ATMs per 100,000 in 2020. Therefore, the growing number of ATMs coupled with the rising integration of IoT devices in ATMs further enhance the growth of the market during the forecast period.

The COVID-19 outbreak negatively impacted the smart finance hardware market, as many of the bank ATMs were closed during the lockdown. This measure by the governments globally restricted the new installation of ATMs. The restriction of outbreak further decreased the transactions through ATMs, as people chose UPI and other wireless transactions during the pandemic that affected the market growth.

Moreover, the shutdown of manufacturing units of hardware across the globe during the pandemic further impacted the market advancement. However, the adoption of contactless ATMs is projected to rise after the pandemic is over, owing to the high demand for less contact-based transactions in the BFSI sector.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- Smart Manufacturing Market - The global smart manufacturing market was valued at USD 254.24 billion in 2022 and is anticipated to grow at a CAGR of 14.9% from 2023 to 2030.

- Biometric Technology Market - The global biometric technology market size was valued at USD 34.27 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030.

Key Companies profiled:

Some prominent players in the global smart finance hardware market include

- Intel Corp.

- Fujitsu Limited

- Diebold Nixdorf

- NCR Corp.

- InHand Networks

- KT Corp.

- Digi International Inc.

- Microchip Technology Inc.

- HiSky

- Multi-Tech Systems, Inc.

- OptConnect Management, LLC

Order a free sample PDF of the Smart Finance Hardware Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment