India Container Market Opportunities and Forecasts 2028

India Container Industry Overview

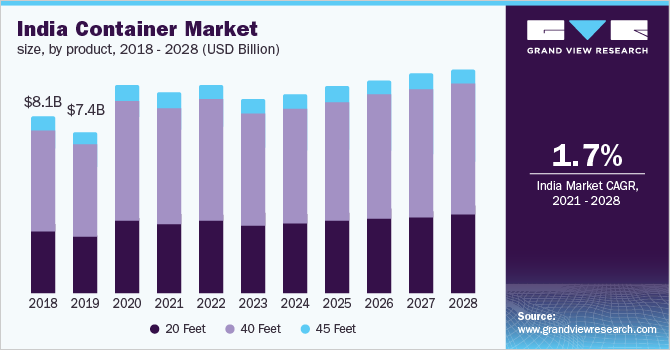

The India container market size to be valued at USD 10.3 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 1.7% during the forecast period.

The growth can be attributed to the increase in maritime shipping on account of an increase in trade agreements across nations. The market is expected to further grow over the forecast period on account of the expansion of the e-commerce industry, digitalization in container shipping, and rising demand for specialized containers. Moreover, an increase in demand for commodities and rapid urbanization are expected to fuel the market growth. Significant developments in commercial vessels and innovation of cargo ships equipped with the latest technologies such as navigation systems, advanced sensors, and other components are expected to drive the demand for transportation through ships, in turn propelling the growth of the container market.

Gather more insights about the market drivers, restrains and growth of the India Container Market

The COVID-19 pandemic has had an unprecedented impact on the transportation sector. During the initial stage of the pandemic, lockdowns were imposed in various parts of the world as part of the efforts to arrest the spread of coronavirus. Moreover, manufacturing facilities were forced to temporarily shut down. This caused disarray in the demand and supply of containers across various ports. Cargo container-loaded ships that were already routed out from the Asia Pacific dropped off several loaded containers in ports across North America and Europe. However, owing to pandemic restrictions, the containers could not return to their origin and were stuck in ports and inland rail depots. As a result, the shortage of containers in the Asia Pacific led to a hike in their prices, in turn encouraging domestic manufacturers in India to develop new containers

In an attempt to reduce dependency on China for container requirements, the Container Corporation of India (CONCOR) has selected ten strategic locations for the production of containers on a pilot basis. A major growth aspect for both international and domestic businesses will involve optimizing the internal logistics chains within the organization. This opportunity is expected to fulfill the demand for containers in India.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

- Shipping Container Market - The global shipping container market size was valued at USD 6.41 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.0% from 2020 to 2028.

- Food Container Market - The global food container market size was valued at USD 145.6 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2021 to 2028.

Market Share Insights

- June 2022:P. Moller-Maersk announced the planned acquisition of ResQ. This acquisition will help Maersk strengthen its training facilities

- December 2021: China International Marine Container (Group) Ltd. collaborated with Vestas Wind Systems A/S and launched a modular side nacelle for the offshore wind turbine

- December 2020: The Ministry of Ports, Shipping, and Waterways in India formed a committee to assess the viability of producing shipping containers in Bhavnagar, Gujarat, to drive the initiative of ‘Atmanirbhar Bharat’

Key Companies profiled:

Some prominent players in the India container market include

- P. Moller and Maersk

- COSCO Shipping Development Co., Ltd.

- China International Marine Container (Group) Ltd.

- CXIC Group

- Singamas Container Holdings Limited

- Hapag-Lloyd AG

- Evergreen Marine Corporation

- MSC Mediterranean Shipping Company S.A.

- Yang Ming

- ZIM Integrated Shipping Services Ltd.

- DCM Hyundai Ltd.

- K. Technologies Pvt. Ltd.

- AB Sea Container Pvt. Ltd.

Order a free sample PDF of the India Container Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment