U.S. Factoring Services Market Demand, Business Prospects, Leading Players Updates 2030

U.S. Factoring Services Industry Overview

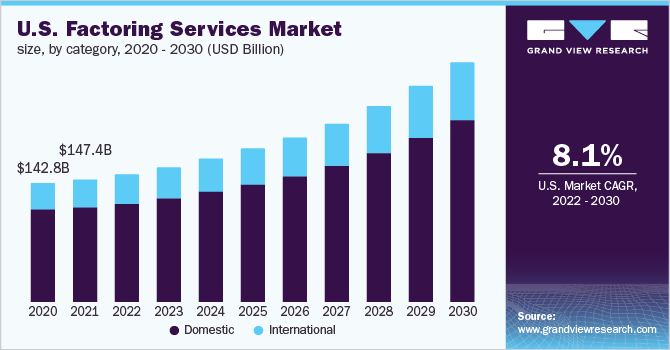

The U.S. factoring services market size was valued at USD 147.40 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2022 to 2030.

The current growth can be attributed to the increasing requirement for alternative sources of financing for Small and Medium Enterprises (SMEs) and the advent of blockchain technology and cryptocurrency in factoring services. The COVID-19 pandemic has emerged as a major challenge for the U.S. economy. According to Deloitte’s recent COVID-19 report, several companies across a multitude of sectors are finding suppliers, customers, and financiers to arrange short-term solutions to support their cash flows. Furthermore, travel restrictions and emergency declarations due to the COVID-19 in the country have affected several industries, which is expected to limit the growth of the factoring services market in the U.S.

Gather more insights about the market drivers, restrains and growth of the U.S. Factoring Services Market

The increased implementation of Machine Learning (ML), Natural Language Processing (NLP), and Artificial Intelligence (AI) is expected to generate profitable growth prospects for the U.S. factoring services market in the near future. For instance, in July 2021, RTS Financial Service, a U.S.-based factoring company, announced a partnership with PCS Software, an AI-driven transportation management platform leader, to provide better factoring capabilities and fuel savings to PCS Software’s marketplace of API-connected applications. This partnership will drive the disruptive innovation for medium- to large-sized enterprise brokers, carriers, and shippers in Canada and the U.S. These benefits will supplement the growth of the market during the forecast period.

Several fintech service providers in the region such as PayPal, JP Morgan, Morgan Stanley, and Wells Fargo offer factoring services to SMEs and freelancers to ease the financial pressure caused due to delayed payments. This alternative form of financing is likely to be adopted and accepted for factoring receivables. However, new technologies are helping these companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts. Additionally, benefits such as cost-effectiveness, powerful insights and reporting, and thorough credit evaluation are expected to push the demand for factoring services.

Account receivable financing is becoming more secure owing to several laws. The governments of various states have developed legal frameworks for the use of electronic invoices. This has helped governments collect taxes efficiently, provide efficient factoring tools, and reduce fraud. Moreover, banks and financial services companies are constantly trying to upgrade their technological and operational expertise to provide cost-effective services to their customers and boost the demand for their services. For instance, in November 2020, Nav, a U.S.-based financial services company, launched a next-generation emended finance platform for small businesses. Features of the new platform included dynamic financing profiles and a full-service funding manager team, which would be used to improve predictions, deliver new products, and boost customer engagement and retention.

The rise in the adoption of Distributed Ledger Technology (DLT) among various SMEs and large enterprises, and increased awareness of blockchain DLT applications among various industries, are driving the growth of the regional market. The technology provides several benefits, such as sending and receiving product information transparently and storing customers’ detailed information securely for the next purpose. For instance, Walmart Inc., one of the leading retail corporations in the U.S., has been using blockchain DLT to track and record its product information. These benefits will supplement the growth of the regional market during the forecast period.

Browse through Grand View Research's IT Services & Applications Industry Research Reports.

- Catalog Management System Market - The global catalog management system market size was valued at USD 3.7 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.5% from 2021 to 2028.

- Software Consulting Market - The global software consulting market size was valued at USD 218.60 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2021 to 2028.

Market Share Insights

- January 2022: FundThrough, a financial technology platform that solves cash flow challenges for growing businesses through fast invoice payments, announced the acquisition of BlueVine, a fin-tech company that provides online business banking and financing to small and medium-sized businesses. This acquisition empowers BlueVine’s finance and expansion efforts in the U.S. market and doubles the number of clients that will depend on FundThrough to convert unpaid invoices into working capital.

Key Companies profiled:

Some prominent players in the U.S. factoring services market include

- HSBC Group

- BNP Paribas

- Barclays Plc

- RTS Financial Services, Inc.

- TCI Business Capital

- Riviera Finance of Texas, Inc.

- CIT Group Inc.

- Triumph Business Capital

- Breakout Capital, LLC

- Charter Capital Holdings LP

Order a free sample PDF of the U.S. Factoring Services Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment