U.S. Medical Display Monitors Market Leading Players Updates and Analysis Report till 2028

U.S. Medical Display Monitors Industry Overview

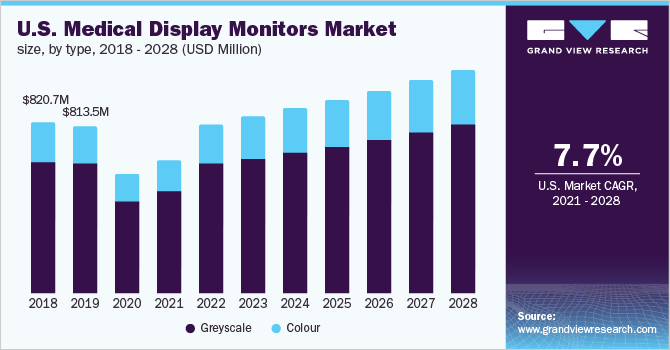

The U.S. medical display monitors market size was valued at USD 577.1 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2021 to 2028.

Medical displays play a key role in critical procedures such as cardiovascular therapy, neurosurgery, and breast cancer surgery. High-resolution monitors display superior quality images needed for easy interpretation of medical data, ultimately ensuring informed decision-making during surgical procedures. Data from an optical microscope, navigation display, video streaming of the operating room, and diagnostic scans, can be viewed using a single display monitor, reducing the surgeons’ burden to fetch data from different sources. Owing to such advantages, the medical display monitors market is anticipated to grow at a higher rate. Additionally, rising diagnostic imaging centers across the U.S., growth in diagnostic screening, and increasing adoption of hybrid operating rooms even by low-tier hospitals are factors anticipated to fuel market growth.

Gather more insights about the market drivers, restrains and growth of the U.S. Medical Display Monitors Market

Minimally invasive procedures are gaining surgical demand due to quicker recovery, smaller incisions, reduced scarring, and pain increased accuracy, and shorter hospital stays. Medical displays ensure superior visibility of diagnostic images, displaying even the slightest difference in tissues and cells, ensuring precise and quicker surgeries. It is highly beneficial for the treatment of breast cancer, and for patients who are not candidates for extensively long surgical procedures. Medical display monitors provide numerous benefits that augment radiologists’ ability and comfort to read images for a longer duration, thereby driving market demand. Further, the rise in comorbidities such as cancer and dental diseases among geriatric patients is said to propel market growth.

Companies like American Portwell Technology, Inc., Barco and many others are constantly developing newer products to support easy operations and ensuring the availability of authentic medical-grade monitors in the market. Portwell developed a medical-grade touch monitor that interacts with its all-in-one computers to ensure a human-machine interface for dental x-rays, imaging controls, ultrasound, and integrates with EHR and lab clinic equipment also. This improves digital interactivity, reduces the need for large storage space, and minimizes mishandling of critical patient data. Barco launched a new series of display controllers for their diagnostic displays in response to reduced radiologist staff and enormous workflow due to the outbreak of the COVID-19 pandemic. Additionally, the pandemic saw a reduction in elective surgeries, a decline in emergency room admissions, and economic instability in hospitals, leading to the market dip. However, it is expected to stabilize by mid-2022.

Browse through Grand View Research's Medical Imaging Industry Research Reports.

- Mammography Market - The global mammography market size was valued at USD 1.95 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 10.26% from 2022 to 2030.

- Dental X-ray Market - The global dental X-ray market size was valued at USD 1.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030.

Key Companies profiled:

Some prominent players in the U.S. medical display monitors market include

- HP Development Company, L.P

- Quest International

- Stryker

- Double Black Imaging

- Steris

- UTI Technology

- NDS Surgical Imaging, A Novanta Company

- Canvys

- Advantech Co. Ltd.

- Barco

- Eizo Corporation

Order a free sample PDF of the U.S. Medical Display Monitors Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment