U.S. Group Level Term Insurance Market 2030: Trends Shaping Financial Security

U.S. Group Level Term Insurance Market Overview

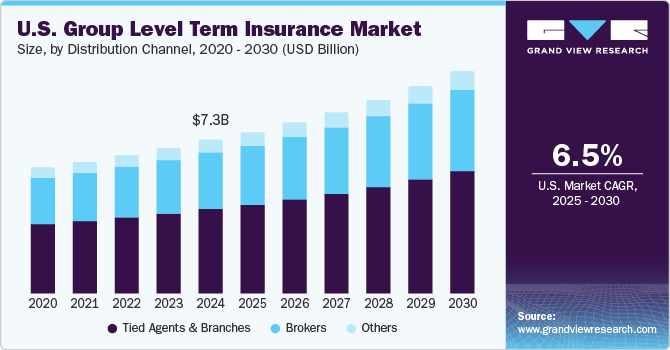

The U.S. group level term insurance market was valued at USD 7.32 billion in 2024 and is projected to reach USD 10.57 billion by 2030, expanding at a CAGR of 6.5% from 2025 to 2030. This growth is driven by several key factors, including the rising need for financial security among employees, increasing healthcare costs, employer-sponsored benefit programs, and a growing aging population.

As healthcare expenses continue to escalate, many employees are turning to insurance solutions that provide financial protection in the event of serious illness or death. Group level term insurance has gained popularity for being a cost-effective option, offering employees access to coverage at a lower price point compared to individual policies. This affordability has significantly contributed to the increasing demand for such products in the U.S. market.

Employer-sponsored benefits are also playing a critical role in market expansion. Companies across sectors, particularly in technology, healthcare, and finance, are incorporating group level term insurance into their benefits packages to attract and retain talent. These insurance plans not only enhance compensation offerings but also help promote financial wellness among employees, which is increasingly recognized as a core component of overall well-being.

The digitalization of the insurance sector further supports market growth. Both traditional insurers and Insurtech companies are adopting technologies such as AI-powered underwriting, automated enrollment systems, and mobile platforms. These innovations streamline policy management, reduce administrative costs, and make it easier for small and mid-sized businesses to provide group insurance options. As digital transformation accelerates, it is expected to be a significant growth driver for the industry.

Order a free sample PDF of the U.S. Group Level Term Insurance Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Tied agents and branches held the largest market share at 55.3% in 2024, largely due to the complexity of group level term insurance policies and the need for in-person, customized advice.

- The brokers segment is expected to experience the fastest growth during the forecast period. Brokers typically offer products from multiple insurers, providing greater flexibility and a broader range of coverage options for employers and employees.

Market Size and Forecast

- 2024 Market Size: USD 7.32 Billion

- 2030 Forecasted Size: USD 10.57 Billion

- CAGR (2025–2030): 6.5%

Leading Companies in the U.S. Group Level Term Insurance Market

Several key players dominate the market, differentiating themselves through pricing, product flexibility, digital tools, and customer service:

- MetLife offers comprehensive and customizable group term insurance plans, catering to businesses of various sizes. The company has a strong reputation in the corporate benefits space and provides scalable solutions for diverse client needs.

- Prudential Financial, Inc. provides flexible and affordable insurance coverage for businesses of all sizes. The company leverages its broad financial services expertise to deliver well-rounded insurance offerings.

- Other notable providers include:

- Lincoln National Corporation

- Unum Group

- New York Life Insurance Company

- Voya Services Company

- United Healthcare Services, Inc.

- Securian Financial Group, Inc.

- Reliance Standard Life Insurance Co.

- The Guardian Life Insurance Company of America

Conclusion

The U.S. group level term insurance market is on a steady growth trajectory, fueled by rising demand for affordable financial protection, employer emphasis on robust benefits packages, and rapid digital transformation in the insurance industry. As companies continue to prioritize employee well-being and operational efficiency, the adoption of group term insurance is expected to expand, making it a vital component of corporate benefit strategies in the years ahead.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Comments

Post a Comment