Veterinary Artificial Insemination Market Outlook, And Competitive Strategies 2030

Veterinary Artificial Insemination Industry Overview

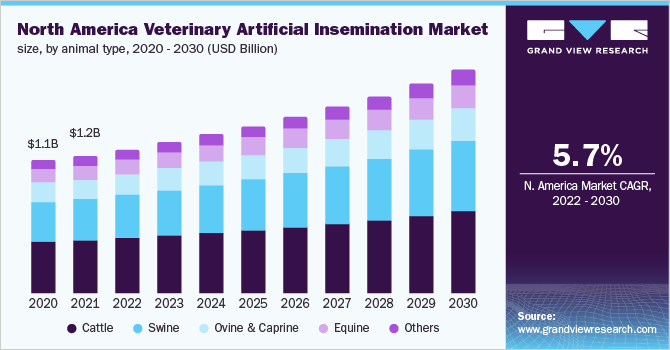

The global veterinary artificial insemination market size was valued at USD 4.2 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2030.

Growing demand for improved animal efficiency and productivity, demand for animal protein, supportive initiatives by industry stakeholders, need for sustainable food production, and adoption of sexed semen in developing markets are some of the key drivers of this market. Genus IntelliGenTM is Genus’ sexed semen technology that is used to develop sexed bovine genetics for Red Sindhi, Gir, Jersey, Holstein, Sahiwal Crossbreeds, and Mehsana and Murrah buffaloes, under the ‘Sexcel’ brand in India.

The COVID-19 pandemic presented several challenges for the market for veterinary artificial insemination. This included challenges in performing AI procedures on-site, dampened demand for AI products and services, and risks and uncertainty due to fluctuating consumption patterns across several key markets. However, the pandemic along with other disease break-outs during the period such as the African Swine Fever (ASF), highlighted the need to produce superior livestock to secure the food source. To safeguard employees and farmers against Covid-19, in June 2020, the Animal Husbandry Department of India launched a program. Under this program, the department was offering telephonic assistance to animal farm owners. In addition, artificial insemination services were being delivered to farmers at their doorstep during the lockdown period. Thereby, such initiatives have contributed to the growth of the market for veterinary artificial insemination.

Gather more insights about the market drivers, restrains and growth of the Global Veterinary Artificial Insemination Market

The artificial insemination technique has been commercially available for over 60 years and has been utilized very effectively in the cattle and dairy industry. Various factors such as the risks involved with animal breeding and disease transmission are the major factors leading to market growth. Increasing productivity using AI technology is boosting the market for veterinary artificial insemination. Female offspring born through artificial insemination are found to produce more milk than normal offspring. The use of semen extenders containing antibiotics is also helpful in preventing the transmission of bacterial diseases. Furthermore, the entire procedure of AI is considered to be much more hygienic than natural mating.

Moreover, as the production conditions and the farmers' needs evolve, many of the animal breeds are no longer suitable for the majority of farms. However, artificial insemination is used as a preferred reproduction method for such breeds and makes it possible to continue to farm the breeds in situ. Associated advantages such as increased efficiency of bull usage, genetic selection, decreased cost of housing, handling bull, and safety for farmers and animals are further anticipated to increase adoption of AI in the coming years. Increasing calf prices is also major factor for adopting the AI technique. According to a report published by the Beef Cattle Research Council in March 2018, bull prices were USD 5,500 to USD 8,000 in Canada from 2015 to 2016. These prices decreased from USD 4,500 to USD 6,500 from 2017 to 2018 owing to the adoption of AI.

The demand for the genetically superior breed of animals is increasing, which in turn is increasing the demand for artificial insemination procedures in animals. The industry players are continuously trying to develop new products along with partnerships, collaboration, and acquisitions to sustain their market share. For instance, in August 2020, Cogent collaborated with AB Europe, a sheep breeding company, to launch a novel sexed semen service for sheep producers in the U.K. In May 2018, Recombinetics partnered with SEMEX for the implementation of a precision breeding program that improved animal health and well-being through hornless dairy cattle genetics.

Browse through Grand View Research's Animal Health Industry Research Reports.

- Animal Health Market - The global animal health market size was valued at USD 39.9 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 10.0% from 2022 to 2030.

- Veterinary Hospitals Market - The global veterinary hospitals market size was valued at USD 76.16 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030.

Market Share Insights

- May 2019: Genus plc partnered with Beijing Capital Agribusiness (BCA) located in China. BCA is expected to assist the company in patented technology applications to develop Porcine Reproductive and Respiratory Syndrome Virus (PrRVS)-resistant animal.

- April 2018: Select Sires introduced an Elite sexed fertility product line. The company would identify sires with superior fertility sex-sorted semen using an Elite Sexed Fertility designation, enhancing its product base.

Key Companies profiled:

Some prominent players in the global veterinary artificial insemination market include

- Genus

- URUS Group LP

- CRV

- SEMEX

- Viking Genetics

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- STgenetics

Order a free sample PDF of the Veterinary Artificial Insemination Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment