Automotive Finance Market Competitive Landscape and Industry Analysis 2030

Automotive Finance Industry Overview

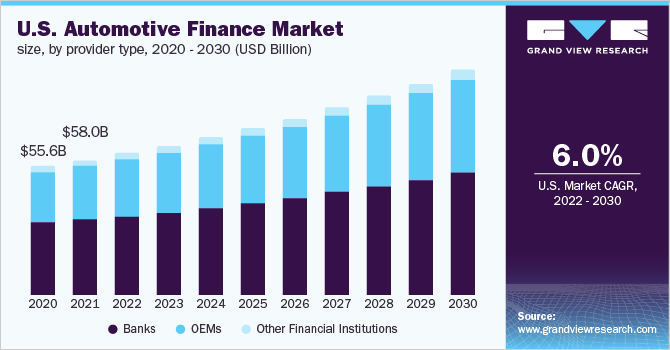

The global automotive finance market size was valued at USD 244.88 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030.

The increasing global demand for electric vehicles is one of the major factors, expected to drive market growth. According to the Experian’s State of the Automotive Finance report, electric vehicles comprised 4.56% of new vehicle financing in Q4 2021, up from 2.25% in Q4 2020 and 1.34% in Q4 2019 in the U.S. According to this report, consumers in the U.S. are more likely to purchase new electric vehicles rather than lease them.

Gather more insights about the market drivers, restrains and growth of the Global Automotive Finance Market

The growing importance of captive automotive finance worldwide is creating new opportunities for market growth. Captive finance is a subsidiary of an automaker that provides loans and financial services to the company's customers. The benefits of starting a captive finance company include personalized finance options for the customers, and equipment rental programs, among others. The companies such as Honda Finance, Ford, Infiniti, and Nissan are seeing strong growth in captive finance.

The growing importance of cryptocurrency across the automotive finance industry is expected to drive market growth. Various automotive technology providers are adopting cryptocurrency-based payments to enhance their offerings. For instance, in March 2022, Car Now, an automotive industry’s digital retailing company, announced its partnership with Cion Digital, a blockchain orchestration platform. Through this partnership, Car Now will offer auto dealers compliant and fast crypto payment and lending solutions.

Artificial intelligence technology is increasingly being used in the automotive finance sector, in order to improve the credit underwriting process, analyze the data, accurately predict whether the applicant can turn delinquent, and thus enhance the approval process. Various automotive artificial intelligence technology providers are making efforts to develop AI-enabled lending platforms. For instance, in October 2021, Upstart, a leading AI lending platform, announced the launch of Upstart Auto Retail software. This software includes AI-enabled financing features which enable the lenders to improve their customer experience.

The growing global demand for automotive refinancing is also one of the major factors, creating new opportunities for market growth. The demand for refinancing is growing due to its benefits, such as lower monthly car payments, reduced interest rates, and shortened loan terms. According to the statistics provided by Rate Genius, a fintech company, 16.0% more additional Americans applied to refinance their automotive loans in 2020 as compared to 2019. As compared to 2019, as many as 17.0% of additional borrowers refinanced their car loans successfully in 2020, as compared to 2019.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- Influencer Marketing Platform Market: The global influencer marketing platform market size was valued at USD 10.39 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 33.4% from 2022 to 2030.

- Intelligent Vending Machines Market: The global intelligent vending machines market size was valued at USD 19.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% from 2022 to 2030.

Market Share Insights

- March 2022: Car Now, an automotive industry’s digital retailing company, announced its partnership with Cion Digital, a blockchain orchestration platform.

- October 2021: Upstart, a leading AI lending platform, announced the launch of Upstart Auto Retail software.

Key Companies profiled:

Some of the prominent players in the global automotive finance market include:

- Ally Financial

- Bank of America

- Capital One

- Chase Auto Finance

- Daimler Financial Services

- Ford Motor Credit Company

- GM Financial Inc.

- Hitachi Capital

- Toyota Financial Services

- Volkswagen Financial Services

Order a free sample PDF of the Automotive Finance Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment