U.S. Cannabis Packaging Market 2030: The Future of Packaging Design

U.S. Cannabis Packaging Market Overview

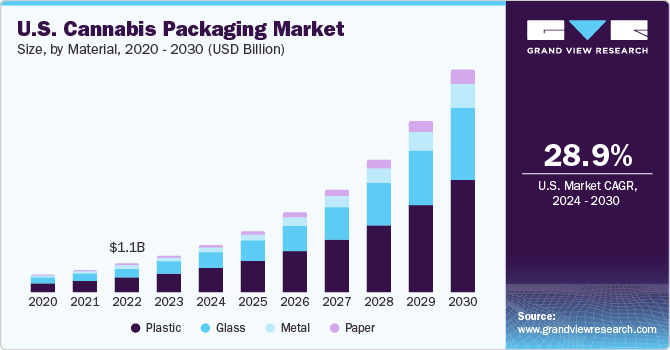

The U.S. cannabis packaging market was valued at USD 1.36 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 28.9% from 2024 to 2030. This significant growth is primarily driven by the legalization of cannabis for both medical and recreational purposes across various U.S. states. Leading states in terms of revenue generation include Colorado, California, Florida, Michigan, Nevada, Oregon, Washington, Massachusetts, Arizona, and Illinois, all of which represent more mature cannabis markets with established medical-use legalization due to the recognized health benefits of cannabis.

In addition to these states, others such as Arkansas, Alaska, Hawaii, Connecticut, Maryland, Louisiana, Minnesota, Rhode Island, Utah, Montana, and Vermont have developed comprehensive medical cannabis programs. This reflects a growing acceptance of cannabis for therapeutic use and points to broader national adoption in the near future, especially as more states consider recreational legalization.

The market's expansion is further supported by increased consumer demand linked to cannabis's various health benefits. These include improved lung function, diabetes regulation, support for weight loss, anti-cancer effects, seizure management, pain relief, and alleviation of symptoms such as anxiety, insomnia, and muscle stiffness. Cannabis-derived cannabinoids are also used to combat chemotherapy-induced nausea and vomiting. Notably, in 2018, the U.S. Food and Drug Administration (FDA) approved Epidiolex (cannabidiol - CBD) to treat rare forms of epilepsy including Lennox-Gastaut syndrome and Dravet syndrome.

Order a free sample PDF of the U.S. Cannabis Packaging Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- By Type: The market is segmented into rigid and flexible packaging. In 2023, the rigid segment accounted for over 63.3% of the revenue, owing to its ability to protect cannabis products from environmental factors such as air, light, and moisture, thereby maintaining product integrity.

- By Material: The market includes packaging made from metal, plastic, glass, and paper. The plastic segment led the market with a 52.6% revenue share in 2023, thanks to its versatility in forming packaging suitable for various cannabis formats like oils, edibles, and concentrates.

- By Product Type: The market is categorized into bottles & jars, tubes, tins, pouches, blisters & clamshells, and others. Among these, bottles & jars held the largest share of 46.1% in 2023.

- By Application: Packaging for recreational use dominated the market, representing 54.16% of the revenue in 2023. This segment is also expected to grow at the fastest CAGR of 33.1% through 2030, driven by increasing legalization for non-medical purposes.

Market Size and Forecast

- 2023 Market Size: USD 1.36 Billion

- Forecasted Market Size by 2030: USD 7.99 Billion

- CAGR (2024–2030): 28.9%

Key Companies and Market Dynamics

Packaging manufacturers in the cannabis sector are actively tailoring their products to meet application-specific requirements. Customization in terms of design and quantity is a notable trend, alongside the growing demand for high-quality printing and labeling. Companies like KushCo Holdings, Inc. are providing custom-branded solutions, including glass jars and barrier bags, to enhance shelf appeal and compliance.

To strengthen market presence and stimulate growth, key players are pursuing new product launches, mergers and acquisitions, joint ventures, and geographic expansion. For instance, in September 2022, RXDco introduced eco-friendly, biodegradable, and recyclable packaging collections—Atid, PearlLoc, and EcoPro—designed to meet the cannabis industry’s demand for sustainable, child-resistant packaging.

Leading Players Include:

- KacePack

- KushCo Holdings Inc.

- JL Clarks Inc.

- Kaya Packaging

- Cannaline U.S. Cannabis Packaging Solutions

- Dymapak

- Diamond Packaging

- Greenlane Holdings Inc.

- N2 Packaging Systems LLC

- Green Rush Packaging

- Elevate Packaging Inc.

- Berry Global Inc.

- Tin Canna

- MMC DEPOT

- Norkol Packaging LLC (Grow Cargo)

- Pollen Gear

- IMPAK Corporation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. cannabis packaging market is experiencing rapid expansion, supported by widespread legalization efforts, growing consumer acceptance, and the health benefits associated with cannabis use. With a projected CAGR of 28.9% from 2024 to 2030, the market is poised to reach USD 7.99 billion by the end of the forecast period. The increasing demand for tailored, sustainable, and regulation-compliant packaging will continue to shape the strategies of key industry players, driving innovation and competition in the years ahead.

Comments

Post a Comment