Urban Air Mobility Market 2030: The Rise of Cargo Air Vehicles

Urban Air Mobility Market Size & Trends

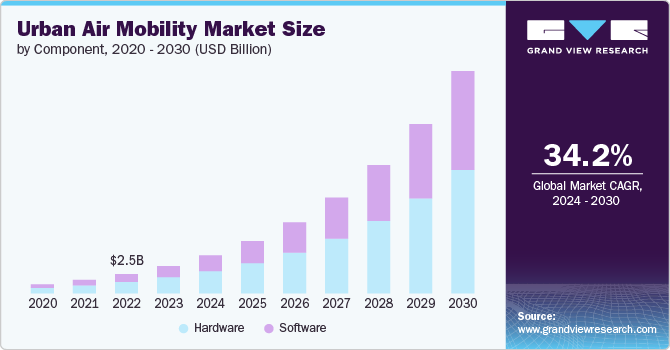

The global urban air mobility market size was estimated at USD 3.58 billion in 2023 and is expected to grow at a CAGR of 34.2% from 2024 to 2030. The market growth is attributed to the rising need for faster and more efficient transportation amid rapid urbanization and a growing global population. Traffic congestion in urban areas has become a major concern, which makes urban air mobility (UAM) a potential solution that can improve commuting within cities, reduce travel times, and subsequently improve the quality of life for urban residents. Besides, as ride-hailing services have created a demand for flexible and convenient transportation, UAM vehicles can become the next generation of on-demand transportation. These factors are expected to open remunerative growth avenues for the UAM market over the coming years.

The continued technological advancements in mobility solutions are further fueling the growth of UAM market. For instance, the developments in electric propulsion systems and autonomous flight control are making electric vertical take-off and landing (eVTOL) vehicles a viable option for urban air mobility applications. These vehicles are more environmentally friendly, which aligns with the growing consumer preference for sustainable mobility solutions. Moreover, advancements in battery energy density and charging infrastructure are crucial for enabling longer range and shorter charging times for UAM vehicles, which will drive their adoption and commercial viability.

Get a preview of the latest developments in the Urban Air Mobility Market; Download your FREE sample PDF copy today and explore key data and trends

The growth potential of UAM market is attracting several public-private partnerships. For instance, in February 2024, Joby Aero, Inc. signed an agreement with Dubai’s Road and Transport Authority (RTA) to introduce air taxi services in the country by early 2026. The company intends to commence the initial operations as early as 2025. This deal provides exclusive rights to operate air taxis in Dubai for the next six years.

The market growth is being further driven by increasing government investments to enhance air mobility. For instance, in February 2024, Vertical Aerospace received USD 10 million in funding from the U.K. Government, as a part of the Aerospace Technology Institute (ATI) Program, to deliver next-generation propellers to be used in its VX4 aircraft. This initiative is aimed at strengthening the country’s position in the global market of urban air mobility, which aims to transform the way people travel around and between cities, providing a green and low noise means of transport.

Urban Air Mobility Market Report Highlights

- The hardware segment accounted for the largest revenue share of nearly 59% in 2023.

- The software segment is expected to record the highest CAGR of around 36% from 2024 to 2030 owing to the critical role of these solutions in facilitating efficient, safe, and autonomous operation of UAM vehicles.

- The air taxis segment accounted for the largest revenue share in 2023. Air taxis offer the potential for significantly faster journeys, especially for short-distance travel within cities, by bypassing the traffic altogether.

- The >300 Kg segment accounted for the largest revenue share in 2023. These UAM vehicles offer potential benefits in terms of increased capacity, versatility, and range required for applications beyond the urban air taxis.

- The electric segment accounted for the largest revenue share in 2023 with the growing preference for sustainable solutions.

- The remotely piloted segment accounted for a significant revenue share in 2023 owing to increasing urbanization and the subsequent rise in the demand for efficient and reliable intra-city transportation solutions.

- The intracity segment accounted for largest market share in 2023 on account of the increasing need for faster and efficient transportation solutions driven by growing congestion in urban areas.

- The passenger transport segment accounted for a significant revenue share in 2023. As traffic congestion in major cities increases, UAM vehicles can potentially offer a faster and more efficient way to travel.

- The commercial ridesharing operators is expected to record the highest CAGR from 2024 to 2030 owing to the advantages associated with UAM vehicles in this segment.

- The urban air mobility market in North America accounted for largest revenue share of over 40% in 2023 on account of increasing inclination toward technological innovation and a significant push towards managing the rising urban congestion through sustainable solutions.

Urban Air Mobility Market Segmentation

Grand View Research has further segmented the global urban air mobility market report based on component, type, maximum take-off weight, propulsion, operation, range, application, product, end use, and region.

Component Outlook (Revenue, USD Million, 2018 - 2030)

- Hardware

- Aerostructure

- Avionics

- Flight Control System

- Propulsion System

- Others

- Software

Type Outlook (Revenue, USD Million, 2018 - 2030)

- Air Taxis

- Air Metros & Air Shuttles

- Personal Air Vehicles

- Cargo Air Vehicles

- Air Ambulances & Medical Emergency Vehicles

- Last-Mile Delivery Vehicles

Maximum Take-off Weight Outlook (Revenue, USD Million, 2018 - 2030)

- <100 Kg

- 100 – 300 Kg

- >300 Kg

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

- Gasoline

- Electric

- Hybrid

Operation Outlook (Revenue, USD Million, 2018 - 2030)

- Remotely Piloted

- Fully Autonomous

- Hybrid

Range Outlook (Revenue, USD Million, 2018 - 2030)

- Intracity (Below 100 km)

- Intercity (Above 100 km)

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Transport

- Freighter

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Fixed Wing

- Rotary Blade

- Hybrid

End Use Outlook (Revenue, USD Million, 2018 - 2030)

- E-Commerce

- Commercial Ridesharing Operators

- Private Operators

- Medical Emergency Organizations

- Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Curious about the Urban Air Mobility Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Comments

Post a Comment