Pharmaceutical Manufacturing Market Share, Analysis and Advancement Outlook 2028

Pharmaceutical Manufacturing Industry Overview

The global pharmaceutical manufacturing market size is expected to reach USD 957.59 billion by 2028, registering a CAGR of 11.34% over the forecast years, according to a new report by Grand View Research, Inc. The presence of supportive regulatory legislations, patentability norms, and high funding and investments in the pharmaceutical industry are anticipated to drive market growth. In addition, the broadening of preventive care has created significant opportunities in the market.

Pharmaceutical Manufacturing Market Segmentation

Grand View Research has segmented the global pharmaceutical manufacturing market on the basis of molecule type, drug development type, formulation, routes of administration, therapy area, prescription, age group, sales channel, and region:

Based on the Molecule Type Insights, the market is segmented into Biologics & Biosimilars (Large Molecules) and Conventional Drugs (Small Molecules).

- In 2020, the conventional drugs (small molecules) segment accounted for the highest revenue share of over 65%. According to an article published in August 2019, in the pharmaceutical market, small molecule drugs account for up to 90% of the total global drug sales.

- For instance, in 2018, 59 new drugs gained regulatory approval from the U.S. FDA, out of which, 71 % of drugs were small molecule drugs. Small molecule drugs represent around 60% share in comparison with large molecule drugs.

- Over the past few years, biologics are increasingly gaining traction with promising efficacy for the treatment of autoimmune diseases and cancer. Owing to the substantial investments and innovative approaches, biologics are gaining significant attention.

Based on the Formulation Insights, the market is segmented into Tablets, Capsules, Injectable, Sprays, Suspensions, Powders and Other Formulations.

- In terms of revenue, the tablets dominated the market with a share of over 26 % in 2020. This is due to the wide availability of tablets in different colors, shapes, and sizes as well as types, such as film and enteric-coated, effervescent, and orally disintegrating tablets.

- The injectable segment is anticipated to grow at the second-fastest CAGR during the forecast period. A rise in the number of approvals for prefilled syringes and auto-injectors is attributed to the segment growth.

- Subcutaneous injections have gained immense popularity in recent years among drug developers, device manufactures, and patients.

Based on the Drug Development Type Insights, the market is segmented into In-house and Outsource.

- The outsourcing segment dominated the market in 2020 with a revenue share of over 54%. Several benefits associated with outsourcing operations are expected to drive the segment growth at a lucrative pace over the coming years.

- Moreover, the integration of Robotic Process Automation (RPA) by contract manufacturers efficiently accelerates the drug development processes.

- In recent years, key drug manufacturers have shifted their focus towards external service providers for R&D and manufacturing services.

- Most of the large-scale drug manufacturers opt for in-house production because it allows the companies to have control over the private information associated with novel molecules.

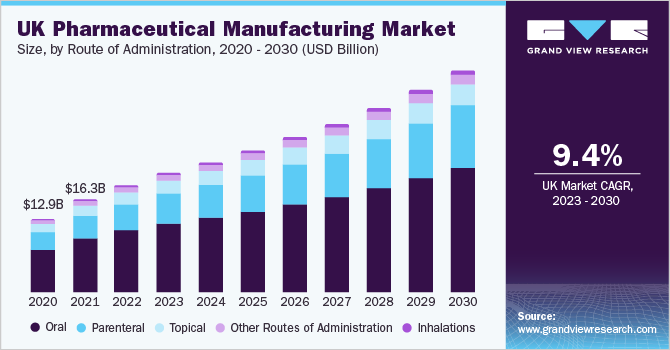

Based on the Routes of Administration Insights, the market is segmented into Oral, Topical, Parenteral, Inhalations, and Other Routes of Administration.

- The oral segment led the global market and was valued at 236.91 billion in 2020. Oral dosage forms are affordable, easy to manufacture, and patient-friendly.

- A significant rise in the implementation of automated systems and barrier systems, including restricted access barrier systems, and isolators, in parenteral manufacturing, is expected to boost the parenteral segment at the fastest CAGR over the forecast period.

- The rise in demand for innovative drug-delivery systems that better fit with the ‘mobile lifestyle’ of patients paves a path for the high adoption of pens and autoinjectors, which further surges the segment growth.

Based on the Therapy Area Insights, the market is segmented into Cardiovascular Diseases (CVDs), Pain, Diabetes, Cancer, Respiratory Diseases and Other Diseases.

- The other diseases segment dominated the market with a revenue share of more than 64% in 2020 and will retain the leading position throughout the forecast years.

- On the other hand, cancer therapies are anticipated to register the fastest CAGR from 2021 to 2028. This is owing to the high sales of oncology drugs, especially KEYTRUDA of Merck and HUMIRA of AbbVie, Inc.

Based on the Prescription Insights, the market is segmented into Prescription Medicines and Over-the-counter (OTC) Medicines.

- The prescription medicines segment accounted for the maximum revenue share of 84.73% in 2020 and will expand further at a steady CAGR from 2021 to 2028 due to the growing prescription drug expenditures across the globe.

- Factors, such as the high demand for cost-effective treatment options and self-medication, have hugely transformed the Over-The-Counter (OTC) medicines segment. OTC medicines are comparatively cost and time-effective as compared to prescription medicines.

Based on the Age Group Insights, the market is segmented into Children & Adolescents, Adults and Geriatric.

- The geriatric segment led the global market and was valued at 203.16 billion in 2020. According to the publications of World Population Prospects: the 2019 Revision, one in 11 individuals were over age 65 years in 2019. This is expected to reach to one in six individuals by 2050.

- The growth of specialty drugs under the Orphan Drug Act has been a boon in pediatric medicine. The introduction of the Pediatric Research Equity Act (PREA) and Best Practices for Children Act (BPCA) provides a carrot-and-stick technique that focuses on the development of pediatric medicines.

Based on the Sales Channel Insights, the market is segmented into Retail and Non-retail.

- The retail segment accounted for the largest revenue share of 77.95% in 2020. As the medical cost and health insurance have risen, more people have shifted their preferences towards self-medication for the treatment of minor health issues.

- In recent years, specialty pharmacy has gained significant traction resulting in the wide availability of specialty drugs at retail pharmacies, which also drives the segment growth.

Pharmaceutical Manufacturing Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Key players have adopted strategic initiatives to expand their presence and maintain a competitive edge in the market space.

Some of the key companies operating in the global pharmaceutical manufacturing market include:

- Hoffmann-La Roche Ltd.

- Novartis AG

- GlaxoSmithKline plc

- Pfizer, Inc.; Merck & Co., Inc.

- AstraZeneca

- Johnson & Johnson

- Sanofi SA

- Eli Lilly and Company

- AbbVie, Inc.

- Sun Pharmaceutical Industries Ltd.

- Novo Nordisk A/S

- Takeda Pharmaceuticals, Inc.

- Cipla Ltd.

- Bristol Myers Squibb Company

- Gilead Sciences, Inc.

Order a free sample PDF of the Pharmaceutical Manufacturing Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment