U.S. Microfluidics Market 2030: The Impact of COVID-19 on Device Development

U.S. Microfluidics Market Size & Trends

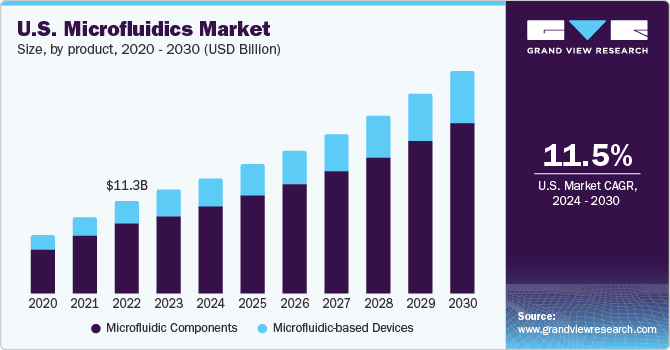

The U.S. microfluidics market size was estimated at USD 12.59 billion in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. Microfluidics devices’ ability to analyze small sample volumes reduces reagent waste and preserves scarce samples, driving demand for these devices. Their increasing use in research and diagnostics has led to the development of advanced technologies. The transformation of microfluidics-based lab equipment into tools compatible with existing research workflows has expanded their applications in biomedical and pharmaceutical research, contributing to market growth.

U.S. accounted for over 39.2% of the global microfluidics market in 2023. The growing use of microfluidics devices in diverse research and diagnostic fields is anticipated to propel the market. For example, the past decade has seen an increase in microfluidic devices suitable for eye-related conditions. The evolution of microfluidics-based lab equipment into stronger tools compatible with established research workflows largely contributed to the expansion of applications of microfluidics technology across biomedical and pharmaceutical research. Microfluidics is expected to be used in biomedical applications. Professionals in this market perform micro-scale processes to ensure improved control, rapid results, and lower costs at various drug development stages.

Gather more insights about the market drivers, restrains and growth of the U.S. Microfluidics Market

The surge in COVID-19 cases has led to an increased demand for microfluidics tools. PCR-based, widely approved tests have become the go-to method for diagnosing COVID-19. In response to the pandemic, many manufacturers have launched new products and increased production to meet the rising demand for IVD tests. Integrating microfluidics with PCR can speed up the testing process, delivering results in less than 10 minutes with high precision. For instance, BeforCure, an Elvesys spin-off, has developed a rapid PCR-on-chip system for virus detection. Based on Fastgen technology, this product utilizes the benefits of microfluidics to provide test results in under 30 minutes.

Microfluidics devices offer a significant advantage in their capacity to analyze small sample volumes. This leads to less reagent waste and aids in conserving hard-to-produce samples. The advent of these devices has spurred demand for low-volume sample devices. An increase in research activities by analytical and clinical researchers has further fueled this demand. Traditional genome analysis methods involve decoding the entire DNA and are time-consuming and costly. Microfluidics devices, capable of analyzing small sample volumes, offer benefits like reduced reagent waste and sample conservation. Their advent has increased demand for low-volume sample analysis and boosted their use in research. These devices require minimal sample volumes for data interpretation, making them more efficient than traditional genome analysis methods. They’ve enabled the downsizing of lab procedures into lab-on-a-chip systems. The market has been stimulated by recent product launches, such as Biotech Fluidics’ low-volume online degassing modules launched in July 2023.

In the past decade, microfluidics devices for ophthalmological conditions have become more available. They’ve successfully measured glucose levels, identified infections, diagnosed dry eye disease, and evaluated vascular endothelium growth factor levels. Recent technologies have used contact lens technology for theranostic and diagnostic solutions. For instance, Guan’s team developed a contact lens-on-a-chip for precision medicine. These advancements include analyzing small-volume nasal secretions to investigate diseases.

In March 2021, a team from Loschmidt laboratories, in collaboration with ETH Zurich, created a microfluidic platform for quick and effective enzyme studies. This innovative platform is already being utilized to develop new thrombolytics for stroke treatment and research bioluminescent enzyme evolution. Furthermore, in November 2019, Panasonic Corporation and IMT co-developed a technology for mass-producing microfluidic devices using glass molding. This method, more cost-effective and precise than traditional glass etching techniques, is used to manufacture biological, environmental, and medical analysis and sensing devices. This is expected to contribute to market growth in the future.

U.S. Microfluidics Market Report Highlights

- Microfluidic components dominated the market with the largest revenue share of 70.4% during 2023 and are expected to grow at the highest CAGR during the forecast period.

- Lab-on-a-chip dominated the market with the highest CAGR of 36.97% in 2023. This technology enables quick DNA probe sequencing and high-speed thermal shifts at the microscale for DNA amplification using PCR.

- Medical dominated the market and held the highest revenue share of 81.63% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- In March 2024, Bio-Rad Laboratories received approval from AOAC International for its dd-Check STEC Solution. This solution, the first of its kind to use the Droplet Digital PCR Method, is designed to detect and confirm the presence of virulence genes from Shiga toxin-producing Escherichia coli (STEC) in raw beef trim, fresh spinach, and carcass sampling cloths.

- In January 2024, Standard BioTools Inc. (Nasdaq: LAB), a company committed to propelling advancements in human health, declared the completion of its merger with SomaLogic. This merger has resulted in forming a leading entity in the field of research, providing unique multi-omics tools.

U.S. Microfluidics Market Segmentation

Grand View Research has segmented the U.S. microfluidics market based on product, application, material type, and technology:

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Microfluidic-based Devices

- Microfluidic Components

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Medical

- Non-medical

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

- Silicon

- Glass

- Polymer

- PDMS

- Others

Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Lab-on-a-chip

- Organs-on-chips

- Continuous Flow Microfluidics

- Optofluidics And Microfluidics

- Acoustofluidics And Microfluidics

- Electrophoresis And Microfluidics

Order a free sample PDF of the U.S. Microfluidics Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment