Term Insurance Market Distributor Analysis and Forecasts 2028

Term Insurance Market Growth & Trends

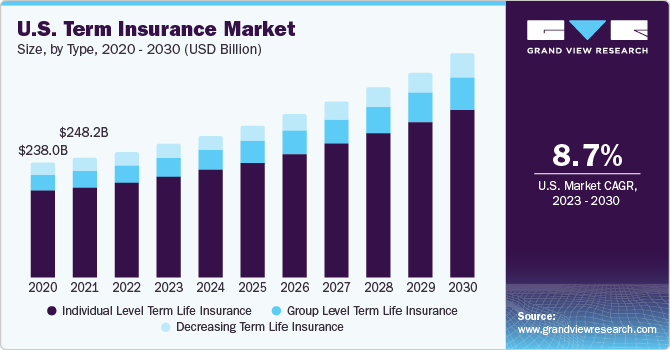

The global term insurance market size is expected to reach USD 1,353.1 billion by 2028, registering a CAGR of 6.9% from 2022 to 2028, according to a new report by Grand View Research, Inc. The growing middle-class population in developing economies like China, India, and Brazil is propelling the demand for term insurance.

Term Insurance Market Segmentation

Grand View Research has segmented the global term insurance market based on type, distribution channel, and region.

Based on the Type Insights, the market is segmented into Individual Level Term Life Insurance, Group Level Term Life Insurance and Decreasing Term Life Insurance.

- The individual-level segment contributed to the highest share of over 75% of the global market revenue in 2021. Rising investment in the insurance sector by various companies is propelling the growth of individual-level term life insurance. Moreover, the sum assured and premiums that are payable remained constant throughout the policy, this may attract the individuals to purchase the plan and thus projected to continue to grow in the market in the upcoming years.

- The group level segment is projected to register the highest CAGR of 7.9% over the forecast period due to its increasing demand. It refers to a policy that provides insurance to a group of people. It offers financials independent to an employee’s family in the event of death. Group-level term life insurance is relatively economical as compared to individual-level term life insurance. Owing to this reason, the segment is estimated to show growth during the forecast period.

Based on the Distribution Channel Insights, the market is segmented into Tied Agents and Branches, Brokers and Others.

- The tied agents and branches contributed a share of around 55% of the global market revenue in 2021 due to its increasing demand. The tied agents and branches segment represents only one insurer. Mostly corporate agents follow the tied agents and branches model for their insurance. It allows them to sell insurance policies of one insurer from the same line of business. Due to these reasons, the segment is estimated to show growth during the assessment period.

- The brokers segment is estimated to register the fastest growth with a CAGR of 7.3% from 2022 to 2028. It plays important role in economic growth development. It acts as an intermediate between insurers and policyholders. Brokers offer professional and technical advice about insurance products. Insurance brokers work closely with their clients in order to fulfill their needs regarding term life insurance which in turn will augment the segment growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

- Usage-based Insurance For Automotive Market - The global usage-based insurance for automotive market size was valued at USD 28.0 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 21.3% from 2020 to 2027.

- Legal Process Outsourcing Market - The global legal process outsourcing market size was valued at USD 10.77 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 30.9% from 2022 to 2030.

Term Insurance Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East and Africa (MEA)

Key Companies Profile & Market Share Insights

The companies main focus is on innovating new types to meet the increasing demand for term insurance. However, implementing sustainability has its unique challenges and limitations. Multiple companies are targeting on the expansion and launches of recent developments in the market.

Some of the prominent players operating in the global term insurance market include,

- MetLife

- Aegon Life Insurance Company

- Prudential Financial

- Northwestern Mutual

- State Farm

- MassMutual Life Insurance Company

- AIG

- Lincoln National

- John Hancock USA

- China Life Insurance Company Limited

- Bajaj Allianz Life Insurance

Order a free sample PDF of the Term Insurance Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment