Telemedicine Market Segments And Regional Revenue Forecasts To 2030

Telemedicine Industry Overview

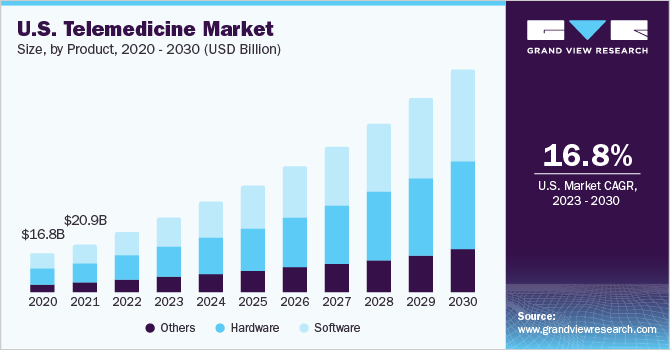

The telemedicine market size was valued at USD 70.4 billion in 2021 and is estimated to grow at a compound annual growth rate (CAGR) of 19.5% from 2022 to 2030.

The growing need to reduce the cost of care, consolidation across the industry, and other strategic initiatives by key companies are some of the main drivers of this market. The market holds many growth opportunities owing to the rising adoption of telemedicine, rising consumer demand & patient acceptance, and enhanced quality of care. In May 2021, Walmart Inc. acquired MeMD-a telehealth provider. This would enable Walmart to offer virtual care access for urgent, behavioral, and primary care across the U.S.

Gather more insights about the market drivers, restrains and growth of the Global Telemedicine Market

Telemedicine was extensively used during the COVID-19 pandemic as it aids in decreasing the contact with healthcare facilities, healthcare staff, and patients, to minimize the risk of COVID-19. In China, online mental health surveys along with communication programs, such as Weibo, TikTok, and WeChat, among others, assisted health authorities and mental health professionals to render mental health services safely and online during the pandemic. Such factors have assisted in market growth during the COVID-19 pandemic. SOC Telemed, a U.S.-based company dealing in telemedicine technology and services, stated in March 2020, that it experienced a surge in demand for on-demand acute care via telemedicine.

Companies in the market have experienced exponential growth during the COVID-19 pandemic as compared to the previous year. For instance, Teladoc Health, Inc. experienced a 109% year-on-year growth from Quarter 3 of 2019 to Quarter 3 of 2020. American Well Corp., another key player in the market, reported that its clients comprising health system and health plan providers deployed tens of thousands of their own care providers onto their platforms during 2020. Around 68,000 active providers had used the Amwell Platform to provide primary care, chronic care management, and specialist visits by December 2020.

American Well Corporation attributed around 76.5 million increase in revenue during 2020 due to the pandemic-induced growth in online visit volume. The pandemic has thus positively affected the overall market. Increasing access to basic healthcare along with improved healthcare quality and patient safety is the major aim of telemedicine solutions. According to a report published by the Agency for Healthcare Research and Quality (AHRQ), the implementation of telehealth or telemedicine solutions improves care delivery to patients. Applications, such as e-ICU and eCare, help in providing apt care and reduce adverse effects or symptoms from going unnoticed.

By providing higher safety and quality standards to patients, the demand for such systems is expected to increase over the forecast period and boost the market growth. Moreover, telemedicine is considered the most versatile technology available to deliver health education, health information, and health care at a distance. Through the technologies, advanced patient-centered care and increased access to remote locations are possible. It also helps in reducing emergency room visits and hospitalization rates, thereby augmenting the market growth. Continued investment in new technologies to expand the capabilities of telemedicine products and services is another key factor anticipated to propel market growth in the near future.

The industry is also witnessing an increased flow of investments, mergers & acquisitions, and entry of new and large-scale companies. This is expected to intensify the competition in the coming years. For instance, in March 2021, Amazon.com, Inc. expanded the access to its virtual visits and telehealth platform- Amazon Care, to serve other Washington-based companies. Until then, Amazon Care was available only to the company’s employees and their families in Washington state. The company further plans to expand its virtual care product and services to its employees and other companies in all 50 states across the U.S. Technological advancements in robotic surgery, Virtual Reality (VR), and Artificial Intelligence (AI)are anticipated to boost the application scope of telemedicine in areas, such as telesurgery.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Healthcare Companion Robots Market - The Healthcare companion robots market was valued at USD 1.5 billion in 2022 and is expected to attain a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030.

- Tele-Epilepsy Market - The global tele-epilepsy market size was valued at USD 0.32 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 15.7% from 2022 to 2030.

Market Share Insights

- August 2020: AMD partnered with iTelemed, an Ontario-based company providing virtual healthcare solutions. This partnership was formed to cater to the unmet healthcare needs of the marginalized population within Canada during the COVID-19 pandemic.

- July 2020: Teladoc Health, Inc. acquired InTouch Health, a U.S.-based company. With this, the company integrated InTouch Health’s portfolio with its existing products and enhanced health care across in-patient, outpatient, and home care settings.

Key Companies profiled:

Some prominent players in the global telemedicine market include

- MDlive, Inc. (Evernorth)

- American Well Corp.

- Twilio, Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

- Sesame, Inc.

- me Inc.

- PlushCare

- HealthTap, Inc.

Order a free sample PDF of the Telemedicine Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment