U.S. Veterinary Orthopedic Medicine Market 2030: The Rise of Regenerative Treatments

U.S. Veterinary Orthopedic Medicine Market Overview

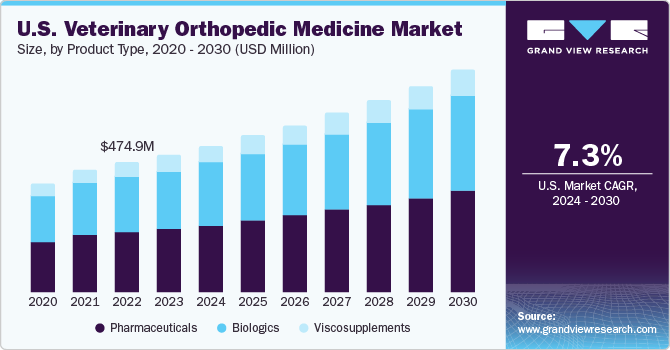

The U.S. veterinary orthopedic medicine market was valued at USD 503.41 million in 2023 and is projected to grow to USD 814.51 million by 2030, expanding at a compound annual growth rate (CAGR) of 7.2% between 2024 and 2030. This growth is primarily driven by factors such as the rising pet population, advances in veterinary medicine, increased uptake of pet insurance, and a growing incidence of orthopedic conditions in animals.

One significant contributor to market expansion is the increasing prevalence of osteoarthritis (OA) in dogs. According to a 2022 article in Frontiers, OA affects 2.5% of dogs clinically. However, post-mortem analysis indicates a much higher prevalence—around 20%—highlighting its extensive impact. Additionally, data from the National Center for Biotechnology Information in 2022 showed that veterinarians diagnosed OA in 38% of dogs (188 out of 500). Obesity, a known risk factor for orthopedic disorders in pets, plays a key role in this rising trend, fueling demand for new treatments and medications.

Technological advancements and new product approvals further stimulate market growth. For example, in October 2023, the FDA approved Librela (bedinvetmab injection), the first monoclonal antibody for treating OA-related pain in dogs. Similarly, in April 2022, American Regent Animal Health, a division of American Regent, Inc., received FDA approval to extend the shelf life of Adequan Canine and Adequan I.M. from 24 to 36 months. Such innovations reflect growing investments in research and development and are expected to contribute significantly to the market’s momentum.

Order a free sample PDF of the U.S. Veterinary Orthopedic Medicine Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- The pharmaceuticals segment led the market in 2023 with a 46.7% revenue share. NSAIDs are a major component of this segment, particularly in equine orthopedic care.

- The dogs segment generated the highest revenue in 2023 and is expected to grow at the fastest rate during the forecast period.

- The osteoarthritis segment dominated in 2023, reflecting the condition's widespread occurrence. While OA clinically affects 2.5% of dogs, post-mortem evaluations show a much higher rate of 20%.

- Injectables were the most used form of treatment in 2023, driven by leading manufacturers in this segment. These include intramuscular and intra-articular therapies.

- Veterinary hospitals & clinics were the dominant end-use segment, serving as central facilities for diagnosing and treating orthopedic conditions, including surgical repair of fractures, joint disorders, and ligament injuries.

Market Size & Forecast

- 2023 Market Size: USD 503.41 Million

- 2030 Projected Size: USD 814.51 Million

- CAGR (2024–2030): 7.2%

Leading Companies & Market Share

- Zoetis Services LLC: Offers a wide range of pharmaceuticals for both companion and livestock animals.

- Boehringer Ingelheim International GmbH: Maintains a portfolio of over 200 veterinary products.

- Arthrex: Renowned for its innovation in orthopedic medical devices and education.

- PetVivo Holdings, Inc.: Parent company of Gel-Del Technologies and CosmetaLife Corporation, focusing on orthopedic treatments.

- VetStem, Inc.: Specializes in regenerative medicine using autologous stem cells for orthopedic therapies.

Other Notable Players:

- Ardent Animal Health, LLC

- Enso Discoveries

- Contura Vet

- T-Cyte Therapeutics

- MEDREGO LLC

- Nucleus ProVets

- Daiichi Sankyo Company, Limited

- Bimeda U.S.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. veterinary orthopedic medicine market is experiencing robust growth, driven by rising pet ownership, increased awareness of pet health, and a surge in orthopedic conditions like osteoarthritis—especially among dogs. Advances in pharmaceuticals, such as new FDA-approved treatments, are further catalyzing market expansion. With the pharmaceuticals and injectables segments leading revenue generation, and veterinary hospitals serving as key care providers, the market is poised for continued advancement through 2030. Leading companies are investing in research, innovation, and extended product lifespans, solidifying the U.S. as a key player in the global veterinary orthopedic sector.

Comments

Post a Comment