U.S. Digital Marketing Software Market Share by Application 2030

U.S. Digital Marketing Software Market Growth & Trends

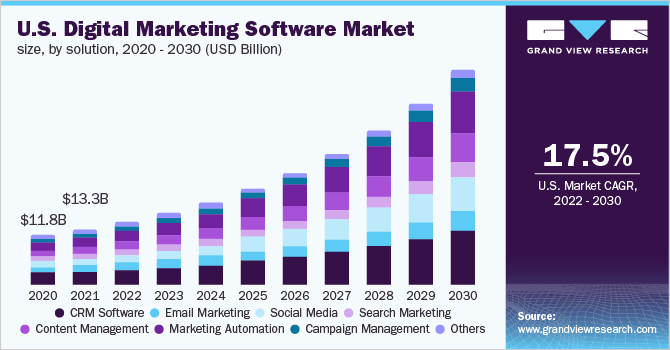

The U.S. digital marketing software market size is expected to reach USD 82.61 billion by 2030, registering a CAGR of 17.5% from 2022 to 2030, according to a new study conducted by Grand View Research, Inc. Technological advancements and the changing needs of end-user industries and industry verticals, particularly SMEs are expected to drive the growth. The rapid growth of cloud computing platforms in the region is also expected to boost the usage of content management, marketing automation, and CRM solutions. Major companies and brands are looking for a larger target audience to promote their content and offer their products and services online. Advertisers should expect more opportunities to market their items online as consumers' preferences for online purchasing evolve. As a result, the digital marketing software market in the country is growing. Furthermore, the country is home to major industrial companies such as Oracle Corporation, IBM Corporation, and Microsoft Corporation, well-positioned in the digital marketing software market.

U.S. Digital Marketing Software Market Segmentation

Grand View Research has segmented the U.S. digital marketing software market based on solution, service, deployment, enterprise size, and end use:

Based on the Solution Insights, the market is segmented into CRM Software, Email Marketing, Social Media, Search Marketing, Content Management, Marketing Automation, Campaign Management, Others.

- The CRM software segment accounted for the largest revenue share of over 21% in 2021. The demand for data-driven insights, which provide improved functionality beyond their conventional roles of activity tracking, information gathering, and passive data repository generation, drives the growth. Small and medium-sized businesses are increasingly demanding these solutions.

- CRM software based on software-as-a-service (SaaS) and on-demand models is projected to give potential growth opportunities. The presence of major CRM software solution providers in the U.S. is another important driver. Large customer relationship management solution providers like Salesforce.com, Oracle Corporation, and Microsoft Corporation currently dominate the segment in the U.S. and have concentrated on increasing their combined market share.

- Social media is expected to witness significant growth during the forecast period. Every day, the average American interacts with their phone approximately 2,600 times. Swipes, clicks, and taps on social media sites such as Facebook, TikTok, and Instagram account for more than half of swipes, clicks, and taps. Consumers spend a lot of time online, and with so many items available at the touch of a button, there is a lot of demand for social media software. Social media and digital marketing demand have increased as artificial intelligence(AI) and data-driven marketing expand.

Based on the Service Insights, the market is segmented into Professional Services and Managed Services.

- The professional services segment accounted for the largest market share of over 66%% in 2021. Professional services are predicted to rise as the demand for trained and accomplished individuals with knowledge in managing, installing, and debugging software grows. Professional services help businesses make better use of their resources, cut down on administrative costs, and increase profits. Professional services also assist businesses in improving resource management by increasing efficiency through enhanced collaboration, integrated knowledge management, and better planning, resulting in the professional services segment's continued expansion.

- The managed services segment is anticipated to register significant growth over the forecast period. Emerging technologies like the internet of things, artificial intelligence, and even drones are opening new revenue streams for managed services segment. There are also challenges, including security threats and persistent concerns about commoditization and margin erosion. Managed IoT is gaining popularity among the newer options. More than half of Managed IoT has experienced significant revenue potential in the past few years, which indicates they are generating steady sales and thus, opening various opportunities for the segment.

Based on the Deployment Insights, the market is segmented into Cloud and On-premise.

- The cloud segment accounted for the largest revenue share of over 67% in 2021. The versatility of cloud-based deployment of digital marketing Software is increased, allowing businesses to tailor products and services on a wide scale. Due to the cloud-based deployment approach, users can access the software from anywhere on any device, including personal PCs, laptops, cellphones, and tablets.

- The on-premise deployment segment is expected to register considerable growth over the forecast period. Due to the security benefits, many firms still prefer the on-premise deployment model. End users in highly regulated areas, such as healthcare and financial services, are more likely to choose an on-premise deployment, fueling the growth. The market vendors are now focusing on integrating an on-premise data center with a cloud.

Based on the Enterprise Size Insights, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs).

- The large enterprises' segment accounted for the largest market share of over 57% in 2021. Large companies use digital marketing to differentiate themselves from the competition. As these organizations have established brand awareness and want to persuade potential customers to convert, large firms want to employ digital marketing to stand out from the competition. Digital marketing softwarelinks businesses with their potential customers on social media through social media marketing and email marketing. Large firms in the U.S. are increasingly using Digital Marketing Software to handle their vast client databases efficiently, which is expected to fuel demand for the market in the large enterprises sector.

- The small and medium enterprises (SMEs) segment is anticipated to register significant growth over the forecast period. SMEs use the digital marketing solution to extend their customer base at a minimal cost, enhance conversion rates, and increase ROI from digital advertising. Since they attempt to break into competitive marketplaces, SMEs employ digital marketing to increase brand awareness.

Based on the End-use Insights, the market is segmented into Automotive, BFSI, Education, Government, Healthcare, Manufacturing, Media & Entertainment, Others.

- The BFSI segment accounted for the largest market share of over 20% in 2021. The BFSI sector is attracting younger, harder-to-reach consumers through digital marketing platforms, which can help raise brand awareness and promote financial education. The demand for digital marketing software has increased as banks and credit unions are using such software to explore new markets, raise awareness, and reinforce corporate culture messaging.

- Media and entertainment will continue to evolve quickly in reaction to industry-wide changes and pandemic-driven demographic shifts. As part of their efforts to cash in on the ubiquity of smartphones and the continuous installation of high-speed data networks, media & entertainment corporations are now focusing on establishing online advertising techniques.

Market Share Insights

- May 2021: Mars and Microsoft Corporation announced their long-term partnership to accelerate digital transformation and increase business operations.

- April 2021: International Business Machines Corporation launched TechHub to strengthen the capabilities of IBM hybrid cloud technologies and accelerate its clients’ digital transformation.

Key Companies Profile & Market Share Insights

Market incumbents are tweaking their business strategies in line with the proliferation of smartphones and the growing preference for personalized advertising.

Some of the prominent players operating in the U.S. digital marketing software market include,

- Adobe, Inc.

- Hewlett Packard Enterprise Company

- Hibu, Inc.

- Hubspot, Inc.

- International Business Machines Corporation

- Marketo, Inc.

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- SAS Institute, Inc.

Order a free sample PDF of the U.S. Digital Marketing Software Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment