Micro-mobility Market Development Trends of Analysis Report 2028

Micro-mobility Industry Overview

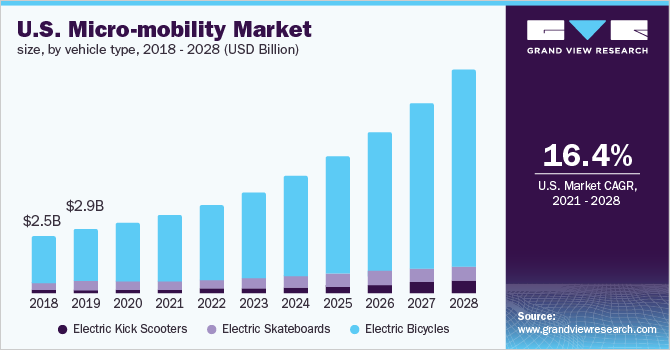

The global micro-mobility market size to be valued at USD 69.32 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% during the forecast period.

Micro-mobility is an evolving field of transportation that includes travel undertaken using a range of light vehicles such as electric kick scooters, electric skateboards, and electric bicycles. Factors such as increasing road congestion, rising oil & gas prices, ease of parking, and saturation within the automotive sector are expected to drive market growth during the forecast period. Furthermore, factors such as the growing electric bicycles and electric kick scooter renting and sharing services across the globe are expected to create new opportunities for micro-mobility in the forthcoming years.

In 2020, the market recorded a negative impact owing to the pandemic. The stringent measures and recent lockdown to contain the coronavirus have hindered the retail business activity of micro-mobility vehicles across the world. The COVID-19 pandemic has rigorously disrupted manufacturing operations and supply chains. This situation is mainly challenging for micro-mobility vehicle manufacturers and dealers. However, the fear of public transportation encouraged some customers to commit to purchasing micro-mobility devices during 2020-21. The post-COVID environment is expected to accelerate the transition to more sustainable mobility.

Gather more insights about the market drivers, restrains and growth of the Global Micro-mobility Market

The increasing greenhouse gas emissions have led to the implementation of several initiatives to reduce climate change, enabling policymakers to place hopes on electric vehicles. This has led to the enactment of an action plan for climate change to reduce the emissions from transportation by adopting sustainable and eco-friendly transportation alternatives such as public transport and electric vehicles. Furthermore, the rising investments in clean energy and the initiatives undertaken by governments for curbing CO2 emissions are expected to boost the demand for electric kick scooters, electric skateboards, and electric bicycles.

Many governments are setting regulations, objectives, and policies for micro-mobility deployment; encouraging OEMs and other industry stakeholders to actively participate in the industry, and building confidence by mobilizing investments and policy frameworks. For instance, electric kick scooters are legal in Canada. They generally require no insurance, license, or number plates to operate in Canada. Similarly, in the U.S., electric kick scooters are permitted on roads, the nonexistence of bicycle lanes, if they do not surpass the speed limit of 25 miles per hour.

Different U.S. states have separate specifications for electric kick scooters. Additionally, micro-mobility vehicles have become a cost-effective urban commute for an end-user. Sleek design and easy handling capability help commuters avoid traffic congestion and simultaneously reduce carbon emissions. The abovementioned factors are some of the key drivers escalating the adoption of micro-mobility vehicles. Since the shared micro-mobility service industry is currently undergoing rapid development and is in a transition phase, the electric kick scooters sharing operators are also focusing on expanding their presence in both untapped and competitive markets.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

- Yacht Market: The global yacht market size was valued at USD 8.50 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2022 to 2030.

- Micro-mobility Charging Infrastructure Market: The global micro-mobility charging infrastructure market size was valued at USD 3.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 25.2% from 2022 to 2030.

Market Share Insights

- June 2022: Porsche expanded its electric bike business by purchasing new models from the manufacturer of electric bicycles in Germany. The joint venture focuses on the development, production, and distribution of a new generation of high-quality Porsche e-bikes

- May 2022: Nashville's transit gaps are being filled via public transportation and micro-mobility integration. As a mobility coordinator, the company sees collaborations with micro-mobility providers like Bird as possibilities to broaden its function from just a transit provider to a mobility coordinator

Key Companies profiled:

Some of the prominent players in the global micro-mobility market include:

- Yadea Technology Group Co., Ltd.

- JIANGSU XINRI E-VEHICLE CO., LTD.

- Xiaomi

- SEGWAY INC.

- SWAGTRON

- Boosted USA

- Airwheel Holding Limited

- YAMAHA MOTOR CO., LTD.

- Accell Group

- Derby Cycle

Order a free sample PDF of the Micro-mobility Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment