U.S. N95 Mask Market End use Estimates and Analysis 2028

U.S. N95 Mask Industry Overview

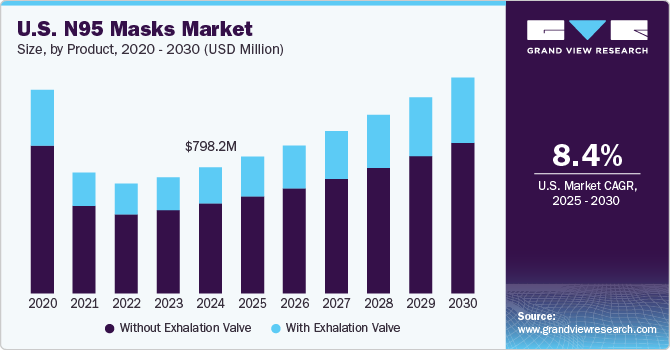

The U.S. N95 mask market size was estimated at USD 5.16 billion in 2020 and is expected to expand at a compounded annual growth rate (CAGR) of 7.3% from 2020 to 2028.

Increased demand for respirators and masks during the COVID-19 pandemic coupled with stringent respiratory safety norms in the construction and manufacturing sector is expected to boost the N95 masks market growth in the U.S. The outbreak of the COVID-19 pandemic is projected to act as a major driver, boosting the demand for N95 masks in the country. The U.S. is one of the most severely affected countries by COVID-19. The rapid spread of the COVID-19 in the country has increased the demand for N95 masks, especially in the healthcare sector, to reduce further transmission.

Gather more insights about the market drivers, restrains and growth of the U.S. N95 Mask Market

With the increased vaccine rollout coupled with the introduction of USD 1.9 trillion economic relief packages by the U.S. government to reduce inflation and jumpstart various economic sectors such as manufacturing, construction is expected to augment the demand for N95 masks as industries are expected to provide mandatory respiratory protection to workers.

Pharmacies and drug stores were at the centerstage of the N95 masks distribution and are expected to continue their performance in the coming years. The healthcare system in the U.S. coupled with the growing e-commerce industry has been compelling retail pharmacies to develop new strategies. Pharmacy chains such as Walgreens and Rite Aid have been aggressively expanding their operations throughout the country with 24/7 availability and pickups at alternate locations.

Before the COVID-19 pandemic, the major end-use sectors for N95 masks included construction, manufacturing, painting, and mining. However, since the advent of the COVID-19 pandemic, these masks have mostly been used by healthcare professionals. Furthermore, the demand for N95 masks by individuals increased significantly during the pandemic to prevent the spread of the virus.

During the pandemic, the government authorities took several steps to maintain an adequate supply of the product. For instance, the U.S. has enacted special laws such as the Defense Production Act (DPA) to increase the production of PPE and to restrict the export of scarce medical resources for domestic use. In addition, several PPE manufacturing companies are working closely with the government to reduce the demand-supply gap of N95 masks.

Browse through Grand View Research's Smart Textiles Industry Research Reports.

- N95 Mask Market - The global N95 mask market size was estimated at USD 3.1 billion in 2021 and is anticipated to expand at a compounded annual growth rate (CAGR) of 9.2% from 2022 to 2030.

- Disposable Face Mask Market - The global disposable face mask market size was valued at USD 38.9 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of -27.6% from 2022 to 2030.

Market Share Insights

- July 2021: 3M introduced a new disposable KN95 respirator, known as the 3M Particulate Respirator 9513, designed for breathability and comfort and filters at least 95% of airborne particles while protecting the user.

- June 2021: Aegle launched NIOSH certified N95 mask with Acteev anti-microbial fabric as well as authentication and NFC chip embedded traceability technology to prevent counterfeiting of masks.

Key Companies profiled:

Some prominent players in the U.S. N95 mask market include

- 3M

- Honeywell International Inc.

- Alpha Pro Tech

- Ansell Ltd.

- O&M Halyard, Inc.

- The Gerson Company

- Cardinal Health

- Medline Industries, Inc.

- Moldex-Metric

- Prestige Ameritech

Order a free sample PDF of the U.S. N95 Mask Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment