U.S. Hyperspectral Imaging Systems Market 2030: Defense Drives the Spectral Surge

U.S. Hyperspectral Imaging Systems Market Trends

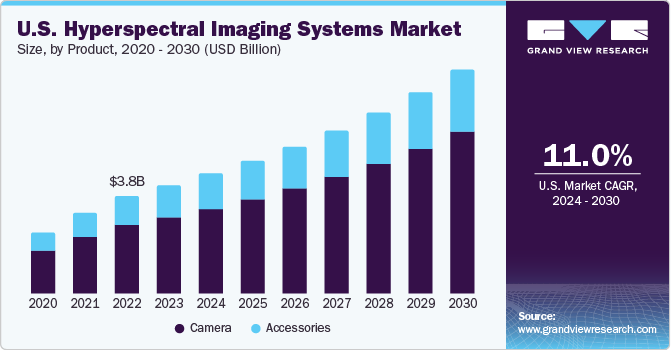

The U.S. hyperspectral imaging systems market size was estimated at USD 4.25 billion in 2023 and is expected to grow at a CAGR of 11.0% from 2024 to 2030. Rising military expenditure, growing adoption of advanced technologies, and heavy investments in various fields, such as agriculture, aerospace, healthcare, and machine vision, are expected to fuel the market growth over the forecast period. Moreover, the presence of technologically advanced healthcare infrastructure, increasing healthcare expenditure, growing adoption of novel technologies, and the presence of several market players are expected to fuel the market growth in the region. In addition, increasing funding for R&D has boosted research activities in the region.

The U.S. accounted for over 30.1% of the global hyperspectral imaging systems market in 2023. The increasing defense expenditure and the broad range of applications for hyperspectral imaging systems are key factors. The Office of Management and Budget reports that the U.S. spent USD 766 billion on national defense in the fiscal year 2022, accounting for 12% of federal spending. This substantial allocation of funds towards defense by lawmakers underscores the importance they place on national security in their budget. Relative to its economic size, the U.S. dedicates a larger portion of its budget to defense than any other G7 member.

Get a preview of the latest developments in the U.S. Hyperspectral Imaging Systems Market; Download your FREE sample PDF copy today and explore key data and trends

The increasing use of hyperspectral imagery systems across diverse sectors like research and development, healthcare, defense, food industry, night vision, and remote sensing is expected to drive market demand. Furthermore, advancements in technology, including sensor design, enhanced spectral resolution, improved spatial resolution, and the development of compact and lightweight devices, are anticipated to stimulate the adoption of these products at a larger base. For instance, in November 2022, Pixxel, a notable player in the field, launched its third hyperspectral imaging satellite using the Polar Satellite Launch Vehicle (PSLV).

The evaluation of hyperspectral imaging systems involves examining various performance aspects, capabilities, and specifications. This typically encompasses factors such as spectral range, spectral resolution, temporal resolution, and more. Hyperspectral imaging, which combines digital imaging with spectroscopy, offers enhanced sensitivity and differencing capability compared to conventional imaging and detection methods. The increasing use of this technology is largely due to its accuracy and clarity. In addition, hyperspectral imaging devices provide several significant advantages, including the ability to analyze spectral data at each point without prior knowledge, and comprehensive information for image analysis and processing. These benefits attract investments from numerous companies. However, the high cost of hyperspectral imaging systems and the lack of standardization and interoperability may impede market growth.

The growing range of hyperspectral imaging applications, including the identification of rock minerals, crop disease diagnosis, diagnostic imaging, and the detection of foreign toxins in food processing, is predicted to enhance its adoption. Furthermore, the use of hyperspectral imaging is notably increasing in disease diagnosis and image-guided surgeries. The market is expected to experience substantial growth, as hyperspectral imaging holds considerable potential for disease screening, detection, and diagnosis, owing to its capacity to identify biochemical changes caused by disease progression, such as alterations in cancer cell metabolism.

U.S. Hyperspectral Imaging Systems Market Report Highlights

- Camera dominated the market and held the largest revenue market share of over 70.8% in 2023 and is also expected to grow at the fastest CAGR during the forecast period, due to technological innovations such as the creation of small, mobile cameras and the advancement of manufacturing technologies.

- Accessories is expected to witness a lucrative growth of CAGR 10.6% during the forecast period.

- Snapshot dominated the market and held the largest share of 49.2% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- Military surveillance dominated the market with the largest share of 31.5% in 2023. The dominance of the segment is due to advancements in data management and component fabrication techniques.

- The U.S. hyperspectral imaging systems companies are working to enhance their product range. These players often focus on diversifying their product lines and expanding into new geographical markets to maintain growth.

U.S. Hyperspectral Imaging Systems Market Segmentation

Grand View Research has segmented the U.S. hyperspectral imaging systems market based on product, technology, and application:

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Camera

- Accessories

Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Snapshot

- Push Broom

- Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Military Surveillance

- Remote Sensing

- Medical Diagnostics

- Machine Vision & Optical Sorting

- Others

Curious about the U.S. Hyperspectral Imaging Systems Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Comments

Post a Comment