Track And Trace Solutions Market Strategies, Analysis and Forecasts Till 2030

Track And Trace Solutions Industry Overview

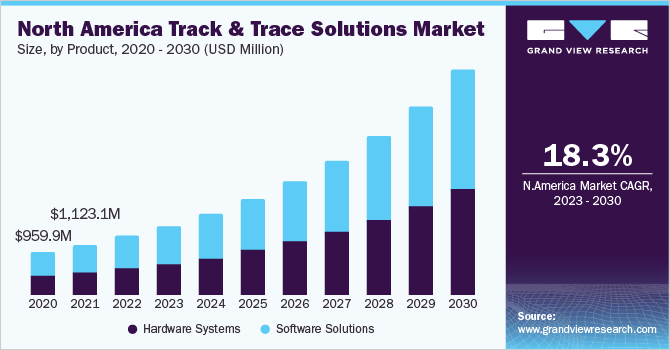

The global track and trace solutions market size was valued at USD 2.98 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.2% from 2022 to 2030.

The market growth is majorly accredited to the growing rate of counterfeiting and theft of healthcare products worldwide. Biopharmaceutical, pharmaceutical, cosmetic products, and medical device manufacturers are adopting track and trace solutions and protecting their products and brand equity. Furthermore, favorable regulations for serialization implementation are anticipated to drive the application of track and trace solutions in the healthcare industry.

The market is anticipated to witness significant growth owing to the rising deployment of track and trace solutions by pharmaceutical and medical device companies. Drug counterfeiting is a major problem faced by pharmaceutical and biopharmaceutical companies. Thus, companies are adopting track and trace solutions for supply chain monitoring. It has been found that the influx of substandard/counterfeit medications is more prevalent in low to middle-income countries, such as India and Africa. According to the United States Trade Representative (USTR) report in 2019, around 20% of all sold drugs in India were counterfeit.

Gather more insights about the market drivers, restrains and growth of the Global Track And Trace Solutions Market

Product counterfeiting and theft are key problems faced by pharmaceutical, biopharmaceutical, and cosmetic companies. According to the WHO, it is estimated that around 10% of all medicines are counterfeit worldwide, and this percentage is much higher in some of the African, Asian, and Latin American countries (10% to 30%). Annually, thousands of people die due to the consumption of fake medicines. Thus, the governments of many countries have set standards and regulations for mandatory implementation of track and trace solutions in the healthcare industry to protect people from fake medicines and other products. In addition, the advancement in products and technology such as RFID drives the adoption of track and trace in the supply chain. It is estimated that over 40 countries and more than 75% of the worldwide medicine supply will be covered by track and trace regulations by 2018. However, the high cost associated with the implementation of track and trace in the supply chain could hinder the growth of this market.

Moreover, stringent regulations and standards pertinent to serialization implementation and aggregation are expected to drive the market. In July 2019, Therapeutic Goods Administration (TGA) imparted new guidelines on product coding to reduce counterfeiting in Australia. However, the high cost connected with the track and trace implementation and the lack of unified global standard regulations for serialization and aggregation could hinder the market growth.

The COVID-19 impact revealed the importance of traceability and standardization to effectively monitor people, supply chain, and assets in the healthcare industry. The COVID-19 outbreak has heightened the risks posed by the global trade in counterfeit pharmaceutical products. According to the World Health Organization (WHO), a rising capacity of false medicines linked to COVID-19 are on sale in developing countries along with an upsurge in counterfeit medical products related to coronavirus.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Electronic Clinical Outcome Assessment Solutions Market - The global electronic clinical outcome assessment solutions market size was valued at USD 1.36 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 15.2% from 2023 to 2030.

- AI-based Clinical Trial Solutions For Patient Matching Market - The global AI-based clinical trial solutions for patient matching market was valued at USD 230.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 26.7% from 2022 to 2030.

Market Share Insights

- January 2022: Optel Group acquired the track and trace unit of Korber Business Area Pharma, also known as Taxeed. The company is based in Germany and has helped Optel to leverage Taxeed’s expertise in agrochemical and pharmaceutical track and trace technologies.

- September 2021: Rfxcel, a subsidiary of Antares Vision Group, signed a five-year cooperative agreement with the Lebanese Republic’s Ministry of Public Health for providing a GS1-compliant traceability hub for securing Lebanon’s entire pharmaceutical supply chain.

Key Companies profiled:

Some prominent players in the global track and trace solutions market include

- Axway

- Mettler-Toledo International, Inc.

- Optel Vision

- TraceLink, Inc.

- Adents

- Antares Vision S.r.l

- Siemens AG

- Korber AG

- ACG Worldwide

- Markem Imaje, a Dover Company

Order a free sample PDF of the Track And Trace Solutions Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment