Third-party Banking Software Market 2030: The Rise of Cloud Solutions

Third-party Banking Software Market Growth & Trends

The global third-party banking software market size is expected to reach USD 47.90 billion by 2030, growing at a CAGR of 8.2% from 2023 to 2030, according to a new study conducted by Grand View Research, Inc. The growing prevalence of online banking solutions worldwide to improve customer experience is anticipated to drive the industry expansion. In addition, the rapid shift from paper-based legacy methods to digitized and advanced methods for process standardization is also acting as fuel to the growth.

The strategic partnerships and acquisitions by prominent market players to overcome the problems in the ecosystem, such as reducing the overall risk and enhancement of product offerings, are expected to accentuate the growth. For instance, in June 2022, Kamakura Corporation, situated in the U.S., was bought by SAS Institute, Inc., a global leader in Artificial Intelligence (AI) and analytics. Kamakura Corporation offers specialist software, information, and consultancy to assist financial businesses across the board. The acquisition was an expansion of the already made significant investments in SAS Institute, Inc.’s integrated solutions, and cloud-ready risk management platform.

Gather more insights about the market drivers, restrains and growth of the Third-party Banking Software Market

Moreover, the rapid development in the Banking, Financial Services, and Insurance (BFSI) sector is expected to increase the need for third-party banking software. For instance, in June 2022, the Bank of England granted a full banking license to Kroo, a U.K.-based digital bank. This license has enabled Kroo to offer overdrafts, savings, and loan products in addition to the existing services to its customers.

The outbreak of the COVID-19 pandemic is expected to play a vital role in driving the growth of the third-party banking software market over the forecast period. In the wake of the pandemic, the rising awareness of e-banking and its applications is expected to create opportunities for the market. In line with this, the snowballing of digital payment platforms is expected to raise the demand for third-party banking software hence, fueling the market growth.

Third-party Banking Software Market Report Highlights

- The wealth management software segment is expected to witness the fastest growth over the forecast period. The rising awareness of managing finances and wealth creation among millennials and Genz is one of the major attributes of the growth

- The cloud segment is expected to witness the fastest growth over the forecast period. The growth is attributable to several advantages offered by the cloud, such as reduced infrastructure costs and improved flexibility

- The risk management segment dominated the market in 2022. This dominance is attributable to the fact that banks and financial institutions are continuously looking for ways to mitigate losses and increase profitability

- The commercial banks segment is expected to grow at the fastest rate. The implementation of strict regulatory compliance by commercial banks to save consumers’ interest is expected to increase the need for the deployment of more secure third-party banking software

- North America dominated the market over the forecast period. This growth is attributable to the presence of some of the largest players in the region such as International Business Machines Corporation and Microsoft Corporation

Third-party Banking Software Market Segmentation

Grand View Research has segmented the global third-party banking software market based on product type, deployment, application, end-use, and region:

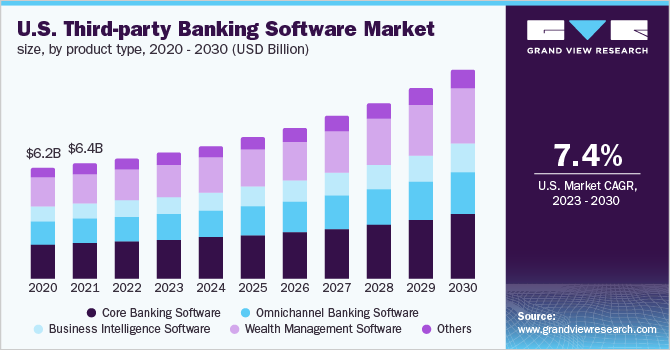

Third-party Banking Software Product Type Outlook (Revenue, USD Million, 2017 - 2030)

- Core Banking Software

- Omnichannel Banking Software

- Business Intelligence Software

- Wealth Management Software

- Others

Third-party Banking Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- On-premise

- Cloud

Third-party Banking Software Application Outlook (Revenue, USD Million, 2017 - 2030)

- Risk Management

- Information Security

- Business Intelligence

Third-party Banking Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Retail Banks

- Commercial Banks

Third-party Banking Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Middle East & Africa (MEA)

Order a free sample PDF of the Third-party Banking Software Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment