U.S. Online Gambling Market 2030: The Shift Towards Interactive Gaming Platforms

U.S. Online Gambling Market Size & Trends

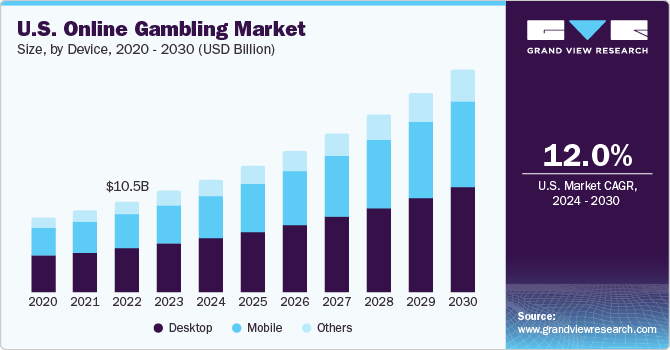

The U.S. online gambling market size was valued at USD 11.68 billion in 2023 and is expected to grow at a CAGR of 12.0% from 2024 to 2030. The growing use of mobile phones and other digital devices, coupled with access to the internet is creating growth opportunities for online gambling. Internet penetration was 92% of the United States’ total population in 2022. Moreover, legalization of online gambling, celebrity endorsements, and corporate sponsorships are also helping market grow in the country.

n 2023, the U.S. accounted for over 16.0% of the online gambling market. With the growing adoption of high speed internet technology, the number of digital devices’ users is also rising, which is having a direct impact on the market. In addition, Smartphones support AR/VR and artificial intelligence-powered applications, which help developers create immersive and interactive gambling applications. Many developers focus on solutions that support and assist gamblers, ensure the authenticity of gambling activities, and prevent fraudulent activities.

Gather more insights about the market drivers, restrains and growth of the U.S. Online Gambling Market

VR in gambling also creates simulation of surroundings. Users can interact with them realistically with specific hardware. VR lets gamblers interact with other gamblers and dealers and offers a more realistic gambling experience, better sound quality, and a realistic game design. Various online gambling platforms offer a free-play version of their games to attract new users. In-app or website advertisements are used to generate revenue in the free-to-play versions.

Another major factor driving the market is the adoption of blockchain technology. Many gambling applications and websites accept payments via blockchain. For instance, BitStarz, a gambling platform with approximately 4 million regular players, accepts Bitcoin. Gambling through cryptocurrency offers vast opportunities as they are fast transactions. With fewer regulations and restrictions for cryptocurrency transactions, they are now widely used by users in online gambling.

U.S. Online Gambling Market Report Highlights

- Based on type, the market can be segmented into poker, sports betting, bingo, and casinos. The sports betting segment dominated the market with the largest revenue share of approximately 50.0% in 2023.

- Based on devices, the desktop segment accounted for the largest revenue share in 2023. This is due to the benefits provided by desktops, such as easy accessibility, etc.

- The mobile segment is expected to witness the highest CAGR during the forecast period. Mobile gambling offers players an opportunity to play anytime and from anywhere.

- 888 Holdings is a global sports betting and gambling company that owns brands such as 888casino, 888poker, 888sport, Mr Green, and William Hill. In 2018, the company expanded its U.S. online poker business by becoming the sole owner of the All American Poker Network.

- In January 2023, Entain announced the acquisition of BetEnt B.V., an online betting and gaming website. The acquisition is aimed at providing customers with various product offerings.

U.S. Online Gambling Market Segmentation

Grand View Research has segmented the U.S. online gambling market report based on type, and device:

Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Sports Betting

- Casinos

- Poker

- Bingo

- Others

Device Outlook (Revenue, USD Billion, 2018 - 2030)

- Desktop

- Mobile

- Others

Order a free sample PDF of the U.S. Online Gambling Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment