Retail Core Banking Solution Market 2030: Enhancing Customer Experience

Retail Core Banking Solution Market Growth & Trends

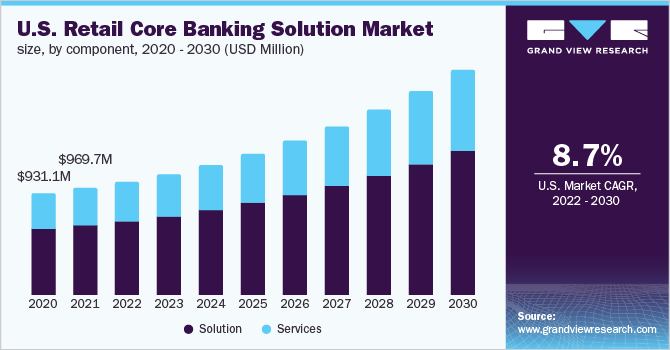

The global retail core banking solution market size is expected to reach USD 9.21 billion by 2030, growing at a CAGR of 9.8% from 2022 to 2030, according to a new study conducted by Grand View Research, Inc. A number of technologies, including blockchain, chatbots, machine learning, artificial intelligence, data analytics, Robotic Process Automation (RPA), and cloud computing, have witnessed increased adoption in the banking sector. Additionally, by using core banking technologies, banks can effectively analyze their customer base while enabling their clients to do their typical banking operations. Therefore, to deliver more integrated & value-added services, numerous banks are introducing core banking technologies to update banking functionality. As a result, the growth of the retail core banking solution market is driven by banks' adoption and implementation of these solutions.

The growing use of Software-as-a-Service (SaaS) based or cloud-based banking platforms offered by software providers like Finastra, FIS Global, and Temenos AG is one of the key industry drivers. Banking institutions can keep an eye on payments, transactions, and other banking activities owing to the existence of cloud-based technologies. Thus, the market will expand as a result of the increasing need for productivity and improvement in businesses.

Gather more insights about the market drivers, restrains and growth of the Retail Core Banking Solution Market

Major businesses are concentrating on enhanced offerings to obtain a competitive edge in the industry. For instance, in January 2019, Temenos AG introduced Temenos Transact, a core banking solution, and Temenos Infinity, a cloud-based digital front office product. These new solutions would offer their customers complete banking capability, and it seeks to hasten business use of cloud computing, which is anticipated to create further opportunities for the market.

The COVID-19 pandemic has considerably impacted the market for core banking systems due to the global increase in the use and adoption of online and digitalized financial services. Additionally, many regions have implemented lockdowns to contain the spread of the virus; as a result, retail core banking solution providers offer Software-as-a-Service (SaaS) platforms that aid banks in maintaining banking operations and remaining competitive during the pandemic. As a result, amid the global health crisis, this has emerged as one of the key growth factors for the market for core banking solutions.

Retail Core Banking Solution Market Report Highlights

- The solution segment dominated the market in 2021. The dominance can be ascribed to the fact that retail core banking solutions make it possible for branches of the same bank or financial institution to communicate with one another and make processing loans, deposits, and credits easier

- The cloud segment dominated the market in 2021. To compete with more cutting-edge digital rivals, financial institutions and banks with on-premise infrastructure are concentrating on implementing cloud-based solutions

- The small & medium enterprises segment is anticipated to grow at the fastest rate over the projection period. The growth of the segment can be attributed to the increasing number of small & medium enterprises worldwide

- The digital banking segment is expected to witness the fastest growth during the forecast period. The growing number of smartphone users and internet penetration is expected to propel the segment's growth

- Asia Pacific is expected to witness the fastest growth during the forecast period. As retail core banking solutions enable them to manage a high volume of transactions and banking services without interruption, numerous banks in the region are concentrating on adopting them

Retail Core Banking Solution Market Segmentation

Grand View Research has segmented the global retail core banking solution market based on component, deployment, enterprise size, application, and region:

Retail Core Banking Solution Component Outlook (Revenue, USD Million, 2017 - 2030)

- Solution

- Services

Retail Core Banking Solution Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- Cloud

- On-premise

Retail Core Banking Solution Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

- Small & Medium Enterprises

- Large Enterprises

Retail Core Banking Solution Application Outlook (Revenue, USD Million, 2017 - 2030)

- Regulatory Compliance

- Risk Management

- Digital Banking

- Others

Retail Core Banking Solution Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Middle East & Africa (MEA)

Order a free sample PDF of the Retail Core Banking Solution Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment